Nurturing the Nest Egg

Chase Hayhurst, CFP®, Senior Wealth Management Advisor | Andrea Taylor, CPA, MSA Wealth Management Advisor | June 13, 2024

In the journey toward financial security, the intersection of saving and spending plays a pivotal role- irrespective of income or assets. This blog post delves into the significance of a well-structured budget and offers key insights for those saving for retirement or already retired. It emphasizes the crucial steps individuals should take to secure their financial future, including strategies for pre-retirement saving and post-retirement withdrawal. Understanding these principles is vital for anyone aiming to nurture and grow their nest egg effectively.

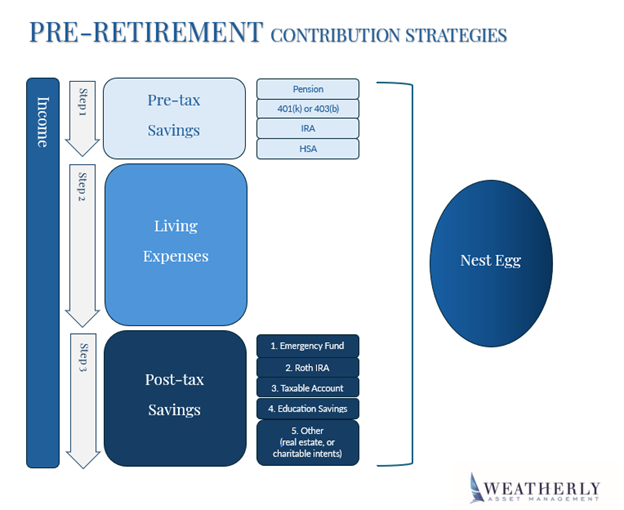

Saving Buckets Pre-Retirement

Step 1: Pay Yourself First

During your working years, it’s easy to overlook the importance of a detailed budget, relying instead on a regular paycheck to support your lifestyle. As careers progress and income increases, many people fall victim to lifestyle creep—spending more as they earn more without increasing their savings.

Fidelity advises aiming for a savings rate of 15% of your pre-tax pay, with the goal of saving enough to replace at least 45% of your pre-retirement income (Retirement Guidelines). While this is a recommended minimum, each household is different and retirement goals will vary. The motto “pay yourself first” is incredibly important. Setting up automatic, recurring savings to an employer-sponsored plan, such as a 401k or other pre-tax accounts like an IRA, ensures your income isn’t spent frivolously and helps reduce your taxable income. Depending on your employer, additional savings vehicles such as Health Savings Accounts (HSA) or Deferred Compensation plans may be available, allowing you to shield additional income from taxation and build your retirement nest egg. HSAs are particularly beneficial for healthcare savings, offering triple tax benefits: contributions are deductible, growth is tax-deferred, and qualified withdrawals are tax-free. Self-employed individuals have similar retirement options, which we explored in a previous blog post- Finding A Balance. Each of these plans have different annual contribution and income thresholds that can be found on the Key Financial Data chart.

Step 2: Understanding your Expenses

Once you’ve contributed to tax-deferred accounts, focus on managing your after-tax income for monthly living expenses and potential after-tax savings for investment accounts. Living expenses can often be broken down into two categories: non-discretionary and discretionary expenses. Non-discretionary represents expenses required to be paid, such as a mortgage, utilities, healthcare, or insurance. Discretionary expenses capture everything else that individuals or families spend to maintain their lifestyles. It’s common for people to mistakenly treat discretionary expenses as essential, such as multiple streaming services. Reviewing your monthly credit card statement can help identify unnecessary expenditures. Free online budgeting tools can categorize transactions, track spending, and provide insights into duplicative services. Taking the time to analyze your spending can uncover overlooked or frivolous expenses, enabling you to streamline your budget and optimize your savings.

Step 3: Prioritizing Post-Tax Savings Buckets

#1 Emergency Fund

First and foremost, we suggest clients save 3-6 months of expenses for unexpected events. Consider investing in liquid accounts like money market funds or high yield savings accounts.

#2 Roth IRA

Once the emergency fund has accumulated, look to tuck away money in a Roth IRA, if eligible. Roth accounts allow you to make after-tax contributions up to the annual contribution limit ($7,000 and additional $1,000 catch up contribution for those 50 and older in 2024). Roth accounts are attractive as the growth and qualified withdrawals are tax free for owners, beneficiaries, and are not subject to required minimum distributions.

Eligibility Requirements: To be eligible to contribute the maximum amount to a Roth IRA in 2024, your modified AGI must be less than $146K if single and $230K if married and filing jointly. Additionally, you or your spouse must have taxable compensation of at least your contribution amount. The income limits and contribution phase outs are further outlined on our blog post Keys to the Key Financial Data Chart.

#3 Taxable Accounts

Once an emergency fund has been established, contributions have been made to retirement

accounts (pre-tax and Roth), and HSAs are funded (if eligible), additional savings can be allocated to taxable accounts. Often this is in the form of taxable investment accounts- Trusts, Individual TODs (Transfer on Death), and Joint accounts. These accounts are attractive as there are no age-based restrictions and have favorable long-term capital gains rates for securities held for at least 1 year. On the other hand, portfolio income is taxed yearly.

Over time, maintaining a balance between funding retirement accounts and taxable accounts can provide greater flexibility in managing withdrawals and taxes. This mix ensures you have accessible funds for unexpected needs or opportunities while optimizing your overall tax burden throughout retirement.

When accumulated taxable accounts are in excess of needs, we began looking to educational accounts (#4) or charitable gift funds (#5). We will talk more about this below.

#4 Educational Accounts

Contributing to tax-advantaged education-savings accounts, such as 529s, can offer significant benefits to both you and the recipient. By leveraging the annual gift tax exemption amount ($18K per person, per individual for 2024), parents or grandparents can reduce their taxable estate while contributing to qualified educational expenses.

Funding Rules: In general, you can contribute up to $18,000 ($36,000 for married couples) per beneficiary per year without triggering federal gift taxes in 2024. However, special 529 rules allow you to front load five years of annual exclusions for a tax-free gift of up to $90,000 (joint taxpayers may fund $180,000). Refer to our blog post 5 Estate Planning Strategies for more information.

#5 Other

We include one last bucket as a catch-all for individual needs and goals. For those looking to diversify their net worth by investing in real estate, they can leverage funds from the taxable accounts. Investing in real estate can provide both rental income and potential appreciation in property value, which can be an effective way to build wealth and generate passive income.

Another common strategy we use with our clients who are charitably inclined is opening a Charitable Gift Fund. Donor-Advised Funds (DAFs) are a popular choice, allowing you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time. This strategy provides flexibility in your charitable giving and can be a valuable tool for estate planning. Contributions to DAFs can also help reduce your taxable estate, which can be particularly beneficial for high-net-worth individuals. We go into more information here: WAM’s Guide to Giving.

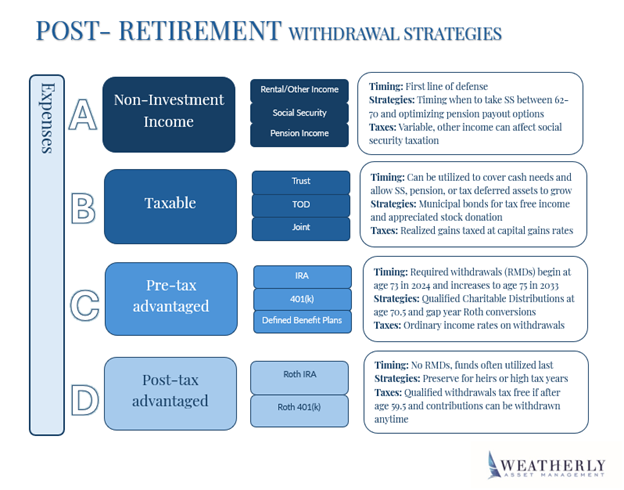

Post-Retirement Withdrawal Strategies

The shift from saving to spending in retirement can be challenging, underscoring the need for a comprehensive financial plan. We work with clients regularly on these plans and review withdrawal rates to maintain sustainable spending levels. It is important to customize your withdrawal strategy- focusing on tax efficiency while balancing factors such as age, income streams, assets, and estate goals. There is no universal approach, it is important to consider different income sources and account types over time for a more tailored strategy.

A. Non-Investment Income

If you have rental properties or other passive income streams, these should be your first line of defense for covering living expenses in retirement. Utilizing these sources can help preserve your investment portfolio, allowing it to continue to grow and support your financial needs in later years.

Two focused planning areas we often discuss with our clients revolve around Social Security and pension income. Deciding when to start collecting Social Security benefits can impact your retirement income. You can begin receiving benefits as early as age 62, but if able, delaying benefits until age 70 can significantly increase your monthly benefit. Evaluating your financial situation and life expectancy can help determine the optimal time to start Social Security. The same goes for pension payouts; to maximize its value, ensure payout options and survivor benefits are considered.

B. Taxable

Taxable accounts are generally the next step to tap into during retirement. These accounts offer favorable tax treatment on long-term capital gains or dividends and come with no age-related restrictions on withdrawals. By using funds from taxable accounts initially, you allow your tax-advantaged accounts more time to grow until RMD age.

C. Pre-Tax Advantaged Accounts

Starting in 2024, Required Minimum Distributions (RMDs) begin at age 73 and increase to 75 in 2033. Withdrawals from these accounts are taxed as ordinary income, which can significantly impact your tax bracket. Therefore, it’s crucial to strategize withdrawals to minimize tax liabilities. Understanding RMD rules and timing your withdrawals can help avoid hefty tax penalties and optimize your retirement income.

Withdrawal Restrictions: You can withdraw from these accounts without a penalty after reaching 59.5 years old. At age 70.5, you can make tax-free charitable donations directly from your IRA, which can satisfy your RMD (Required Minimum Distribution) requirements and reduce your taxable income. For more information on recent updates to Secure Act 2.0 read our recent blog Secure Act 2.0

D. Post-Tax Advantaged Accounts

Roth accounts are often saved for later in retirement or strategically leveraged by high earners due to their unique tax advantages. Unlike traditional retirement accounts, Clients over the age of 59.5 who have held their funds in a Roth account for at least five years can withdraw contributions and earnings tax-free. By delaying withdrawals from Roth accounts, individuals can allow their investments to grow tax-free for a longer period, maximizing their retirement savings. High-net-worth individuals may find Roth accounts advantageous for estate planning, as these accounts are not subject to required minimum distributions during the original owner’s lifetime. This feature allows for a more flexible and tax-efficient transfer of wealth to beneficiaries.

Conclusion

A well-structured contribution and withdrawal strategy is essential for a financially secure retirement. Prioritizing various income sources and understanding the tax implications of different account types optimizes retirement savings. We help many of our clients who are small business owners and executives prioritize income and wealth strategies through various personal and business transitions. There are many different planning opportunities available based upon various ages, life events, and individual’s personal situations that Weatherly can identify and plan for. Whether this involves running a full financial plan or isolating a particular scenario- we enjoy educating our clients and optimizing the right path forward.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.