Navigating Tax Implications When Selling Real Estate: Strategies for Homeowners and Investors

Marty Rascon, Wealth Management Associate Advisor | Ryan Richardson, CFP®, ChFC®, Senior Wealth Management Advisor | February 20, 2025

Investing in real estate ranks among the most significant financial decisions most individuals will make in their lifetime. Whether investing in a primary residence or an investment property, there are several critical factors that must be considered. Selling a property, especially one held for a long time or a property that has significantly appreciated in value brings substantial tax implications. These consequences often influence the decision to sell. This blog explores key tax considerations and strategies to potentially reduce your tax burden when selling real estate.

Section 121 Exclusion:

For those looking to sell their primary residence, the first strategy that could assist in easing your tax burden is taking advantage of the Section 121 exclusion as outlined by the IRS.

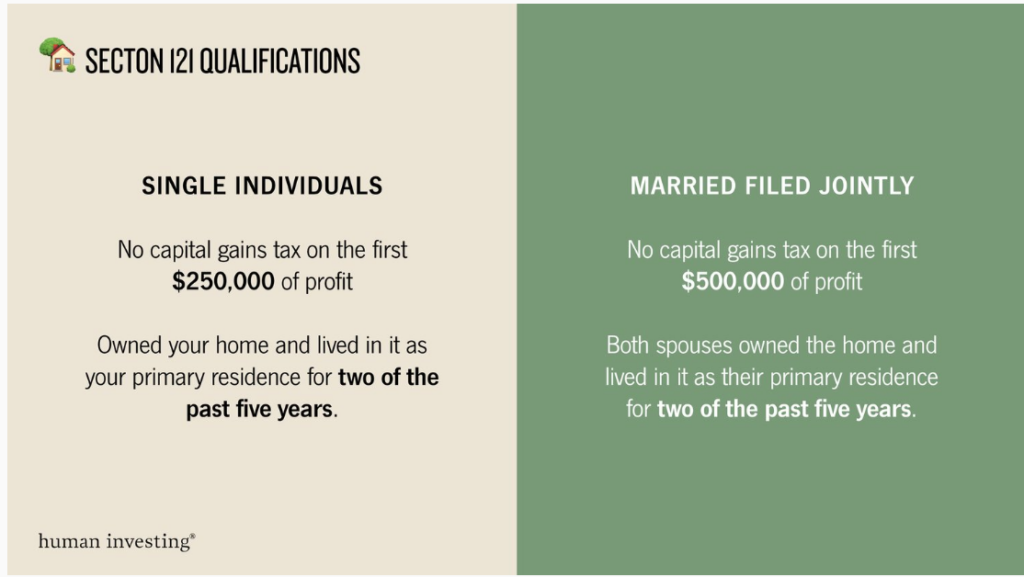

The IRS’s Section 121 exclusion allows homeowners the ability to exclude a substantial portion of the gain on their home from their taxable income. For individuals, this amount is $250,000 and for those filing jointly, this amount increases to $500,000. We would also note that the cost basis of a primary residence is the purchase price plus any additional upgrades, so it is important to keep track of upgrades overtime as the basis is a very important figure in determining your capital gain exposure.

To qualify, sellers must meet the ownership and use tests – owning and residing in the home as their primary residence for at least two of the last five years.

Ownership and Use Test:

- Ownership Test: The seller must have owned the home for at least two years.

- Use Test: The home must have been the seller’s primary residence for at least two years within the five-year period ending on the sale date.

This exclusion does not apply to investment properties, second homes, or vacation homes, unless these properties are converted into primary residences that meet the specific criteria.

The Section 121 exclusion can be a great tool to assist homeowners that have a low basis in their primary residence or have seen substantial appreciation in the value of their home. While this provision does primarily apply to a primary residence, there are strategies that can be applied to investment properties to assist with tax burdens.

Below is a summary of the tax benefits and requirements to utilize the Section 121 exclusion:

Source: https://www.humaninvesting.com/450-journal/is-it-time-to-sell-your-home

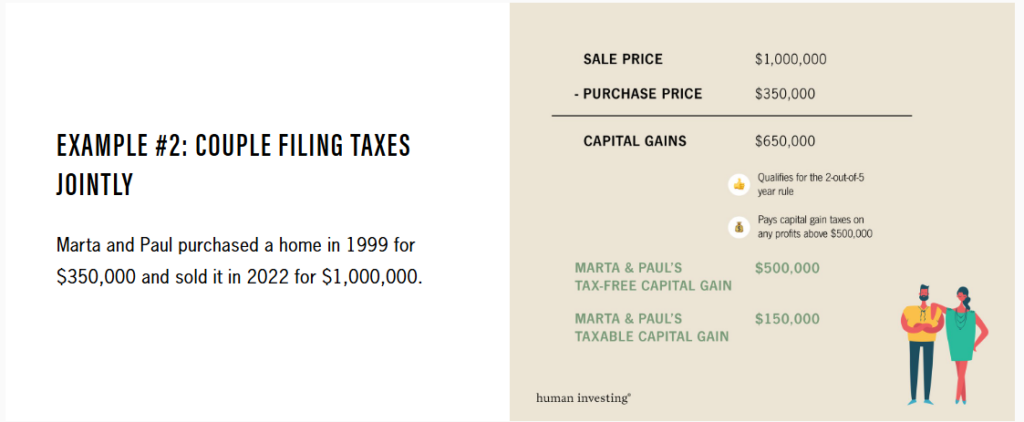

Below is a great example of the Section 121 exclusion in practice. The scenario assumes a couple purchased a home for $350,000 and later sold the home for $1,000,000. The taxable gain on the home would have been $650,000 without the exclusion, but because they met the ownership and use tests, they were able to exclude $500,000 from their capital gain and now are only taxed on $150,000 as opposed to $650,000.

https://www.humaninvesting.com/450-journal/is-it-time-to-sell-your-home

1031 Exchange:

For individuals that have investment properties (second homes, vacation homes, etc.) a 1031 exchange can be a powerful tool to defer capital gains taxes and manage a potential tax burden. Since these types of properties do not qualify for the Section 121 exclusion, sellers would be subject to the full capital gain imposed on the sale of the property and may be subject to depreciation recapture upon the sale if they have been deducting depreciation expenses on these properties. The 1031 exchanges allow for the tax-free exchange of one “like-kind” property to another and can help defer capital gains taxes into the future.

How it works:

The section 1031 exchange process is fairly straightforward but there are some important things to know and timelines to understand. This strategy allows for the exchange of one investment property to another with a broad interpretation of the term “like-kind” property. For example, if you exchanged an apartment building for a commercial building, this would still qualify under the rules of a 1031 exchange since both properties are categorized as investments.

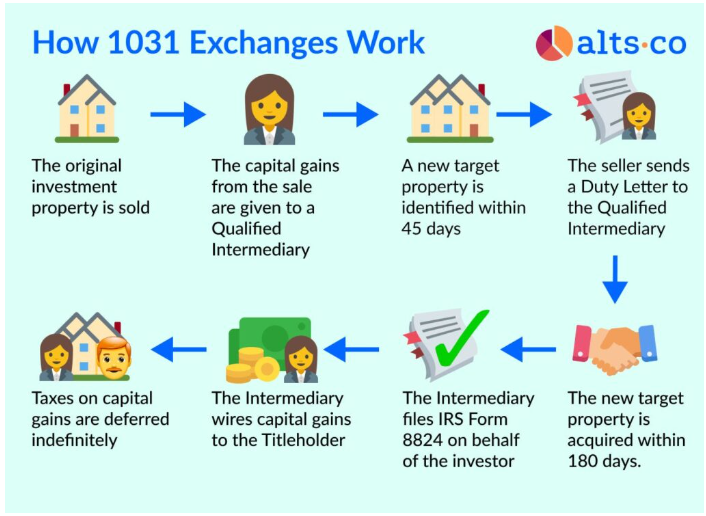

Generally, an exchange is a simple swap of one property for another, however, finding your suitable replacement property may require some time. That is why the majority of 1031 exchanges are what are referred to as delayed exchanges. The mechanics of a delayed 1031 exchange are important to note:

- Sale of investment property

- Qualified Intermediary: Upon selling your investment property, the proceeds must be transferred to a qualified intermediary rather than directly to you to avoid disqualification.

- Identification Rule (45-day rule): From the date of the sale of your investment property, you have 45 days to identify a replacement property in writing to the intermediary. The IRS allows you to designate three properties as potential exchanges as long as you eventually close on one of them.

- Completion Rule (180-day rule): You must close on the new property within 180 days of the sale of your old property.

It is important to note that if there is any cash leftover from the sale of your previous property upon closing on the replacement property, there could be tax implications on the surplus. As an example, if you sold a property for $1,000,000 and bought a property for $900,000, the $100,000 difference would be subject to taxes.

Below is a great illustration of the steps involved in a 1031 exchange:

Source: https://alts.co/1031-exchanges-the-biggest-little-secret-in-real-estate

Benefits and Estate Planning Considerations:

The ultimate benefit of implementing this strategy is that the 1031 is a tax-free exchange of one property to another, so if you have an investment property with a low-cost basis or a property that has significantly appreciated this can be a very powerful tool in managing your tax burden. From an estate planning perspective, utilizing the 1031 exchange strategy can be even more beneficial for your heirs. During your lifetime you can defer taxes on investment properties and then upon your passing, your heirs will inherit these assets with a step-up in cost basis which can significantly reduce the tax burden your heirs will have to manage upon inheriting the assets.

Investors may find themselves in a situation where they no longer want the day to day responsibilities of managing property, would like to defer their capital gains, but remain invested in real estate. Luckily, there is a strategy that could allow you to accomplish all these goals.

Delaware Statutory Trusts:

Delaware Statutory Trusts (DSTs) provide an attractive option for investors who prefer not to manage properties directly. These trusts, established by professional real estate companies known as DST sponsors, allow individuals to invest in significant real estate ventures, typically valued between $30 million and $100 million. This investment structure diversifies into various property types, including multifamily units, office spaces, industrial sites, retail locations, and niche markets such as senior living facilities and self-storage.

Advantages of DST Investments:

Tax Efficiency: DSTs are eligible for 1031 exchanges, offering investors the ability to defer capital gains taxes by reinvesting the proceeds from sold properties into new real estate holdings within the trust.

Access to Premium Assets: Investors gain access to institutional-grade real estate, which would typically be out of reach due to high entry costs.

Passive Investment Opportunity: Investors are not required to manage the properties directly, which is ideal for those who prefer a hands-off investment.

Efficient Transactions: DSTs can facilitate quicker property exchanges, minimizing the risk associated with a traditional 1031 exchange deadlines.

Estate Planning Perks: DSTs allow for a step up in basis for heirs, simplifying the inheritance process and potentially reducing future tax burdens.

DST to an UPREIT: An additional benefit/strategy that could be pursued is the 721 exchange which allows investors to further defer capital gains by converting their DST ownership into an UPREIT where they receive Operating Partnership Units (OP Units). This allows investors access to potentially more liquidity since the OP Units can be converted to REIT shares. REIT shares tend to offer more liquidity compared to a DST investment and typically create a passive income stream to the shareholders.

Considerations of DST Investments:

Investor Qualifications: To invest in a DSTs, individuals must meet the criteria of an accredited investor, defined by having a net worth exceeding $1M (excluding primary residence) or an annual income surpassing $200,000 ($300,000 for joint filers) over the last two years.

Control and Liquidity: While DSTs offer a passive investment model, this also means investors have minimal control over the day-to-day management and decisions. Additionally, DSTs are typically illiquid with investment terms ranging from 3 to 10 years, requiring a long-term commitment.

Market Exposure: Like all real estate investments, DSTs are subject to market fluctuations and interest rate risks, which could affect profitability and cash flow.

Operational Costs: It’s important to understand the fee structure of DSTs, as management and operational fees can vary and impact overall returns.

Delaware Statutory Trusts and UPREITs can be an excellent way for investors to stay in the real estate market without the responsibilities of direct management, offering tax deferral benefits and estate planning advantages. However, potential investors should conduct thorough due diligence and consult with financial advisors to ensure that DST/UPREIT investments align with their overall financial and estate planning objectives.

How Weatherly Can Help:

At Weatherly, our advisors have extensive experience with real estate transactions and their integration into clients’ broader financial plans. We collaborate with clients and other professionals to tailor strategies that align with individual financial goals. Our team is ready to provide guidance on optimizing real estate transactions and planning for future financial stability.

For more details on the strategies mentioned above and how we can assist you, visit our website or contact our team directly.

*Disclosures:* The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Blog content is human-generated by the Weatherly team members. AI was used to assist with generating titles and subtitles.