Our Roadmap to Retirement Planning

Ryan Richardson, CFP®, Wealth Management Associate Advisor | Chase Hayhurst, CFP®, Wealth Management Associate Advisor | December 16, 2021

For those approaching retirement, it can be an exciting time as they look forward to the next chapter in their life, whether it’s spending more time with family and/or focusing on the causes closest to them. We often see individuals ease into retirement by continuing on a part-time basis with their employer or through consulting work within their related field. This transition may bring a level of uncertainty as they shift focus to a different set of priorities such as income and spending, asset preservation, and estate planning to name a few. Many of these priorities will carry through to those already in retirement along with additional planning opportunities that will be discussed later. In this blog post, we will explore a variety of topics to help individuals prepare for retirement and build confidence as they enter and live out their golden years.

SAVE:

As you close in on retirement, it is an essential time to take inventory of your financial picture and prioritize based on importance. A quick win is to ensure that you are saving as much as possible. Individuals are often in their prime earning years as they approach retirement and should focus on maxing out employer retirement plans or contributing enough to take advantage of a full employer match, if available. The 2021 maximum contribution an employee can put into an employer retirement plan is $19,500 for those under 50 and $26,000 for 50 and over. Additional savings can be allocated to taxable or Trust accounts that do not have carry contribution limits. If self-employed, there are additional opportunities to fund a Profit-Sharing or Defined Benefit plan that can go beyond the traditional limits above. For additional contribution limits please see Weatherly’s Key Data Chart.

SPENDING/BUDGET:

After ensuring you are saving as much as possible, we recommend tracking how much you are spending on a monthly basis on both discretionary and non-discretionary items. Non-discretionary items can include bills such as utilities, mortgage payments, insurance etc. while discretionary items fall into areas such as going out to eat, vacations, and hobby related expenses. We suggest reviewing the past three months of your bank transactions to get a sense of your average monthly expenses. Alternatively, there are various budgeting websites that can track your expenses such as Mint.com that can be a helpful resource and found here.

ACCOUNTS:

Now that you have an idea of how much you are saving and spending, it is time to review where each of your accounts is held and the balances thereof. It is quite common for people to change jobs throughout their careers and leave their accounts within a prior employer’s plan. It is important to make sure you are able to access these accounts and Weatherly can help you consolidate them, if appropriate. While going through this process can be time consuming it is important to also look at the allocation of each of these accounts to ensure your entire portfolio is aligned with your risk tolerance and time horizon.

ESTATE REVIEW:

As you work through locating and accessing each of your accounts, it is a great opportunity to review the titling and beneficiaries of the accounts to verify they reflect your current estate planning objectives. While estate planning can vary widely between families depending on their unique situation and desires, we recommend all individuals have the following four documents in place.

- First, is a Will and Testament which is a key instrument used to outline how an estate is to be settled in a manner desired by the deceased. They typically include an executor of the estate, named beneficiaries, instructions for how and when the beneficiaries will receive assets, and guardians for any minor children.

- Secondly, a Revocable Trust that each of the assets are registered under excluding those with beneficiary designations. Assets in the trust will pass outside of probate, saving time, court fees, and potentially reducing estate taxes. You can also specify the terms of the trust precisely, controlling when and to whom distributions may be made.

- Third, a Power of Attorney document that provides legal authorization to a designated person to make decisions on your behalf regarding property, finances, investments, or medical care. Power of Attorney is most frequently used in the event an individual has a temporary or permanent illness or disability, or when they are unable to be present to sign necessary documents.

- Lastly, a Health Care Directive or commonly referred to as an Advance Directive which is a legal document that lets your loved ones and health care team know what kind of care you want, or who you want to make decisions when you are unable to do so.

FINANCIAL PLAN:

Before we move into our next section covering additional planning opportunities for those within retirement, let us first explore the importance of running a financial plan. When Weatherly works with clients to develop a plan, we take a holistic approach to ensure every aspect of the client’s financial profile is accounted for. While not limited to, we will generally request the following information:

- Overview of investable and real assets

- Annual expenses – both discretionary and non-discretionary

- Annual income sources and target retirement dates

- Liabilities

- One-time liquidation events such as business or real estate sales

- Family and business priorities and values

- Goals such as paying for education, real estate, retirement, or philanthropy

Once these items have been compiled, we will run a year-over-year cash flow-based projection using conservative assumptions that highlight the outcome of the base case scenario. The base case scenario will illustrate if the client is on track for a successful financial plan or if adjustments will need to be made. We will include a few different alternative scenarios to explore items that are in the client’s control such as different spending levels or retirement dates along with areas outside of the client’s control such as bear market events or longer life expectancy to name a few. These plans serve as a benchmark for future updates as we can look back and compare how your plan has evolved over the years. If you would like to learn more about how Weatherly works with clients in developing financial plans, we have included an earlier blog post here.

For those that are already in their retirement years, there are several different strategies and planning opportunities that are useful to ensure your assets not only cover your day to day living expenses but also the increased costs in the form of medical expenses. Individuals may no longer be covered by their employer’s insurance plan and will therefore need to purchase private insurance until they are eligible for Medicare coverage. Planning for this large and unpredictable expense is an important aspect of retirement planning. To learn more about how to prepare for healthcare costs in retirement, please follow the link here.

With a continued focus on spending and asset preservation it is important to align retirement income sources with goals and expenses. Spending will continue to have the largest impact on a successful retirement and will therefore be important to have a comprehensive withdrawal strategy. Not only are withdrawal amounts important, but the buckets that these funds come from are equally important to successfully funding goals for a long and prosperous retirement.

The main sources of retirement income outside of an investment portfolio typically come in the form of social security, pension, or rental income. However, these funds may not adequately cover living expenses in retirement and withdrawals from an investment portfolio must be made. Let’s explore the different account types and which buckets we recommend pulling from first to fund retirement living expenses.

Taxable Accounts: Draw from 1st

- Include Trust, Individual and Joint Accounts.

- Withdrawals may be subject to capital gains

- Holding period of 1 year or greater = favorable Long Term capital gains rates (currently 0%-20% depending on income level)

Pre-Tax/Tax-Deferred: Draw from 2nd

- Include 401(k), IRA, 403(b), Pension (DB/PSP)

- Withdrawals are taxed at ordinary income rates (currently 10%-39% depending on income level)

- 59 ½ – no penalty for withdrawal

- RMDs required by 72

Post-Tax/Tax-Advantaged: Draw from last

- Include Roth IRA, Roth 401(k)

- Tax Free withdrawals for owners and their heirs

Due to the preferential capital gains rates associated with taxable accounts, this would be the preferred bucket to draw upon first allowing for funds within the tax deferred bucket to continue to grow. Roth accounts are the most advantageous from a tax standpoint, which is why it is recommended to allow these accounts to grow for as long as possible with the added benefit to their heirs also being able to withdraw funds tax-free.

There is no one size fits all strategy, which is why regularly revisiting your financial plan to make sure you are on track to meet your goals is so important. Clients with a higher retirement income may not need to rely as much on their portfolio for living expenses allowing for a different asset allocation than those with lower income levels focusing on asset preservation and income in the form of dividends and interest.

Planning opportunities

Social Security Analysis

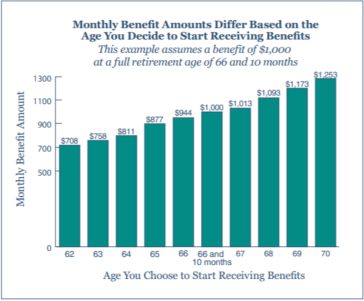

- As part of a comprehensive retirement plan, it is important to consider your retirement income when deciding on when to take social security. Timing of when to begin social security can have a significant impact on retirement income, as seen in the chart below.

- By running a social security breakeven analysis, we can help determine the most appropriate time to begin payments.

Chart Sourced from: https://www.ssa.gov/pubs/EN-05-10147.pdf

- Please use the following link to different social security calculators offered by the social security administration website.

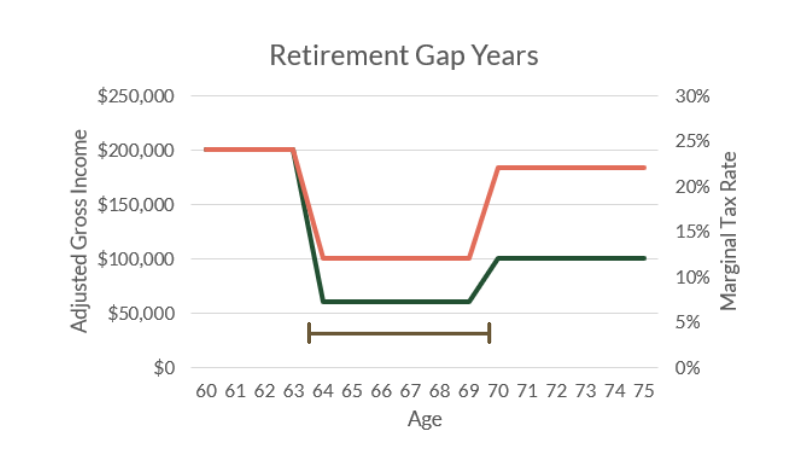

Roth Conversions – GAP Years

During the years between beginning retirement and taking your Required Minimum Distribution (RMD) at 72, many individuals experience a steep drop in income. These gap years provide for an ideal time to review claiming Social Security benefits and potential Roth conversion strategies. If you would like to learn more about the benefits of Roth conversions, we have included a link to a previous blog highlighting this strategy here.

Chart Sourced from: https://www.abovethecanopy.us/how-to-take-advantage-of-your-retirement-gap-years/

QCDs – Giving Strategies

After turning 72 the IRS requires individuals to take Required Minimum Distributions (RMDs) from their tax deferred accounts such as an IRA. If the RMDs are not needed for living expenses and individuals are charitably inclined a Qualified Charitable Distribution (QCD) is a strategy to reduce taxable income while achieving their philanthropic goals during retirement. Individuals can take advantage of this strategy beginning at age 70 ½. For more information on charitable giving, please reference our previous blog on the topic.

As we have covered, retirement planning is a very dynamic phase of life that requires proper preparation and ongoing focus across various aspects. Weatherly is here to help provide clarity and guide you into a successful retirement allowing you to focus on what matters most. We welcome you to reach out to your trusted advisor for any questions you may have on this topic or your managed accounts.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.