WAM’s Guide to Giving

Aubrey Brown, CFP®, CRPC®, M.S. Wealth Management Advisor | Brooke Boone Kelly, CFP®, MACC, Senior Wealth Management Advisor | November 17, 2022

It’s that time of the year again when we celebrate Thanksgiving and start preparing for year end! For many of our clients it is an opportunity to give thanks and give back to their communities in the form of charitable donations. The charitable landscape has grown significantly during the last couple of decades and progressed even further in recent years in the midst of a global pandemic, Russia/Ukraine war, and global inflation. In 2021 alone, charitable giving by Americans totaled $484.85 billion, up approximately 4% from the prior year. Donations are most impactful when there is a specific need, and we have seen our fair share of new challenges in recent years.

While the most common way to give is in the form of cash or check, it isn’t always the most tax efficient method to give to charity. In this blog post, we outline tax efficient strategies to help maximize charitable giving in hopes to have a positive influence on the world.

Donor Advised Fund (DAF)

A Donor Advised Fund (DAF) allows donors to contribute appreciated assets to a charitable account and capture a current year tax deduction*. The funds can then be invested tax free until they are granted out over time to qualified 501c3 public charities.

The ins and outs of the DAF is best summarized by the three Gs- Give, Grow and Grant.

Give→

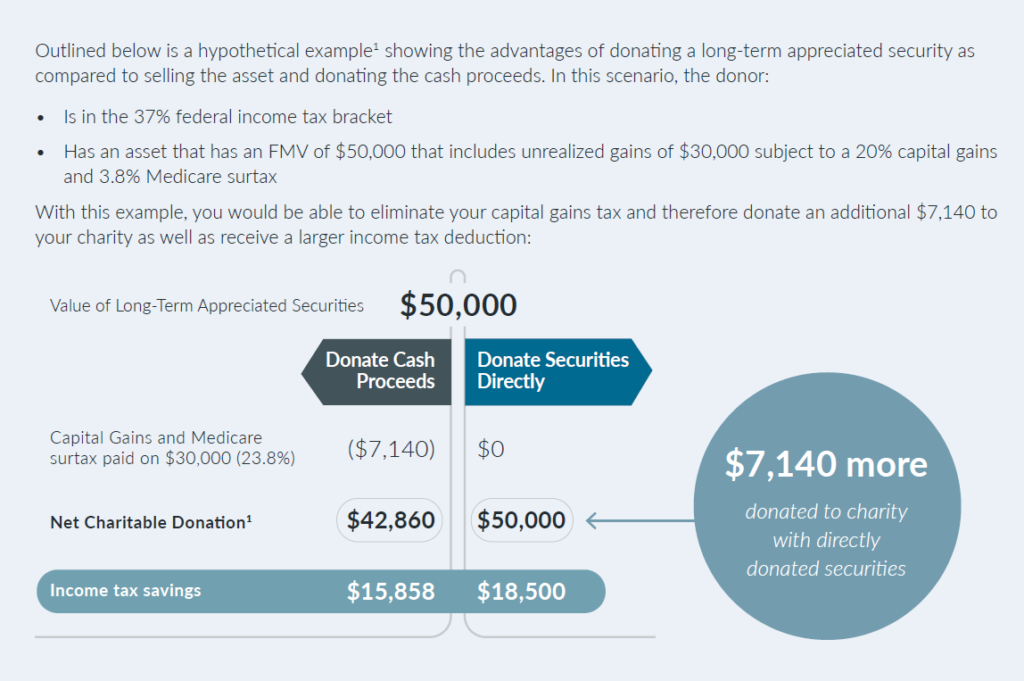

For a current year tax deduction*, donors can make an irrevocable contribution of cash, publicly held and some privately held assets prior to December 31. While the DAF does allow for cash donations, contributing a long term, appreciated asset may allow the donor to deduct the Fair Market Value (FMV) of the asset and effectively eliminate the associated capital gain tax implications had the donor sold the asset and donated cash. Donating appreciated securities typically results in a larger deduction and more money for the end charity, as the following example illustrates:

Chart Sourced from Fidelity Charitable

Tax Benefits:

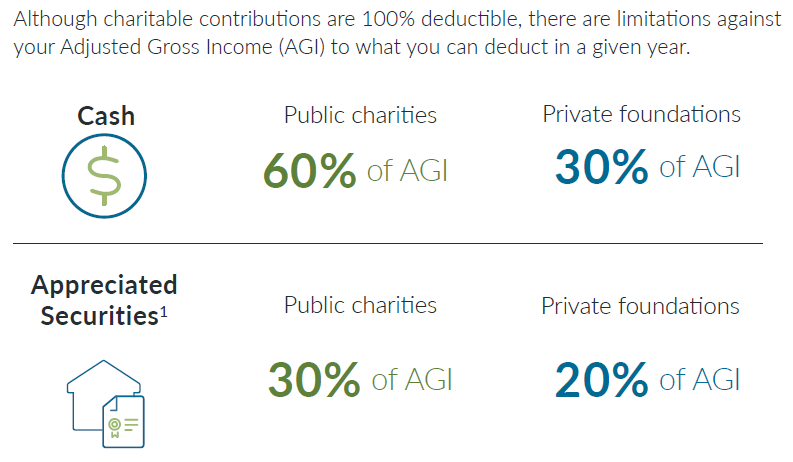

Donors who itemize their deductions can have their turkey and “gravy”, too, as they may be eligible for a tax deduction* in the year an appreciated asset contribution is made to a DAF, with some Adjusted Gross Income (AGI) limitations:

Chart Sourced from Fidelity Charitable

Although the AGI figures above may limit your current year deduction, any unused amount that exceeds the limits can be carried forward and deducted within the next 5 years. For this reason, charitable giving and year end tax planning should have a seat at the same table to ensure charitable intent and tax benefits are aligned.

Grow →

Once the assets are transferred into the DAF, most large custodians allow the funds to be invested for potential tax-free growth.

Grant →

Since tax deductions are captured on the front end, when assets were initially contributed to the account, it allows the donors to take their time in granting out to 501c3 public charities. This may come in subsequent years or whenever the donor is ready.

DAF Strategies to consider –

• Contribute long term, highly appreciated securities and/or to limit concentration risk in a portfolio: The Weatherly team can assist in opening a DAF and subsequent asset selection to fund the account.

• Consider a Bunching strategy in high income tax years: If income is higher in a particular tax year, multiple year’s worth of contributions can be “bunched” into the high-income tax year for a larger deduction. Donors can then take their time granting out the funds in future years.

Qualified Charitable Distribution (QCD)

A Qualified Charitable Distribution (QCD) allows an individual age 70.5 or older to donate up to $100K per year from IRAs directly to one or more charities. These distributions are not included in taxable income and can be beneficial for those taking Required Minimum Distributions (RMD) at age 72 and/or claiming the standard deduction.

QCD client example:

A now retired married couple, Mr. And Mrs. Awesome, worked hard and saved some money in the Awesome Family Trust, but much of their savings were through salary deferrals to their employer’s 401k plans. Since retiring, they have rolled their 401ks into IRA accounts. For the current tax year, Mrs. Awesome, age 75, has an IRA RMD of $50k. Mr. Awesome is not RMD age, 72, yet. The Awesome’s paid off their home mortgage and therefore, anticipate they will take the standard deduction for this tax year. They have minimal expenses and can live off their Social Security Income and pension income, totaling around $250k a year.

As they adjust to retirement, a big goal is to continue their annual charitable donations of $50k. The Awesome’s advisor recommends they complete a QCD direct from Mrs. Awesome’s IRA to the various charities they are passionate about. Since they do not need the RMD income, Mrs. Awesome selects 5 different charities to give $10k in QCDs to, and therefore, satisfying her RMD requirement for the year. They can meet their philanthropic goals without itemizing their deductions and get to exclude $50k from their taxable income.

The next tax year, Mrs. Awesome’s IRA RMD is approximately $60k. After a few dialogues, the Awesome’s decide that they would like to be consist with their $50k annual gifting goal. Their advisor helps them complete the same 5 QCDs of $10k each. The remaining $10k RMD is sent to the Awesome’s Family Trust and is included in their taxable income for the year.

QCD Strategies to consider:

• Using QCDs to satisfy a portion or entire RMD for the year can limit taxable income and keep you in a lower overall tax bracket.

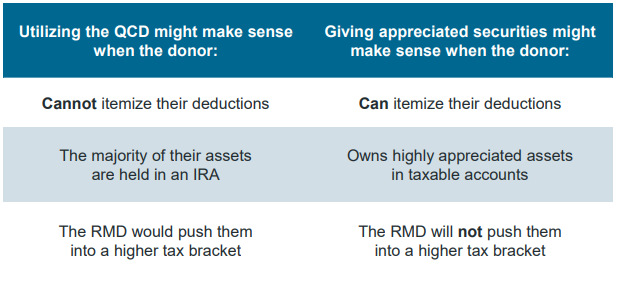

• The chart below highlights a typical client profile for a QCD strategy versus giving appreciated securities to a DAF:

Appreciated Stock Donation to DAF vs QCD Strategy

Chart Sourced from Fidelity Charitable

Charitable Trusts and Estate Planning

For Ultra High Net Worth and philanthropic individuals, more complex strategies can be considered as part of an estate and legacy plan. Depending on the donor’s philanthropic and estate planning goals, Charitable Lead Trusts (CLTs) and Charitable Remainder Trusts (CRTs) can create income streams for an individual or a charity for a certain period with the remaining balance going to a charity or other heirs. These types of trusts pair philanthropy with other financial goals and can even help reduce estate taxes. The Weatherly team is here to coordinate with your estate attorney to ensure these trusts are set up correctly and with your tax professional to determine initial funding and tax deductions.

Another item that combines charitable giving with estate and legacy planning would be to list a DAF as a beneficiary in your trust or retirement account. This allows for ultimate flexibility as a DAF successor can be updated at any time without involving an estate attorney. Donors can list either individual(s) or public charity(ies) as successors on the account. If an individual is listed as successor, then the successor takes over the DAF at the original accountholder’s passing and can donate to charities as they wish. This could be used to start the family conversation surrounding wealth and/or help carry out the family legacy. If a charity is listed as a successor, the DAF balance will go directly to the charity of your choosing. This can help reduce estate taxes and fulfill charitable goals while maintaining assets during a donor’s lifetime. Consult with your attorney, tax professional and Weatherly before implementing this strategy.

Strategies to consider:

• Incorporating family members in charitable giving and planning.

• Charitable giving at passing can reduce estate tax liability

How Can WAM help?

Your Weatherly team is here to assist in your charitable endeavors while considering your overall tax situations. We can determine the best strategy to facilitate your giving, research charitable organizations and coordinate with your attorney and tax professional as appropriate. We also request tax returns to review prior year giving and to identify strategies going forward. As always, please don’t hesitate to reach out with any questions or to schedule a yearend planning call. In the meantime, we would like to give THANKS to all our clients for our partnership over the years.

*In order to receive a tax deduction for charitable giving, one must itemize deductions on with Schedule A.

Additional Resources:

Top San Diego Charities

Top National Charities

2022 Fidelity Giving Report

2022 Key Financial Data Sheet

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.