The Historical Impact of Elections on Markets

Stone Churby, M.S., Wealth Management Associate | Marty Rascon, Wealth Management Associate Advisor | May 9, 2024

As the United States draws closer to the presidential election in November and the end of the current election cycle, many individuals may have questions and concerns about the intersection of financial markets and politics. However, when it comes to markets and your portfolio, how much impact do elections really have?

In this blog post, we review the history of US presidential elections and their impact on markets and explain why it’s important to remain disciplined and keep a long-term mentality when it comes to your portfolio and financial goals. We also touch on important financial planning considerations to think about as we head into the final stretch of the 2024 US presidential race.

Impact of Presidential Elections on Markets:

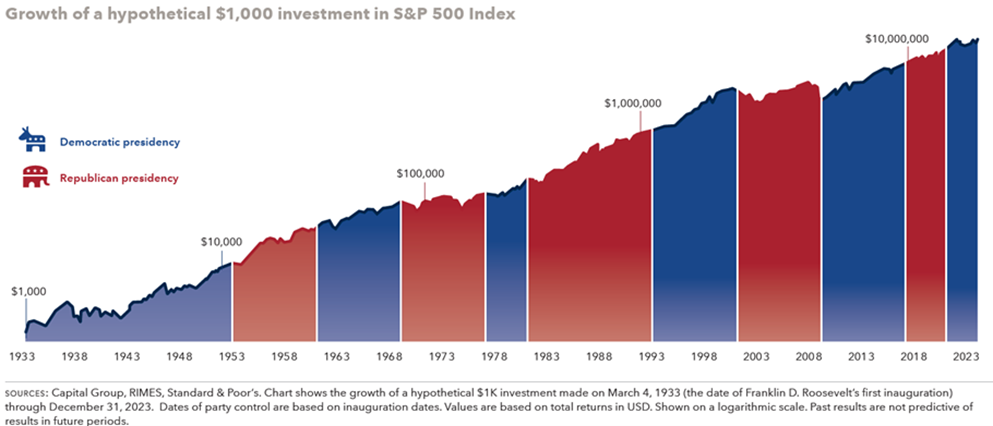

The gravity of elections is not to be understated, American policy and sentiment will change because of this year’s election. However, the impact on financial markets is not as material as people may assume. Since Franklin D. Roosevelt stepped into office in 1933, there have been eight democratic and seven republican presidents. A $1000 investment in the S&P 500, held through all 15 presidents, would have been worth over $21 million at the end of 2023. The returns generated by holding the S&P 500 regardless of election results have historically been far superior to any attempt to “time” the market based on which political party holds the White House. There appears to be little viability for an investment strategy that uses political party affiliation as a timing mechanism. The graphic below showcases the consistent upward climb of US stocks, regardless of the party in control, reiterating the importance of holding through short periods of volatility that may surface leading up to an election.

The insignificance of party affiliation on stock market returns can also be seen within the House and Senate. There is no statistical significance on stock market returns when the house and senate are both controlled by the same political party. According to Forbes, the stock market showcases the best-annualized returns when Congress is split. This is due to a natural balance of power that occurs in the legislative branch, where neither party can fully enforce their agenda resulting in a more natural development of the economy. To understand how politics have little effect on stock market outcomes, it is important to understand how financial assets derive their value.

Market returns are seldom guided by political idealizations. The impact election cycles have on markets is dwarfed by the effects of the current economic cycle and interest rates on stocks and bonds. The stock market tends to focus on the economic environment, a company’s financial health, cash flows, etc. to determine the viability of an investment. To increase success, companies primarily focus on their underlying business, market dynamics, and effective investment opportunities to keep the business healthy and viable. These decisions are made rationally and apolitically to best provide for the company and shareholders.

As we have demonstrated above, markets tend to be agnostic to the results of a US Presidential election in the long run. However, with increasing political discourse in the months leading up to an election it is not uncommon for markets to experience some form of volatility. With the constant news cycle, it may seem like the current political and economic backdrop is unprecedented, but it is important to keep in mind that uncertainty and controversy have surrounded every election. Therefore, it is vital to maintain a disciplined and long-term view of markets and your portfolio to avoid common pitfalls.

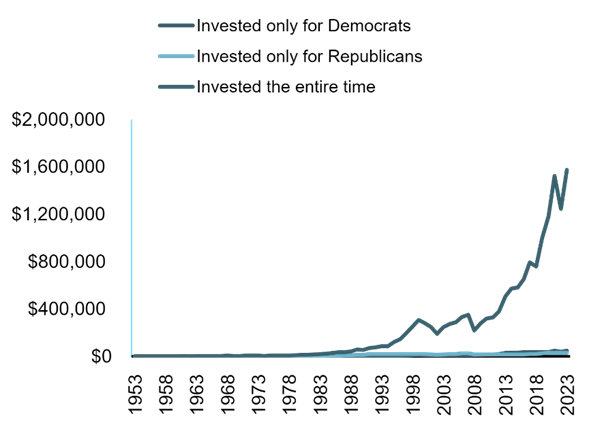

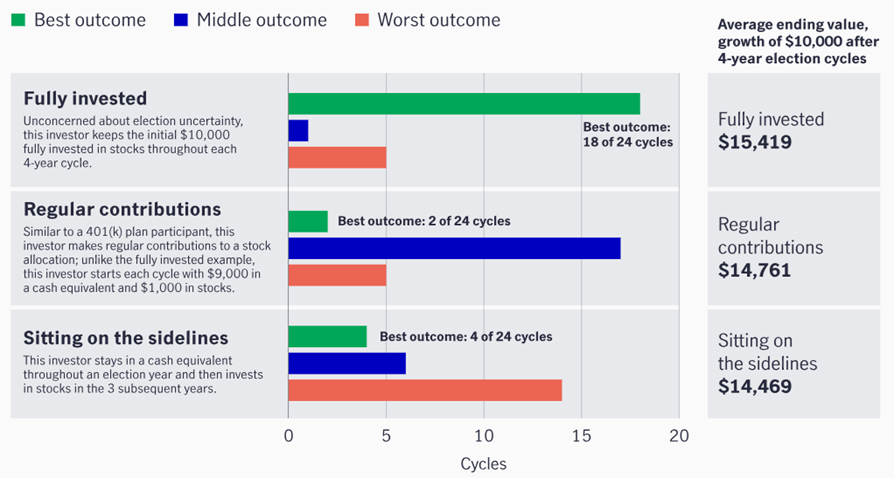

Staying Invested vs. Flight to Safety

Sitting on the sidelines of the market is a strategy that historically has not paid off. This is also true when it comes to election years. Data of the 23 election cycles since 1932 shows that a continuous investment, not based on election cycles, outperforms sitting on the sideline to avoid potential volatility. With an original investment of $10 thousand, the strategy that chose to stay uninvested on the sidelines until after the election results historically underperformed the strategy that was fully invested by over 6% for the four-year observation period. This example showcases how time and longevity in markets have historically outperformed strategies associated with political party affiliation.

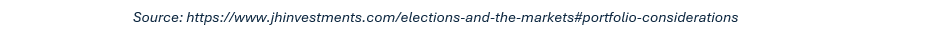

However, investor behavior seems to ignore the prudent strategy of “staying the course” during election years. Investor uncertainty around elections can be quantified by the large influxes of capital into money-market funds late in the election cycle. The last two years of an election cycle show a much larger inflow of assets into money markets than equity funds, displaying a retreat to safety by investors wanting to stay away from election-induced volatility. While cash can present as an attractive safety net, it is not a shelter needed for political volatility. Political idealizations that show up in markets tend to have short-lived ripple effects that are non-material when it comes to investment and financial planning.

As the data shows, the unwarranted retreat to safety comes at the cost of returns. When it comes to your financial success, it is more important to focus on time than timing. We see in the different graphics that a steady and continuous investment strategy performed the best throughout the emotion-based volatility seen during election cycles. Elections provide an opportunity for people to voice their opinions on hot-topic issues, causing panic among individual investors. The threat of new political ideas coming from the White House can cause people to fear for their future, thus positioning themselves on the stock market sideline when it is not needed. We believe that political discourse is important for the future development of our society. Without elections and the democratic process, people’s voices would be lost, drastically changing the core foundation the United States was founded on. However, it is important to keep political idealizations separate from your financial plan.

Financial Planning Considerations:

While we have seen that historically markets tend to focus on the broader economy rather than which party holds power, there are other topics to consider that are completely separate from financial markets. In 2017, the Tax Cuts and Jobs Act (TCJA) was passed which led to significant changes to our tax code. However, most of these revisions to the tax code are set to expire in 2025 if there are no updates to the legislation. Some of the items set to expire include the following:

- Estate Tax Exemption: The current estate tax exemption for 2024 is $13.61 million per person or $27.22 million per couple. This is set to expire in 2025 if there are no changes.

- Standard Deduction: The 2017 TCJA temporarily raised the standard deduction which is set to expire in 2025.

- Income Tax Rates: The TCJA decreased tax brackets across the board and will revert to pre-2018 levels in 2025.

For additional current tax information, you can reference our key data chart. Although these aspects of the tax code are set to expire in 2025, nothing is certain and there is a strong possibility that there will be further revisions to the tax code moving forward. However, with proper preparation and planning, there are opportunities present that you can take advantage of by consulting with an experienced group of financial professionals. Weatherly Asset Management has been having conversations with clients about the expiration of these tax laws and we continue to develop strategies to help our clients achieve their financial goals.

Staying the Course:

Historically speaking, markets have remained agnostic to the results of the US presidential election. In the period leading up to elections, it is not uncommon for markets to experience some form of volatility, but it is important to remember that in the long run what matters most is the underlying fundamentals of the economy. It is also important to keep in mind that uncertainty and controversy have been affiliated with every election cycle in US history, and that should not keep you from staying the course and maintaining a disciplined mindset when it comes to navigating markets.

We seek to offer peace of mind through professional investment management and holistic financial planning. Through our investment management services, we create customized portfolios to match your risk tolerance, time horizon, and financial goals by maintaining an appropriate, long-term asset allocation. Through our financial planning services, we take your financial picture and create a customized road map illustrating actions needed to achieve your financial goals. Within our financial planning services, we also create various “what-if” scenarios to address the changing landscape of your life, goals, and the broader economic and investment backdrop. Whether it’s creating portfolios, developing financial plans, or talking through your questions and concerns our group of experienced professionals are here to serve as your partner along your financial journey.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.