Expanding Horizons: The Benefits of Adding International Equities to Your Portfolio

Brent Armstrong, CFP® Wealth Management Advisor, Partner | Marty Rascon, Wealth Management Associate Advisor | July 11, 2024

We’ve all heard the old cliché “Don’t put all your eggs in one basket,” and that couldn’t be more evident than in the realm of investing. In the field of investing, putting all your eggs in one basket is often referred to as “portfolio concentration,” and can be a very risky investment strategy that can leave your portfolio vulnerable. Portfolio diversification, on the other hand, is an investment strategy that aims to reduce overall portfolio risk by investing in various types of assets knowing that they will behave differently than each other. There are many ways to achieve diversification within your portfolio, from investing in stocks, bonds, real estate, cash, etc., each of which behaves differently over time depending on the underlying economic conditions. Achieving proper diversification in your portfolio is a time-tested and prudent investment strategy that can provide reduced risk and peace of mind.

There is one factor of a properly diversified portfolio that can often be overlooked by investors. “Home bias” is a common pitfall amongst investors in which they prefer their domestic assets rather than assets from outside their own country. Many reasons can explain this home bias, but one of the most common reasons is investors feel more comfortable investing in securities that they are more familiar with. Unfortunately, this bias is limiting investors in their ability to achieve proper diversification within their portfolios and oftentimes leaves them overly concentrated in their own country’s assets and their country’s dominant sectors. This blog will explore international investing and the role it plays in your portfolio. We will discuss the benefits, opportunities, and items to be aware of when considering adding an international allocation to your holdings.

Diversification Matters:

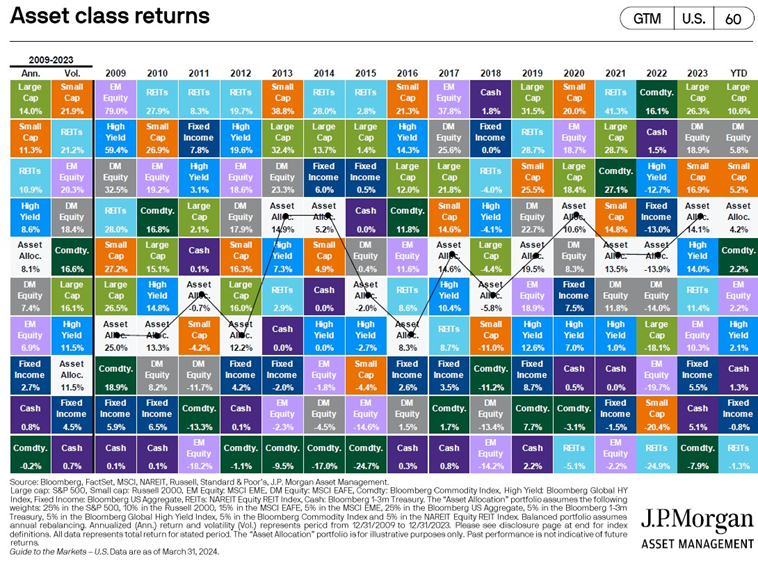

As we discussed above, diversification is a vital aspect of developing a resilient investment strategy that can assist you with achieving your financial goals while spreading your risk amongst various asset classes. Below is a helpful representation as to why diversification matters in an investment portfolio. Just as it is extremely hard to time the market, it is also a challenge to predict which asset class will outperform another in any given year. The below chart illustrates the performance of different asset classes in each calendar year from 2009 to the second quarter of 2024. What you’ll notice is asset classes perform differently from year to year, primarily due to underlying economic conditions. Diversification comes into play when you have exposure to various asset classes to ensure you reduce risk and smooth out your returns over time.

The logical question to ask next is how does diversification work in practice. The answer lies in the correlations of assets, the degree to which two assets move with each other. This is especially true when it comes to investing internationally and thinking globally rather than being laser-focused on domestic assets.

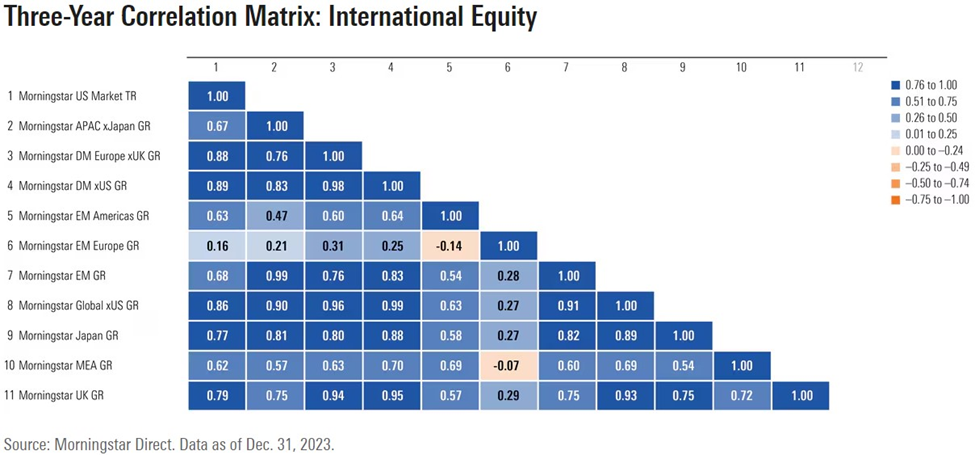

Below is a correlation matrix provided by MorningStar illustrating the degree to which international equities move with each other.

In the above chart, the darker the rectangle, the more highly correlated the assets are. As an example, the MorningStar US Market TR is highly correlated to the MorningStar Developed Market Europe xUK index at .88 but has a low correlation to the MorningStar Emerging Markets Europe index. To put it simply, when the US market moves in a certain direction, most of the time so do the developed markets of Europe. However, emerging markets in Europe are not highly correlated with the US market providing diversification benefits since those asset classes behave differently.

In recent years, the correlation between US equities and international equities has become more correlated as we have experienced a more globalized economy. However, historically this has not always been the case, and diversification benefits are still present within international markets.

Home Bias & Sector Comparison:

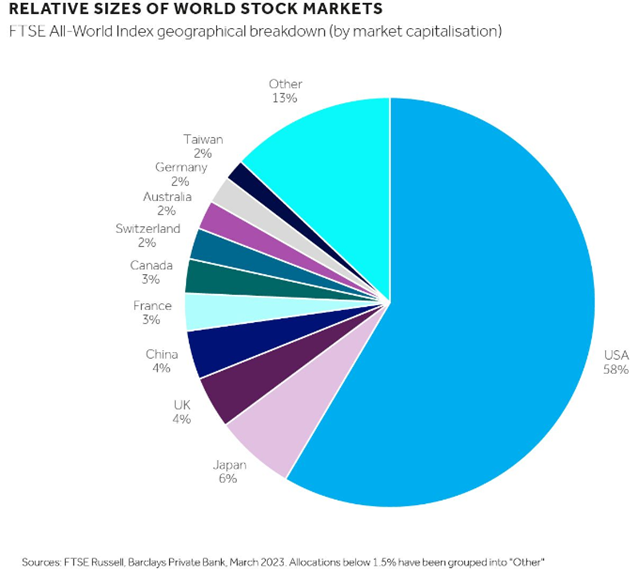

Investors often fall into the trap of preferring their own domestic assets and ignoring the larger global picture. As an example, according to Barclays in the United Kingdom, it is estimated that on average approximately 25% of portfolio allocations are in UK assets despite UK assets comprising only 4% of the global market index.

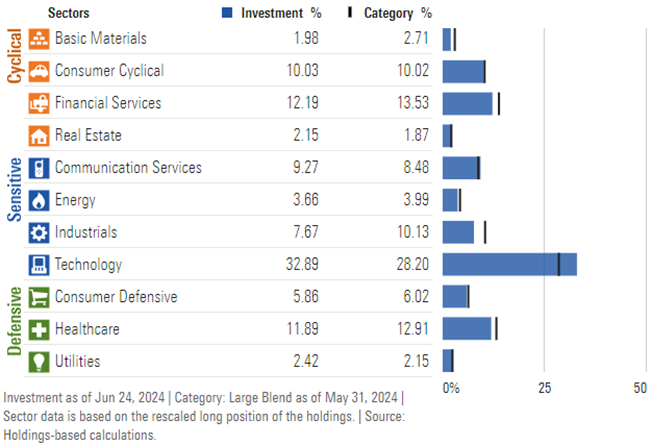

This example of home bias demonstrates an investor’s inability or apprehension to invest outside of their borders. This causes a few different problems and lack of diversification is chief among them. There is also another, more granular, issue with home bias that has to do with the composition of each country’s equity markets. For example, in the United States, roughly 32% of the S&P 500 is comprised of growth-oriented technology companies.

S&P 500 index sector weights as demonstrated by SPY

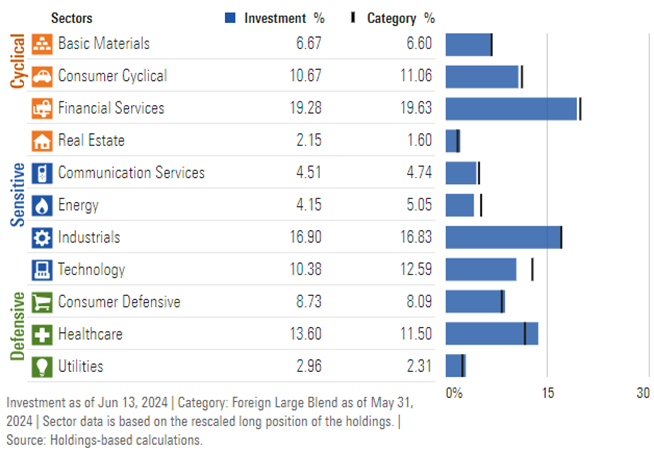

However, if we look at a broad-based international index as demonstrated by the MSCI EAFE, which is an index that tracks Europe, Australasia, and East Asia, we can see that the market composition is completely different. As demonstrated by the below chart, the sector composition for the MSCI EAFE is not as overly concentrated in any one sector to the degree the S&P 500 is. Additionally, the composition of this international index is more heavily tilted towards companies that would be considered value stocks as opposed to the US that is tilted heavier toward growth stocks.

MSCI EAFE index sector weights as demonstrated by EAFE

By having your portfolio heavily concentrated in your domestic markets, you may be missing opportunities and diversification benefits present from international exposures. As we can see from the index comparisons of the S&P 500 and the MSCI EAFE, there are concrete differences in each’s sector composition. Without some international exposure, you could be missing out on opportunities abroad in sectors that aren’t highly represented in your own domestic market and have too much exposure to a particular sector.

US vs. International Historical Performance:

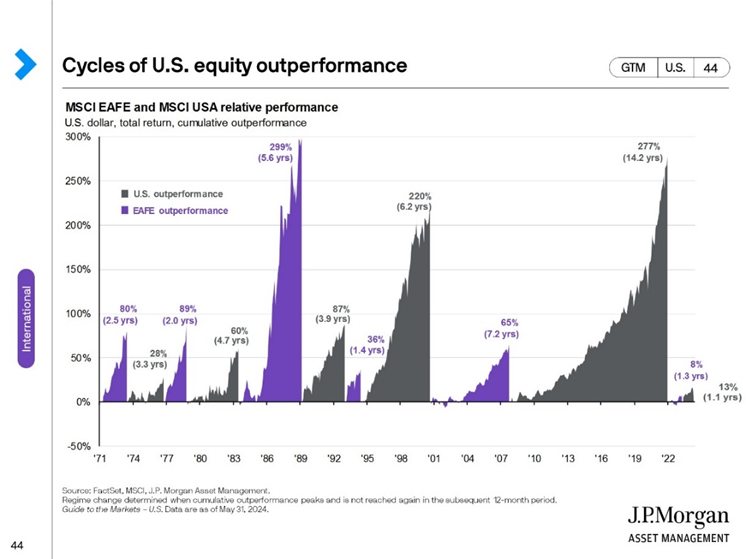

The performance of US vs. International equities are cyclical in nature. There are periods when International markets outperform their US counterparts and vice versa. The below chart shows an illustration of the various cycles of US vs. International performance and the corresponding years that outperformance lasted and the return differential.

As demonstrated by the above chart, in recent history, the US experienced the longest period of outperformance since 1971 at just over 14 years. However, there are periods when having international exposure in your portfolio would have been a real benefit. The most recent period of international outperformance came in 2022 when the MSCI EAFE beat the MSCI USA index for 1.3 years with a return differential of 8%. And again, just like it’s extremely difficult to time the market, predicting when the international vs. US pendulum swings is just as difficult. By having some international exposure, you may be able to participate in upside potential even if the US market is not doing well, demonstrating another benefit to a globally diversified portfolio.

International Valuation as of 2024

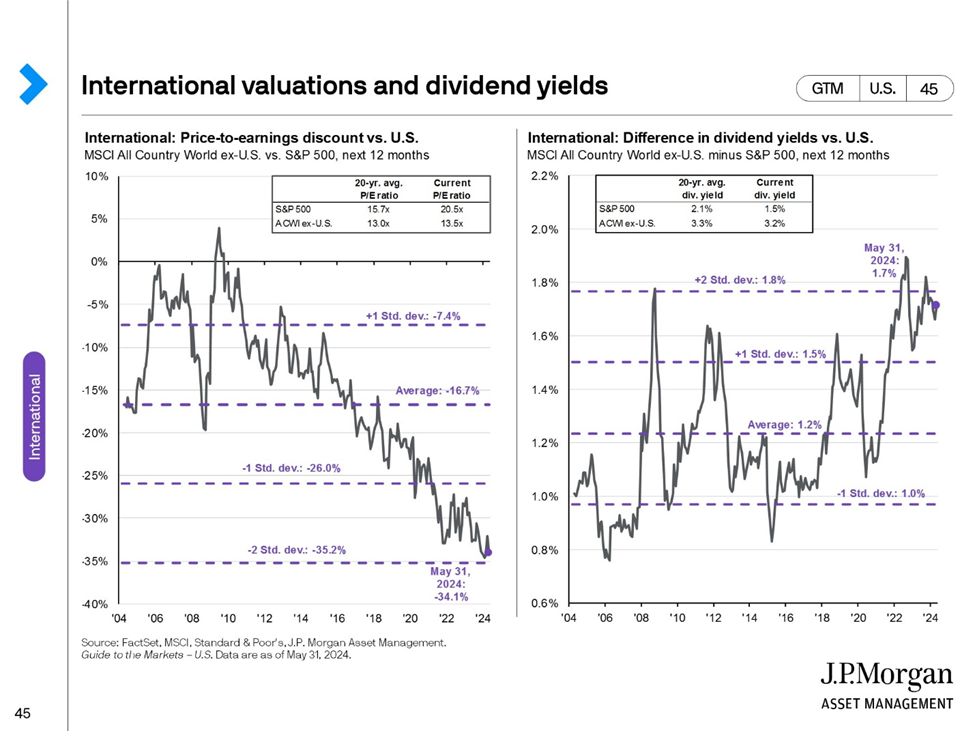

Another compelling reason to add international exposure to your portfolio stems from the current valuation differences between US equities and international equities. The below chart from JP Morgan demonstrates the differences in pricing as demonstrated by the price-to-earnings ratio (P/E). The P/E ratio is a measurement of a company’s current stock price to its earnings per share allowing for comparisons between companies, sectors, and even countries. Historically, the US market has demanded a higher P/E ratio due to the quality and growth of the companies within the S&P 500. However, at this point, international equities are cheap relative to historical averages, and the US is expensive relative to historical averages. Additionally, for income-seeking investors, international equities provide a higher dividend yield relative to their US counterparts making for an attractive investment given the valuation of US to international stocks.

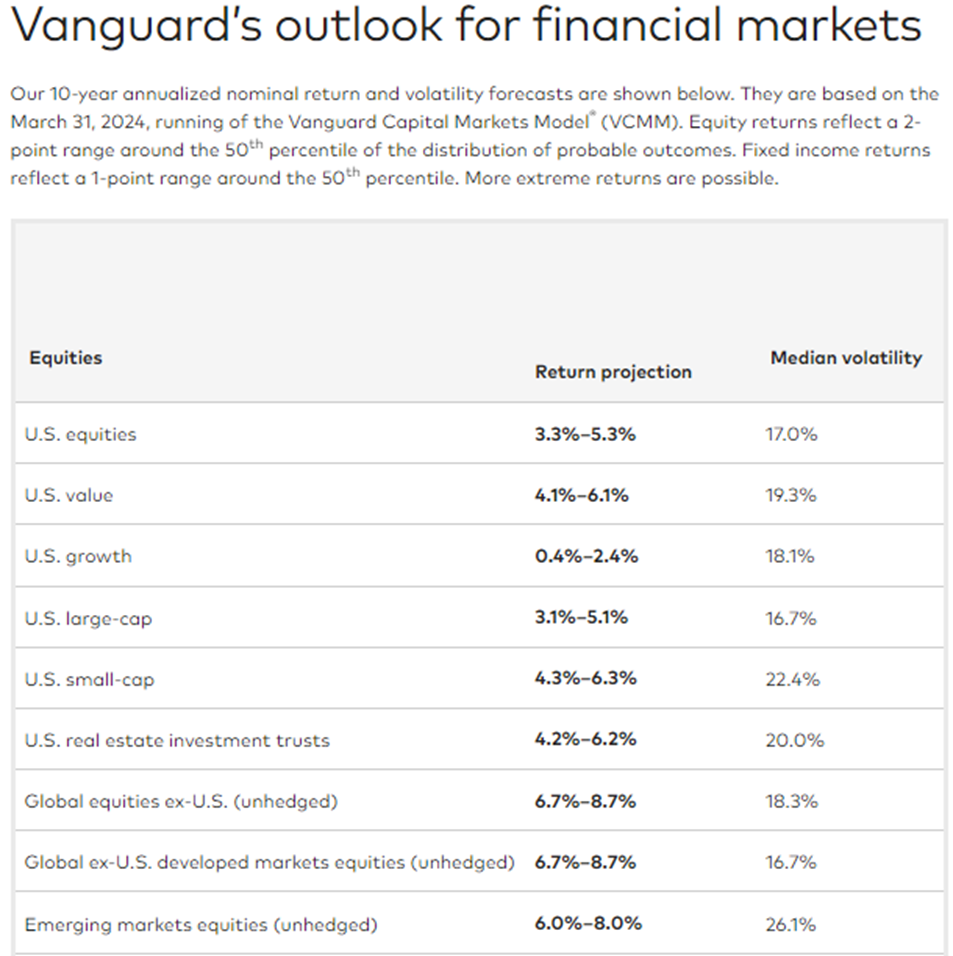

Additionally, several large asset managers such as Vanguard and Blackrock continue to argue for the inclusion of international equity given the long outperformance of the US market along with opportunities abroad. Vanguard also provides their forward 10-year return and volatility forecasts for various asset classes. Based on their research and models, they are forecasting international equities to outperform US equities over the next 10-years.

Challenges and Considerations

With every investment, there are inherent risks and challenges. Below we would like to outline a few to be aware of when considering investing internationally.

- Fees & Expenses: If you are a domestic US investor looking to invest internationally be aware that some mutual fund and ETF providers may have higher fees associated with their international offerings. This is due to different transaction costs in international markets along with the need to invest significant time and resources to understand international markets and recommended investments.

- Geo-political risks: Political, economic, and social dynamics vary from country to country and can be hard to understand and foresee for domestic investors. Additionally, differences in legal systems from country to country could cause potential issues for investors internationally.

- Currency: If you are a US-based investor looking to invest directly in international stocks, you would be required to exchange your dollars for foreign currency. This would bring in currency risk for the holding period as the value of each country’s currency appreciates or depreciates relative to the other. Generally, utilizing a vehicle like a fully hedged international ETF or mutual fund is the preferred route.

- Liquidity: Liquidity risk refers to the risk of not being able to sell your investment quickly and convert it to cash. This risk is present when investing directly in international markets, especially emerging markets. Here again, utilizing an ETF or mutual fund with ample liquidity is preferred if you want exposure to these asset classes.

Conclusion

Keeping a global perspective when constructing your diversified portfolio may help to reduce overall portfolio risks and help you take advantage of opportunities abroad. Countries vary in the composition of their markets and it’s important to consider this granular detail to understand the risks and opportunities you have exposure to. Although US equities have outperformed international in the recent past, it’s important to remember that this relationship is cyclical and it’s very hard to predict when international or US markets will outperform the other.

At Weatherly, we specialize in personalized financial planning and creating customized portfolios to meet the needs of our clients. As part of our portfolio construction, Weatherly has maintained an overweight to US equities over the last decade due to favorable economic conditions in the United States and the historic period of outperformance relative to international equities. However, within client portfolios, we retain exposure to international equity given all the reasons mentioned in this blog post.

Our team of experienced advisors are here to discuss your financial needs and goals. Through our financial planning and investment management services, we seek to offer you clarity and confidence on your financial journey.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.