Benjamin Franklin once said, “In this world, nothing is certain except death and taxes.”

Given the recent shift in presidential power, there has been a renewed focus around potential tax and estate law changes under the Biden Administration. Specific to estates, there is a proposal for the estate exclusion amount to drop from the current record high of $11.7M/person to as low as $5M or $3.5M/person and the amount over these thresholds to be taxed at 45% versus the current 40% rate. In preparation for these potential changes on the horizon, the best first step is to complete a financial evaluation with Weatherly to approximate future net worth and gifting capabilities within a record-low interest rate environment. If you have a good nest egg to support your needs, there are a few estate planning tactics to consider. In this blog post we outline “The What” and “The How” of some gifting and estate planning strategies to proactively discuss with your team of professionals.

1) Annual Gifting, 529s and Forward Gifting

The What – Annual gifting to the next generation or other family members may be a tax savvy way to pass assets to the next generation while also lowering your overall estate value. For 2021 tax year, the gift tax annual exclusion amount is $15,000 per person. The IRS will not require a gift tax return to be filed and the gift will not count against the estate exclusion amount, which is currently set at $11.7M/person. Please reference our 2021 Key Financial Data Chart for further details.

The How – A parent or grandparent who is above the estate exclusion amount and wants to help the next generation save for education, may want to consider a forward gift via a 529 account. As it currently stands, in a given year the IRS will allow an individual to make a forward lump-sum gift equal to five times the annual gift exclusion, or $75,000/person ($150,000/married couple), to a 529 account. If no other gifts are made to the 529 account beneficiary over the next 5 years and you make the 5-year election, it will not count against your estate exclusion amount. Once the funds are in the 529 account, they can be invested, grow tax free and are not taxable at withdrawal if they are used for eligible education expenses.

Please reference the following link for additional information and examples on forward gifting to 529 accounts: https://www.ameriprise.com/financial-goals-priorities/family-estate/estate-planning-and-529-plans

2) Intra Family Loans

The What – Intra-Family loans are agreements between family members to access capital with benefits that may not be available in an institutional relationship. If structured properly, the loan can be advantageous to both parties – the lender can transfer wealth without making an outright gift and the borrower can make smaller interest payments, skip tedious applications, and obtain flexible repayment structures. Loan interest rates must be set at or above the AFR (applicable federal rate) via the IRS website, which is updated monthly.

The How – A parent or grandparent can enter an agreement with a future beneficiary of assets when they are buying a home or starting a business. A written contract is outlined between the parties, with potentially attractive terms for the beneficiary, for example: interest-only payments, lower than market interest rates, or loan forgiveness up to the annual gift exclusion. The lender transfers these dollars out of their estate without tampering with their estate exclusion. Please check with your Advisor to ensure that the signed promissory note meets the IRS requirements for an intra-family loan.

Please reference the following link for additional information and examples on intra-family loans that may help your loved ones: https://www.fidelity.com/viewpoints/wealth-management/insights/intra-family-loans

3) Family Limited Partnerships

The What – A family limited partnership (FLP) is an entity created by family members to run a commercial project, start a venture, or hold assets. A general partner (GP) owns the largest share of the business and is therefore controls the management of the FLP, similar to a trustee. There are also limited partners with some relation to the GP that own shares and have no management responsibilities. FLP interests can be gifted or sold to members of the family via share ownership so that any growth or revenue from the FLP is no longer included in the original depositor’s estate.

The How – A couple that has amassed a significant net worth can create an FLP and name themselves as general partners with their revocable (living) trust as the sole limited partner. Real estate or securities can be held in the FLP with limited partner shares gifted to beneficiaries on an annual basis at a value near the annual gift exclusion amount. Minority or marketability discounts may apply to limit share valuations. The couple maintains control as general partners, but limited partners will receive the benefit of future income and asset growth typically at a lower tax rate as the investments appreciate and return capital. The FLP can also set stipulations to protect against mismanagement.

Please reference the link below for additional information and insight to how and why a Family Limited Partnership may fit your family’s needs: https://www.thebalance.com/family-limited-partnerships-101-357872

4) Outright Gifts to Trusts

The What – A revocable (living) trust is a useful tool for those wishing to avoid probate, provide credit protection for heirs, outline distribution wishes, and maintain the ability to amend their trust. The owner of the revocable trust pays the taxes on assets held within the trust.

The How – While many clients have an active revocable trust, their next generation beneficiaries may not. Beneficiary heirs can establish their own revocable trusts and serve as grantor and trustee, and the trust can be for their benefit. The parents or grandparents can help cover estate attorney expenditures to establish the next gen trust and then fund the new trust with large gifts, most often times over the current annual gift exclusion. The benefits are to both parties. The recipient of the gift is involved in his or her own critical estate planning. The parents or grandparents remove the future appreciation of the asset from their estate and the amount gifted over the annual gift exclusion goes against their estate exclusion.

5) Irrevocable Trusts

The What- An irrevocable trust is a vehicle that can be used to remove assets from the grantor’s taxable estate. The grantor creates the trust and designates another individual or corporation as independent trustee. Once the trust is created, it typically cannot be revoked, amended, or terminated. These vehicles are usually appropriate when the grantor can relinquish control of the assets, does not need the assets during his or her lifetime and does not plan to change the beneficiary designation(s) of the trust.

The How- A high net worth couple with assets over the estate exclusion often have life insurance policies that may not be needed during their lifetimes, but rather needed by their beneficiaries for taxes, estate fees or inheritance at their passing. If structured properly, an Irrevocable Life Insurance Trust (ILIT) enables individuals to exclude a life insurance death benefit from their taxable estate at their passing. Essentially, the insured individual or grantor of the ILIT, transfers the life insurance policy ownership from the grantor to the ILIT. The beneficiary – whether it be a spouse or child – is the individual(s) listed in the ILIT document. The grantor can still pay the policy premiums via annual gift directly to the ILIT and a Crummey Letter stating a gift had been made would be provided to the beneficiary. Assuming the grantor makes no other gifts to the ILIT beneficiary for the year and the premium payment, or gift, is below the annual gift exclusion amount, it would not count against the grantor’s lifetime exclusion amount. If policy ownership is transferred from the grantor to the ILIT three years prior to the grantor’s passing or the ILIT purchases the policy from the grantor, the death benefit is typically excluded from the insured’s taxable estate. Had the policy not been transferred to an ILIT and the insured remained the owner of the policy, the entire death benefit would usually be included in the insured’s taxable estate.

Please reference the following link with additional information on revocable trusts and irrevocable (ILIT) trusts: https://www.wealthadvisorstrust.com/blog/definitive-guide-on-irrevocable-life-insurance-trusts

The When

While there are a number of strategies to plan for an estate, administering an estate also requires a detailed structure to ensure that legacies are fulfilled and needs are addressed. The role of a successor trustee can be complex and taxing, but Weatherly Advisors can serve as a quarterback for optimal collaboration with your team of professionals. Our updated Estate Settlement Checklist catalogues key steps during the nine months of estate administration.

How WAM Can Help

Record-low interest rates, historically high exemption amounts, and unpredictable future tax policy make it more important now than ever to align Estate Planning objectives with desired outcomes. Through collaboration with your trusted professionals and next generation beneficiaries, Weatherly Advisors leverage financial and investment planning techniques to create a Ripple Effect across your interconnected family and community. Please reach out to a Weatherly Advisor for any assistance we can offer your family.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

***Content Updated_Friday, April 23, 2021

Over the past year we’ve had many phrases added to our lexicon – social distancing, flatten the curve, Zoom fatigue, and many others.

For every “can you hear me?” or “you’re on mute” we’ve heard, we’ve also felt concern and hope for our collective communities.

In March of 2020, we were told to shelter-in-place and now twelve months in, we are optimistic about broader re-opening in the near future while the WAM team continues to operate in a hybrid model. The rapid rate at which governments, businesses and scientists worked together to develop and administer a global vaccination is unparalleled.

We wanted to share this blog to keep you up to date on Spring happenings at Weatherly.

Updates on Taxes:

2020: The recent 2020 tax year was unlike any other, with strategies like Roth Conversions and skipping Required Minimum Distributions applying to many of our clients. We’ve found this tax guide as well as this article helpful in highlights the changes that may apply to your unique situation.

The IRS extended the deadline to file for the 2020 tax year to May 17th; taxpayers do not have to take any action to take advantage of the extended deadline. The deadline to make a Q1 estimate remains April 15th.

Prior to filing, you may be eligible to contribute to IRAs (Traditional, Non-deductible, SEP and Roth) or make an employer contribution to a Self-Employed 401k. Our 2020 and 2021 Key Data Chart may be useful in determining the limits that apply to you.

Custodians have rolled out most tax forms at this juncture, and our team has been providing to clients and tax professionals securely. Please let us know if there is anything we can provide for your tax filing, and as always we appreciate a secure copy when completed.

2021: The Biden Administration has been busy working on the $1.9 Trillion stimulus plan, known as the American Rescue Plan passed last week, to aid in boosting the economy and supporting those most impacted by the pandemic.

The American Rescue Plan outlines short-term solutions to aid the economy, however President Biden is now focusing on long-term economic plans and modifying the tax code to help close the funding gap. Bloomberg highlighted the first major tax hike since 1993 in this article, with a focus on raising the corporate tax rate, raising the income tax rate on those earning more than $400,000 and expanding the estate tax reach.

Our team of advisors are available to discuss planning opportunities and how the potential tax bill may impact you and your family.

Updates on Our Team:

The Weatherly team continued to learn and grow over the last year, despite the challenges that were presented working and living in a remote environment.

Aubrey Brown, one of our Wealth Management Associate Advisors, completed his Master of Science Degree in Personal Financial Planning through the College for Financial Planning (CFFP) in 2020. Aubrey continues to develop his expertise in planning for clients.

Yoshi Brownlee, our Team Administrator and Marketing Specialist, obtained a Professional Certificate in Marketing offered through SDSU’s College of Extended Studies and One Club San Diego in September 2020. Yoshi continues to work with the Partners to develop the Firm’s marketing initiatives.

We also onboarded Andrea Taylor as a Wealth Management Associate in February. Andrea’s 4 years with Ernst & Young in audit and accounting coupled with a Masters of Science in Accountancy will augment our team of professionals.

Weatherly in the News:

We have many exciting updates on our the Weatherly Newsroom.

In the March 13th edition of Barron’s, Carolyn was named as a Top 1200 Advisor. She was also listed as one of Forbes 2021 Best-in-State Wealth Advisors.

Carolyn, Brent Armstrong, Kelli Ruby and Ryan Richardson were also named 2021 Five Star Wealth Managers.

Our team is proud of what we have accomplished over the past 26+ years and being able to serve our clients during a global pandemic. Weatherly also surpassed $1 Billion in assets under management at the end of 2020.

ADV and Privacy Policy:

On an annual basis Weatherly Asset Management (WAM), as an SEC Registered Advisor, is required to deliver the following documents to all of our clients either electronically or by US mail; please see attached:

Part 2A of Form ADV (the Firm Brochure)

Part 2B of Form ADV (the Brochure Supplement)

If you have opted for hard copy delivery of compliance communications, you will be receiving these in the mail in the coming weeks. These documents have also been posted to all client portals for future reference.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Brooke Boone Kelly, CFP® also contributed as a co-author on this month’s blog.

The effects of the COVID-19 pandemic are far-reaching, as witnessed by major shifts in how we live, work, socialize and educate. The impact on the educational system in America is profound, as school districts juggle with how to both protect teachers and students from transmission of the virus, particularly as new strains are emerging, and how to protect the integrity of learning in a remote environment.

Getting kids back in school has been a priority of the Biden administration, with a goal of K-8 returning to in-person learning within 100 days if his Inauguration, right around mid-April. According to yesterday’s episode of The Daily Podcast (NY Times), about 1/3 of children are remote learning and 1/3 are hybrid, which may work for some students. However, remote learning tends to be subpar to in-person, and the disadvantaged suffer the most – particularly those effected by cost (hardware, software, wifi), learning disabilities or those that need help from adults who are also working remotely.

While challenging, COVID-19’s impact on education also brings a growing universe of technology, terminology, and metrics; balancing synchronous learning (real time, face to face, in person or video chat if available) vs. asynchronous (blogs, discussion boards, electronic text). While college-aged and postgraduate learners may have experienced asynchronous learning, most traditional experiences consist of a blend. Once a group of mainly in-person learners, now have a whole growing population of 5–12-year-olds evolving into sophisticated consumers of changing technology. The change in the traditional higher education business – which some argue was long overdue – highlights pricing pressures as universities move to a more digitally-driven model and students have more postsecondary educational options.

What this means for our clients:

Parents and grandparents alike want the best possible future for their families. The WAM team saw a boost in gifting in 2020, from family members that have been impacted by COVID-19 and to national and local charities. While there are shifts in the educational system underway, 529 college savings plans and custodial accounts can create a future benefit for young children.

As mentioned above, there has been over a decade of growth in “massively open online courses” (MOOCs), industry-driven certification programs, coding bootcamps, two-year associate degree programs, trade schools and vocational schools. While 529 plans are commonly used to cover costs associated with 4-year universities, there is a good chance many of the alternatives are also covered. As part of the TCJA of 2017, up to $10,000 can also be used annually on elementary, middle or high school tuition.

We’ve touched on the impact of “supercharging” or gifting 5 years upfront to 529 plans in a previous blog. Educational planning opportunities are just as important in a post-pandemic world and can provide an estate planning benefit if there is a change to the current estate tax exclusion amount.

What this means for our team:

We pride ourselves on a culture that values education, continued learning and problem solving. WAM has team members that regularly pursue master’s degrees, certifications, online training, and licensing to elevate their skill set and the client experience. During the last year, our team has shifted to remote learning when appropriate.

We continue to work with our clients in a hybrid remote capacity and strive to bring new investing and planning ideas to our dialogs. With the change in how we work with clients, we often utilize screen sharing capabilities, our secure portal and e-signature as we work together. We’ve taken the opportunity to not only educate ourselves, but often to walk through new tools and systems with our clients too.

What this means for the world:

Over the past two decades, access to 3 meals a day, internet service, and technology hardware have been growing challenges faced by a large percentage of the learning population. Public K-12 schools traditionally have had to combine fundraising, and donations with grant money to outfit the technology learning curriculum, and have comprehensive meal assistance programs. Private institutions may have historically had larger budgets and greater resources, but diverse income levels amongst the student body still posed challenges. The present concerns are mounting, and many nations are gauging the impact on future economies too.

According to a study published by the Organization for Economic Co-operation and Development (OECD), “existing research suggests that students in grades 1-12 affected by the closures might expect some 3% lower income over their entire lifetimes. For nations, the lower long-term growth related to such losses might yield an average of 1.5% lower annual GDP for the remainder of the century.” The effects of lost in-person learning aren’t only economic, the school closures expect to also disrupt emotional, social and motivational development especially in younger children. The impact will fall mainly to disadvantaged students and vulnerable populations. The K-shaped recovery in America will only deepen as the gaps in the educational system widen.

The pandemic has accelerated many trends already in place and disrupted many industries. How people are able to choose to pursue education in the future for work related training, higher and lower education and all age groups, young and old, will influence how we emerge.

How WAM can help:

Our advisors are here to discuss opportunities in the educational space including college funding and estate planning, how we can learn together remotely, or charitable giving. Please contact the team to discuss your unique situation and how we might be of assistance.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Not much is normal these days – political conventions are virtual, major sports are played in empty arenas, and classrooms are remote. One thing that seems to remain a constant are the proposals being put forth by Presidential Candidates in the upcoming election to outline their goals, objectives, and strategies and the corresponding action by advisers to prepare their clients.

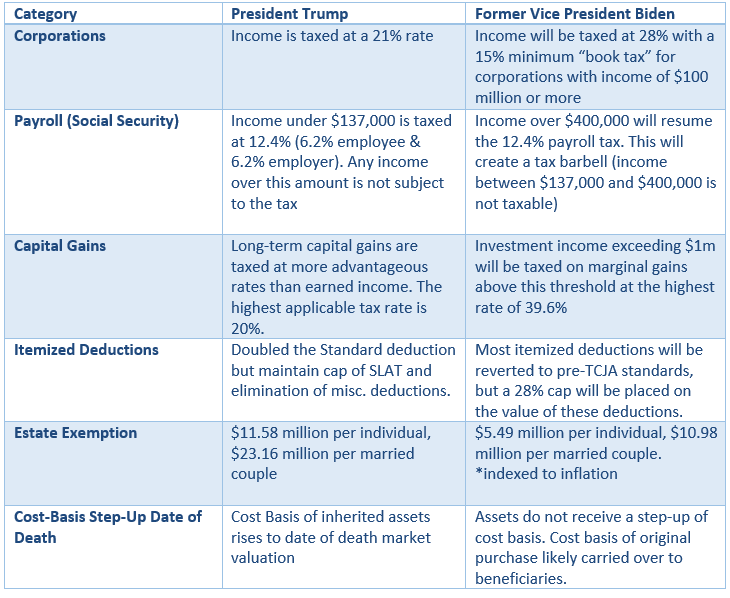

Former Vice President Joe Biden, now the Democratic Party’s official nominee for President, recently released his tax policy proposal for his administration should he win the White House in November. Key provisions in the 2017 Tax and Jobs Cuts Act (TCJA), set to expire in 2025, are now at stake of being eliminated early. President Trump’s communication has alluded to making the TCJA permanent. Below are the respective Candidates’ tax policies for their administrations:

Recently passed legislation in the SECURE and CARES Acts has created an opportunity for Weatherly clients in their “gap years” with large amounts of tax-deferred assets to potentially utilize a Roth Conversion in 2020 to lower personal taxes in future years and alleviate the tax burden for their heirs.

- CARES Act – As Required Minimum Distributions (RMD) have been waived in the 2020 calendar year, IRA owners have the flexibility to entirely skip their distributions or selectively withdrawal for Qualified Charitable Distributions or Roth Conversions. Both strategies can help reduce RMDs in future years without generating as large of a tax bill this year. Additional information on Qualified Charitable Distribution strategies to help reduce RMDs in future years. We will discuss the Roth Conversion strategy in more detail below.

- SECURE Act – Certain non-spouse beneficiaries are now required to fully withdraw the balance of an Inherited IRA within a 10-year window. Previously, these heirs could distribute the balance based on their life expectancy, a significant advantage for individuals at a young age with a long life ahead of him or her. Reducing the balance of non-Roth IRA assets will allow for greater tax flexibility for the ultimate recipient of the assets as distributions from Inherited Roth IRAs are not taxable.

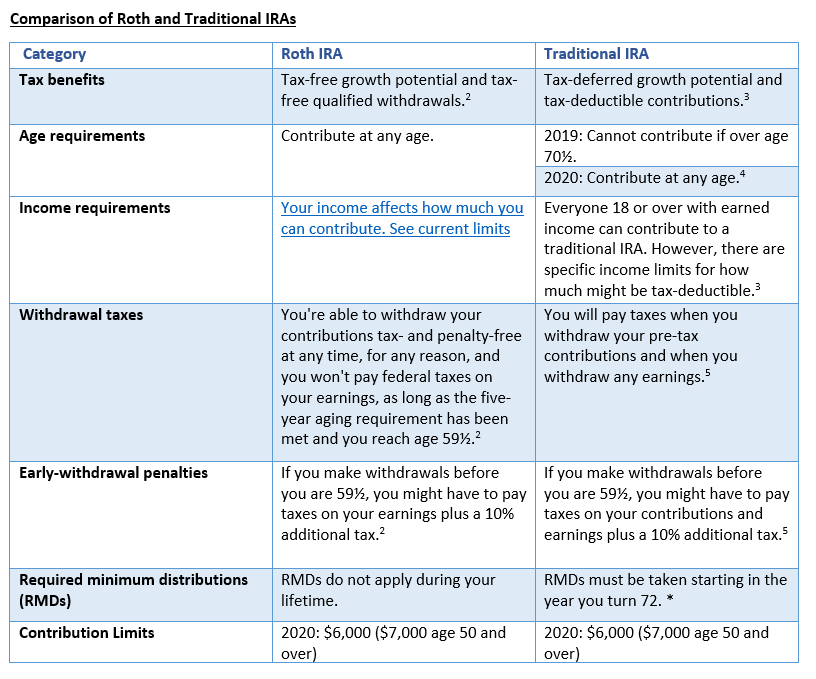

For many individuals a Roth conversion is somewhat of an unfamiliar concept. In order to understand this concept better, let’s look at a comparison between key features of a Traditional IRA and a Roth IRA, how they came to be an effective financial planning tool, how they work, and why they may make more sense than ever to do in 2020.

The Roth IRA was introduced as part of the Taxpayer Relief Act of 1997, but the Roth Conversion didn’t get its start as an effective financial planning tool until 2010, when limitations from the Tax Increase Prevention and Reconciliation Act of 2005 were removed. The removal of the limitations allowed individuals with a Modified Adjusted Gross Income (MAGI) over $100,000 to fully utilize the capabilities of a Roth Conversion.

How does a Roth Conversion work?

A Roth conversion allows individuals to take pre-tax money (cash or securities) from a Traditional IRA or 401(k) and reinvest those funds into a Roth IRA. The distribution from the traditional IRA will be included in gross income and subject to income tax at the time of conversion.

Why consider a Roth Conversion?

The decision to complete a Roth Conversion primarily comes down to deciding to pay taxes today or at retirement, with the intention to pay taxes at a lower tax rate today than you would in future years. This strategy can be especially effective for those expecting to be in a higher marginal tax bracket in the future and if you can afford the tax bill generated by the conversion.

With the amount of fiscal stimulus recently pumped into markets to combat COVID-19, along with the current low tax rate policies, there is a large likelihood that taxes will increase in the foreseeable future. If an individual believes they will be in a lower tax bracket during retirement, a Roth Conversion may not make sense.

What does this mean for your beneficiaries?

One of the major changes to retirement accounts under the SECURE act was the removal of the “Stretch” provision for IRAs inherited in 2020 and after. Certain non-spouse beneficiaries are now required to fully withdraw the balance of an Inherited IRA within a 10-year window.

Because of the removal of the “stretch” provision, it may be beneficial to use a specific Roth Conversion strategy that is referred to as the “amortization table approach.” This approach focuses on lowering the income tax liability for individuals who inherit a Traditional IRA. This can be done through the conversion of a higher annual dollar amount to a Roth IRA during the original IRA owner’s lifetime, in order to minimize the tax burden beneficiaries will face when taking their Required Minimum Distributions (RMDs) within the required 10-year window.

Read more about this approach here.

Why is now the time to consider this?

With the current backdrop of the COVID-19 pandemic, many individuals have seen a reduction of hours or a wage decrease, which may mean they are in a lower tax bracket this year than in previous or future years. Individuals who took advantage of the CARES Act ability to skip their required minimum distributions may also be in a significantly lower tax bracket in 2020. The additional unknown surrounding what taxes will look like in 2021 and going forward makes this year an ideal time to explore Roth Conversions with your advisor.

Caveats:

It is important to consult with a financial or tax professional when considering a Roth conversion to make sure that the conversion does not push the client into a significantly higher federal income tax bracket. Additional information regarding the 2020 Tax Rate Schedule can be found here.

For Example: A married couple filing jointly with taxable income of $60,000 can convert up to $20,250 to a Roth IRA while still staying within the 12% tax bracket. The 22% tax bracket starts at $80,251.

Additional Resources:

https://www.barrons.com/articles/trump-biden-and-taxes-what-to-expect-51596843040

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

The novel Coronavirus has dramatically disrupted lives on a global scale. As businesses and individuals attempt to adapt to a post-COVID world, a series of new trends and opportunities have emerged. We have observed a shift away from major US cities to more affordable communities outside of traditional metropolitan areas. Clients transitioning to new living spaces have capitalized on the low interest rate environment and explored multi-generational gifting strategies or intra-family loans with our team. As we all continue to battle the pandemic, we welcome you to lean on your trusted Weatherly advisors to safeguard your financial assets and uncover potential planning opportunities.

White Picket Fence Comeback –

A trend the Weatherly team is following closely has been the exodus of some Millennial and Generation X populations from cities to suburbs. As real estate prices and rents have skyrocketed in major metropolitan areas, like New York and San Francisco, young adults have looked for relief in less expensive pastures as they start families and settle in their careers. Outside of monetary factors, recent concerns over COVID-19 infection and social turmoil have also augmented the migration to suburbia. Homeownership in the United States rose to 67.9% in the second quarter, its highest level since the housing peak in 2008. Conversely, the number of renter households fell by 7.2%. Owners under age 35 have been the leaders in driving this trend as the group’s home ownership rate is now at 40.6% [1]. Skilled workers that previously may have been required to work on-site, may now have the flexibility to stay with their current employers, but resettle to a different location and work remotely. We may see a lasting impact on commercial properties as businesses move away from shared workspaces and offices as a heightened focused is placed on social distancing and telework.

Zero-Interest Rate Policy (ZIRP) –

When the markets took a downturn in late February and early March 2020, the Federal Reserve acted quickly and provided a safety net for the domestic economy by lowering the Fed Funds rate to near 0%. This paramount move was in hopes to add liquidity by allowing businesses and consumers to borrow money at favorable rates and spur investment activity. The Fed Funds rate has had a spillover effect on the broader fixed income market as interest rates across the board came down in tandem. Included in this, is the 10-year treasury yield which is largely tied to mortgage interest rates. This has sparked a fury of homeowners looking to refinance their mortgage at lower interest rates. You can check today’s current interest rate estimates via sites like bankrate.com . With unemployment skyrocketing, refinancing has been a silver lining for Americans to maintain cashflow needs or provide the ability to invest extra funds into a deflated stock market. The historical low rates have also created an opportunity for the first-time homebuyer looking to enter the residential real estate market.

Gifting Outside the Box –

The simultaneous decline in real asset values and volatility in financial markets have created a gifting opportunity for high-net worth clients interested in advanced estate planning. Depressed assets, that may appreciate significantly following the COVID-19 pandemic, could possibly be transferred earlier than anticipated through a direct cash gift, sale by installments, or transfers in an intra-family loan. In these scenarios, assets can be passed or purchased at a depreciated market values with interest payments at modest levels due to historically low interest rates. Below we’ve outlined some strategies we’ve reviewed with clients assisting the next generation with first-time home purchases.

- Direct Cash Gift – We’ve recently worked with clients to assist their heirs through a one-time gift or periodic gifting schedule. Parents can also offer to co-own or purchase a home outright with a child as the parent, with a longer credit history and greater asset base, can often qualify for a lower interest rate than the child could on his or her own. Although this is the simplest method of transferring wealth, it’s important to be mindful of the annual gift tax exclusion, $15,000 per person as of 2020, given that any gifts above this amount can result in a decrease in your lifetime exemption and a gift tax return filing.

- Installment Sale – An Installment Sale is a transfer of property where at least one payment is made in a tax year different from when the sale is agreed upon. Breaking up the sale allows for the seller to piecemeal the capital gain realized from selling the asset, which may have appreciated significantly from purchase date or feature cost basis reduction from depreciation. The buyer also doesn’t have to come up with the full payment amount right away and can chip away at the purchase price over time.

- Intra-Family Loan – A loan, with the proper documentation, can be a great way to provide liquidity to younger family members with a purchase of an asset that would normally be out of their price range. Starting with a promissory note that outlines the loan amount, term, and an appropriate interest rate is the best practice to ensure that an audit down the line won’t result in any tax consequences. Here’s a link to an Index of Applicable Federal Rates (AFR) to use as a baseline for the stated interest rate.

How Can WAM Help?

We invite you to leverage us, as your trusted advisors, to run financial planning scenarios to determine housing affordability, suggestions to estate plans and connections to mortgage professionals. We can help streamline the mortgage process by providing necessary documentation to lenders in a secure format. For those new to the residential real estate market, we suggest reviewing our First-Time Home Buyer’s Checklist which provides a step-by-step guide to home ownership. Please contact us with any questions or to continue the conversation.

Sources and Further Reading –

https://www.thebalance.com/treasury-note-and-mortgage-rate-relationship-3305734

https://www.nerdwallet.com/article/mortgages/closing-costs-mortgage-fees-explained

https://www.chase.com/personal/mortgage/home-mortgage/getting-started/mortgage-prequalification

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Daily life changed globally and permanently due to the COVID-19 virus, and at Weatherly we have adapted to the dynamic landscape in multiple ways. While our team has been mostly working remote since mid-March, we are still running business as usual and are implementing a variety of tools to make Weatherly a safer and more socially responsible workplace.

During this uncertain time, we know that communication is paramount which is why we have increased our email blast frequency to twice a month to capture ongoing strategy changes, as well as market updates. If you are not already included on our email list and would like to be, please sign up for our mailing list by filling out this contact form.

Like many businesses, we transitioned to calls and virtual meetings in March for the safety of our clients and team. While in-person meetings are not a possibility at this time, WAM has utilized GoToMeeting for video conferencing for a number of years. This tool not only allows us to communicate more effectively while in different locations, we also have the added benefit of using the screen sharing and presentation capabilities. Our advisors can walk through your client reports with you by page, access your custodian’s website, or demonstrate how to get onto your secure Weatherly portal. This is especially useful during tax time, when you or your CPA upload tax documents for your advisor to analyze. Whatever the task, our advisors can virtually be right by your side to accomplish it. If you are interested in setting up a quarterly review, or secure portal training session via GoToMeeting, please do not hesitate to reach out to our team. We would be happy to help you get set up.

Working remotely has given us the opportunity to tap into the depth of Microsoft’s productivity software offerings. Microsoft’s secure remote access and communication tools have been crucial for our team internally. Through the security and usability of Teams, SharePoint and other communication software, our team has been able to stay on the same page while also providing service in a timely manner. Another tool that has made remote work possible is the secure utilization of DocuSign. We have been diligent in using DocuSign whenever possible for its environmental and convenience benefits, but it has now become essential in allowing business to continue seamlessly while also remaining distant.

One thing that hasn’t changed throughout this transition to remote work is Weatherly’s commitment to protecting your data. Cybersecurity has and always will be a main priority of our business. Our client and team communications remain secure with the use of the Weatherly portal, DocuSign and apps that encrypt and password protect physical documents. We have increased our use of apps like GeniusScan to allow for secure scanning and sharing of internal records. As more innovative technologies emerge, we are continuously evaluating which tools offer our clients the most optimized experience.

In preparation for our team’s gradual return to the Weatherly office, we are focusing on safety first by implementing more extensive safety measures. We have added hands-free soap and hand-sanitizer dispensers and increased frequency and depth of our cleaning program. We are also in the process of installing tempered glass barriers between workspaces to create more physical boundaries once we can work in the office together safely. While we are not resuming in person meetings at present, we hope these changes will make you feel more comfortable coming into our office when it is safe to do so.

Under normal circumstances, our team prides itself on our boutique atmosphere and face-to-face communication style. The quarantine has provided us with a unique opportunity to discover new ways to connect with each other and our clients. To maintain our spirit of team collaboration, we participate in daily team video calls to touch base on day-to-day activities as well as ongoing projects and progress on larger firm strategy initiatives. Now more than ever, the importance of staying connected is critical.

As we navigate this new “normal,” we work hard to remind each other that while times are uncertain, we can be confident in our ability to adapt and remember to have a laugh or two as we grow in this new environment. While nothing can take the place of sitting right across from a coworker and catching up, we work to bring our workplace culture into our remote environment through weekly team-building activities, exchanging songs we are listening to and sharing recipes tried over the course of the stay at home order. We are excited to share our team cookbook and quarantine playlist with you. We hope this inspires you and your family to find creative new ways to stay connected while staying at home. Check out the links below for our collaborative playlist and cookbook!

Read our Weatherly Cookbook here

Listen to our WAM Quarantine Playlist here

While the crisis is ongoing and our interactions may look a bit different these days, the team at Weatherly remains committed to providing an elevated client service experience for you and your family. We look forward to seeing you in the office again soon but for now please stay healthy and stay safe.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

The signing of the Coronavirus Aid, Relief, and Economic Security (CARES) Act on March 27,2020, not only provided aid to many Americans and small businesses affected by the Coronavirus pandemic, but also made significant changes to the charitable giving rules to encourage individuals and corporations to donate during these unprecedented times. The Weatherly team has outlined the key provisions that may impact your 2020 giving and ways to support during the COVID-19 pandemic.

Some of the most notable changes to giving due to the CARES act include:

- Above- the-line Charitable Deduction

- Taxpayers who claim the standard deduction in 2020 can deduct up to $300 above- the-line, or against their gross income, for cash contributions to charity.

- AGI Limitation for Cash Donations

- Historically, individuals could deduct up to 60% of adjusted gross income (AGI) for cash contributions to eligible charities. Under the CARES Act, taxpayers can deduct up to 100% of their AGI for the 2020 tax year.

- Corporations can now deduct up to 25% of AGI this year, up from 10% in prior years.

- Any donations above the new 2020 limitations can be carried over for up to five years.

- To take this deduction, taxpayers must:

- Itemize their deductions

- Donate in cash direct to a public charity.

- The new increased limits do not apply to cash contributions to supporting organizations or Donor Advised Funds (DAFs). The old limit of 60% AGI will remain for such cash contributions.

- The new limits do not apply to contributions of publicly traded appreciated securities. The 30% of AGI limitation will remain the same for 2020 stock donations.

- Qualified Charitable Distributions (QCDs) – and Required Minimum Distributions (RMDs)

- In prior years, clients over age 70.5 who were taking RMDs from their IRA accounts may have completed a Qualified Charitable Deduction (QCD). Tax law allows donors to give up to $100,000 of their RMD direct to a qualifying charity of their choosing. The amount sent to charity counted towards the donor’s RMD for the year but is excluded from taxable income. Additional information about QCDs in our charitable blog post.

- As highlighted in our CARES Act Write Up, one of the most significant changes under the Act is the waiving of Required Minimum Distributions (RMDs) from certain eligible retirement accounts in 2020.

- Like prior years, a 2020 QCD direct to charity will not show up as taxable income to the individual. However, the distribution will not offset any RMDs as they are not required in 2020 tax year.

- Given these changes, it may be more beneficial to utilize a different charitable strategy for 2020 tax year. Weatherly is here to help explore the most impactful philanthropic giving approach for you this year.

The Role Philanthropy Can Play

Philanthropy and private sector support can play a key role in getting emergency funding and resources to those in need during times of crisis. Since the beginning of the global pandemic through 4/28/2020, more than $8.7 billion has been donated to the COVID-19 outbreak and various relief efforts according to the Center for Disaster Philanthropy (CDP) and its partner, Candid. To encourage further philanthropic activity, the GivingTuesday nonprofit organization has arranged a GivingTuesdayNow emergency event on 5/5/2020. This event is meant to unify, raise awareness, and support each other, our communities and global nonprofits during these unprecedented times.

Ways to Support COVID-19

During this global pandemic, philanthropic support can make the greatest difference in a several different areas, including, but not limited to: hunger; food and shelter, basic health services for vulnerable populations; Personal Protective Equipment (PPE) and medical needs for healthcare workers; Research and Development initiatives for vaccines, treatments, diagnostics, and antibody testing; ventilators; social service organizations; community foundations; and sustaining current nonprofits with funding gaps that may exist in these tough times. We have complied a list of ideas and resources on how to support in these areas via monetary or nonmonetary means during GivingTuesdayNow and beyond:

- The GivingTueday nonprofit organization has six ways to show generosity during these difficult times, including: Give/Donate, Thank those on the front lines, Volunteer virtually, Support your local community and small businesses, Show Kindness to your neighbors and friends, and Respond. These are all relevant to GivingTuesdayNow and throughout the pandemic.

- If you would like to give via monetary means, we recommend looking to organizations in your community that you may already support. Many nonprofits are struggling to stay afloat as they are not holding events or galas that typically provide much of the funding needed to carry out their philanthropic missions.

- For any new organization you would like to give to, it is important to do your research prior to donating. Giving Compass and the National Center for Family Philanthropy have created a list of funds across the United States providing immediate and long-term relief to COVID-19.

- Fidelity Charitable had “A Conversion with the CDC Foundation” webinar with various ways to help with COVID-19 at the Local, National, and Global needs.

- As many of us are social distancing and sheltering in place, virtual volunteer opportunities to aid those impacted by COVID-19 can be found here.

How Weatherly Can Help

Given the charitable giving changes under the CARES Act, the Weatherly team is here to collaborate with your CPA and team of professionals on a 2020 giving strategy that fits with your financial plan and philanthropic goals. We are also here to help facilitate any grants from or contributions to your Donor Advised Fund (DAF)2 for GivingTuesdayNow or future 2020 giving. As always, our team welcomes a dialog on how we can accomplish your charitable giving goals and positively impact our community and world.

Resources:

- https://disasterphilanthropy.org/disaster/2019-ncov-coronavirus/

- Link to Charitable Blog: https://www.weatherlyassetmgt.com/blog/39tis-the-season-of-charitable-giving-and-tax-planning/

- https://www.wealthmanagement.com/philanthropy/cares-act-sweetens-pot-charitable-giving

- https://3b4nu03zhqkr21euttbrqaxm-wpengine.netdna-ssl.com/wp-content/uploads/2020/04/20200409_CARES_RESOURCE.pdf

- https://now.givingtuesday.org/about/

- https://www.fidelitycharitable.org/guidance/disaster-relief/how-to-help-novel-coronavirus.html

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

There seems to be a new pattern emerging, another year and another tax overhaul. On December 20, 2019 President Donald Trump signed into law the Setting Every Community Up for Retirement Enhancement Act, better known as the SECURE Act, as part of the government’s new spending bill which will inevitably affect most retirement savers for better or worse. While the Act is quite extensive, we plan to focus on the key provisions most likely to affect you and your loved ones effective January 1, 2020:

- Changes effecting retirement plan beneficiaries

- RMD pushed to age 72

- Traditional IRA Contributions

- Qualified Charitable Contributions (QCD)

Removal of the “Stretch” Provision

Perhaps the most impactful change resulting from the SECURE Act is the elimination of the “stretch” provision for most non-spouse beneficiaries of inherited IRAs and other retirement accounts. Under the prior law, for those account owners who passed away prior to December 31, 2019, their non-spouse beneficiaries were able to “stretch” Required Minimum Distributions over their life expectancy, or in the case of a qualifying trust, over the oldest applicable trust beneficiary’s life expectancy.

Moving forward, for most non-spouse beneficiaries who inherit a retirement account in 2020 and beyond, the “10 Year Rule” applies. This new rules states that the entire inherited retirement account must be emptied by the end of the 10th year following the year of inheritance. Beneficiaries do have flexibility as to the timing and quantities of the distributions to help with the tax impact as long as the account has been depleted by the end of the 10th year.

While the elimination of the “stretch” provision will affect a significant portion of beneficiaries, there are a few groups deemed “Eligible Designated Beneficiaries” that will not be subject to the new legislation:

- Spousal Beneficiaries

- Disabled Beneficiaries

- Chronically Ill Beneficiaries

- Individuals who are not more than 10 years younger than the decedent

- Certain minor children of the original account owner, but only until they reach the age of majority. Age of majority follows state rules and thus will vary.

For these “Eligible Designated Beneficiaries”, the same rules that applied prior to the SECURE Act will continue.

The SECURE Act has not only changed the rules and requirements of individual beneficiaries but may also lead to significant changes where trusts are named as the beneficiary of a retirement account. In general, there are two different types of trusts that would be set up as a beneficiary of a retirement account, a Conduit “See-Through Trust” or a Discretionary Trust, and both types could have unfavorable outcomes as a result of the Act.

Many Conduit trusts are drafted in a manner that only allows for the RMD to be disbursed from an Inherited IRA, with a subsequent amount passed directly to the trust beneficiaries. With the amendments made by the SECURE Act, for those beneficiaries of trusts who do not fall under this new classification of “Eligible Designated Beneficiaries” and thus subject to the 10-year rule, there is only one year in which there is an RMD, the 10th year. This has the potential to lead to an unfavorable tax situation in which the entire account balance is ultimately distributed to the beneficiaries in the final year.

On the other hand, Discretionary Trusts don’t fare any better than the Conduit Trust. The reason for this is because Discretionary Trusts are typically drafted in such a way as to retain a portion if not all income and distributions within the trust. As such, any income or distributions that are retained in the trust are taxed at the maximum rate of 37% after just $12,950 of income. So, there is the possibility of not only the entire account balance having to be distributed by the 10th year but also the unfavorable trust tax rates if not distributed to the beneficiaries.

Now we intentionally said, possibility , because the IRS has not clearly outlined whether the Conduit or Discretionary Trusts that have an “Eligible Designated Beneficiary” of a spouse, minor child, or beneficiary within 10 years will “See-Through” to these beneficiaries and not be subject to the new SECURE Act rules. The Act does specifically provide guidance that such trusts can be treated as an “Eligible Designated Beneficiary” when the beneficiary of the trust is a disabled or chronically ill person. We will need to await further guidance from the IRS for a final ruling on other groups of “Eligible Designated Beneficiaries”.

Most retirees will not be affected by the change in Required Minimum Distribution (RMD) starting age, however, it is important to mention for those who are about to take their first RMD. The SECURE Act has changed the age an individual must begin taking RMD’s from 70 ½ to 72. So how do you know when you are supposed to begin taking your RMD if you turned 70 ½ in 2019 or will turn 70 ½ in 2020?

2019

For those individuals who turned 70 ½ years old in 2019, you will be required to take your first RMD by April 1, 2020. If you have already begun taking RMD’s in previous years, these changes will have no material effect on your RMD withdrawals.

2020 and beyond

For those individuals who are turning 70 ½ on January 1, 2020 and beyond (i.e. those individuals born after June 30th 1949), will not be required to take their first RMD until April 1 of the year following the year in which they turn 72. This isn’t a huge change but even one or two years of additional growth and contributions can be quite impactful on retirement accounts.

Another major change resulting from the SECURE Act is the elimination of the age limit for traditional IRA contributions. Under current law, Traditional IRA contributions are NOT allowed after 70 ½. However, the new act lifts this age limit and allows contributions past 70 ½ if there is earned income (Roth IRA’s have never had contribution age limits). With the new change, Traditional IRA’s are now aligned with the rules for Roth IRA’s and other retirement accounts.

Married couples filing their taxes jointly, can continue to contribute to their Traditional IRA as well as continue to make spousal IRA contributions for a spouse that is no longer working.

Qualified Charitable Contributions (QCD)

With RMD’s being pushed to age 72 and extension of IRA contributions, it would seem that QCD’s would follow suit, but in fact there were no changes to the rules. Individuals will continue to be able to utilize their IRA or Inherited IRA to make a QCD beginning at age 70 ½ and gift up to $100k per year. This will allow the individual to make the charitable contribution directly on a pre-tax basis. Beginning in the year an individual turns 72, any amounts given to charity via a QCD will reduce the then necessary RMD as well.It is important to note that post 70 ½ contributions will reduce any future QCD’s by an equivalent amount.

Additional Changes

In addition to the changes that we have covered thus far, below are a few other notable changes that have been introduced as part of the SECURE Act.

- A penalty-free distribution from a retirement plan prior to age 59 ½ for a qualified birth or adoption up to a lifetime limit of $5,000

- Medical expense deduction AGI hurdle rate of 7.5% extended for 2019 and 2020

- A repeal of the TCJA-introduced Kiddie Tax changes (reverting away from a requirement to use trust tax brackets and back to using the parents’ top marginal tax bracket).

- Reintroduction of the qualified higher education tuition deduction. Allows for up to $4,000 of qualified tuition to be used as an above line deduction

- Mortgage Insurance Premium Deduction: May continue to deduct premiums. AGI phaseouts begin when AGI exceeds $100k MFJ or $50k MFS

- 529 plans are now permitted to use up to a $10k lifetime amount for apprenticeship and repayment of student loans

- Employers may adopt plans that are entirely employer funded, such as stock bonus, pension plans, profit sharing plans, and qualified annuity plans, up to the due date (including extensions) of the employers return

How Weatherly can help:

- Review your beneficiaries

- Discuss your RMD distribution schedule

- Estate planning considerations for IRA beneficiaries

Useful links

https://www.irs.gov/pub/irs-drop/n-20-06.pdf

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

“…In this world nothing can be said to be certain, except death and taxes.” -Benjamin Franklin 1789

What Benjamin Franklin said so many years ago still stands true today. There is no escaping death and taxes. While the individual tax filing extension date just passed on October 15th and as we gear up for our year-end tax planning strategy, we felt it would be a good opportunity to review the history of income taxes and role of the Internal Revenue Service (IRS).

As we all know, it is our civic duty as Americans to pay our fair share of taxes. Although tax is such a broad category including sales tax, state and local tax, property tax, excise tax, estate tax and much more, for purposes of this blog post we decided to focus our attention on federal income taxes. These taxes carry the majority share of the IRS revenue each year.

The IRS recently released data for the 2017 tax year. Although this was before the passage of the major tax reform bill in late 2017, The Tax Cuts and Jobs Act (TCJA), we wanted to analyze the numbers. Most taxpayers played their part as over 143 million tax returns were filed with individual income tax collections totaling $1.6 trillion dollars. Due to the progressive nature of the tax brackets, the average effective tax rate for 2017 was 14.6%. However, certain US citizens carried the bulk of the tax burden. The top wage earners are often scrutinized for utilizing various tax strategies to lower their amount of taxable income. So, let’s examine the top 1% of taxpayers and their impact on the IRS revenue.

To put things in perspective, to be a top 1% taxpayer, you would need income in excess of $515,371 (as of 2017). Although the top tax bracket for the 2017 year was 39.6%, these top 1% of taxpayers had an average individual effective tax rate of 26.76%. This is partially due to portfolio related income taxed at the preferential qualified dividend/long-term capital gains rates of 20% (highest capital gains tax rate). However, the top 1% of taxpayers accounted for 38.47% of the total income tax revenue collected by the IRS. Furthermore, the amount paid by the top 1% is greater than the amount of tax paid by the bottom 90% of tax payers combined (29.92% of total tax share). As these top earners pay much of the total share of income tax, we wonder if this will change in the future. This largely depends on the state of the economy and political landscape. Before predicting where we are headed with the 2020 election on the horizon, we wanted to look back at how taxes changed through different presidential administrations.

Abraham Lincoln 1861- 1865

Although short lived, the Revenue Act of 1861 imposed the first tax on the American people. The tax was 3% on income over $800 and it was used to pay for the Civil War. To enforce collection, the Internal Revenue Service (IRS) was created on July 1, 1862. This tax was repealed by Congress in 1871.

Grover Cleveland 1885-1889, 1893-1897

In 1894 Congress tried to enact a federal flat rate income tax but the U.S. Supreme Court ruled it unconstitutional because of the varying population in each state. What a time to earn money!

Woodrow Wilson 1913- 1921

In 1913, The IRS created form 1040 for better tax reporting and record keeping. Additionally, the 16th Amendment was changed so taxes did not need to be proportionate to state population. Then a 1% tax was placed on income over $3,000 and 6% on income over $500,000. In 1916, the tax was increased to 2% to aid in World War I expenses. Taxes changed yet again in 1917 by placing the 2% tax on all income over $1,000 and the surtax increased to 63%. By 1920, taxation revenue was up to $6.6 Billion, but fell to $1.9 Billion by 1932 as a result of the Great Depression.

Herbert Hoover 1929-1933

The Revenue Act of 1932 ended up being a major tax reform in US history. The bill caused increased tax rates across the board with the lowest rate starting at 4% and gradually increasing to the highest rate of 63%. This greatly impacted high earners and caused the affluent to explore various tax strategies to reduce income. Corporate taxes also increased by nearly 15%.

Franklin Roosevelt 1933-1945

With the wealthy uncovering several tax loopholes, President Franklin Roosevelt sought out to tax the rich to offset the large deficits created by the New Deal. In 1944, he raised the top marginal tax rate to its highest rate ever, 94%, to help fund the war. And then in 1945, he lowered the rate down to 86.45%. By 1945, yearly tax revenue was $45 billion, up from $9 billion in 1941. Much of this increase was required to fund Social Security which was established in 1935.

Harry Truman 1945-1953

Although Republicans in the Senate and House were able to cut rates in 1948, President Truman increased taxes in 1950 to raise money for the Korean War. The lowest and highest tax brackets increased to 20% and 91%, respectively.

Lyndon B. Johnson 1963-1969

The Revenue Act of 1964 was initially pushed for by President John F. Kennedy but implemented by President Lyndon Johnson. The idea was to cut tax rates to increase job growth. This act cut the top rate to 70%. Furthermore, the standard deduction was initiated and set at $300. Then, in 1965 Medicare was introduced. Similar to other social programs like Social Security, Medicare made it more difficult to lower taxes without running large deficits.

Ronald Reagan 1981- 1989

President Ronald Reagan’s Economic Recovery Tax Act of 1981 greatly reduced the top tax rate from 70% to 50%. The law also indexed tax brackets for inflation. His hope was to encourage savings and investments to stimulate economic growth. Then again in 1986, Ronald Reagan created the Tax Reform Act to further cut taxes and simplify the tax code. The top rate was lowered to 28%, and the standard deduction and personal exemption were increased. This favored many but was extra beneficial to low-income households.

George H.W. Bush 1989- 1993

President George H.W. Bush passed the Omnibus Budget Reconciliation Act of 1990. This raised the top rate to 31% in efforts to reduce the federal deficit.

Bill Clinton 1993-2001

Bill Clinton raised the top tax bracket to 39.6% in 1993. He also increased the taxable portion of Social Security benefits. In 1997, President Bill Clinton signed the Taxpayer Relief Act. The act introduced new tax breaks for families with dependent children and education costs. It lowered the capital gains tax rates to 10-15% to encourage investments. The Roth IRA was born.

George W. Bush 2001-2009

President George W. Bush implemented The Economic Growth and Tax Relief Reconciliation Act of 2001 to lower tax rates and drop the top rate to 35%. A new 10% tax was imposed for the first $6,000 of income for individuals ($12,000 for married couples). Bush also initiated The Jobs and Growth Tax Reconciliation Act of 2003. This act cut taxes again and lowered capital gains rates. This greatly benefited high earners.

Barack Obama 2009-2017

The Obama American Taxpayer Relief Act of 2012 and Obama’s Affordable Care Act of 2010 increased the tax rates with the top rate being 39.6%. It also placed additional taxes relating to health care. The Net Investment Income Tax (NIIT) was also created which imposed a 3.8% surtax intended to tax portfolio income over a certain threshold. Learn more about NIIT here.

Donald Trump 2017- Present

President Trump pushed the Tax Cuts and Jobs Act of 2017 through Congress, with numerous changes to the tax law. To highlight a few, the standard deduction nearly doubled, various tax deductions were eliminated, estate tax exclusion nearly doubled, individual tax rates were lowered, and corporate tax rates dropped significantly to a flat 21%. The top individual rate is currently at 37%. A Sunset provision was also enacted which would cause some of the changes to revert to prior law in 2026.

To review details of the current tax law, please reference our 2019 Key Financial Data Sheet.

When reflecting on our country’s long history of taxes, it is evident that we have come a long way since 1861! As the 2020 election nears, discussions about expanding social programs and health care reform polarize political debates. As we do not have a crystal ball to see into the future, we will reserve judgement on what will happen with the tax code going forward. However, we believe it is important for investors to focus on what they can do today.

Although income taxes are often the highest tax US citizens pay, capital gains tax from investment portfolios can also be costly. As we are in the longest bull market to date, it is becoming more challenging to offset gains. Many investors face a difficult question when seeking to rebalance or de-risk their taxable investment accounts. Do you sell investments to reach your target allocation and incur additional taxes OR pay no taxes (by making no changes) and have a higher risk exposure to equity investments? As this can be a costly question, investors can look to tax strategies in other areas to help limit the total liability.

Some of these tax strategies include-

- Contributions to retirement accounts

- 401Ks and self employed 401Ks (by year end)

- Traditional IRAs and Roth IRAs (by April 15th of 2020)

- SEP IRA (by April 15th or October 15th if filing an extension)

- Donations to Charities

- Qualified Charitable Distribution (QCD) through IRA

- Donations to Donor Advised Fund (DAF)

- Tax Loss Harvesting

- Utilizing Old Tax Loss Carry Forward or Net Operating Losses for businesses (NOL)

As your trusted advisors, we are happy to elaborate on the strategies above and explore potential opportunities. As the bulk of this planning needs to be completed PRIOR to yearend, it is important to take action sooner than later. To allow us ample time to review and make recommendations to your specific situation, please provide us with your 2018 tax return at your earliest convenience.

As opinions vary around the topic of taxes, we hope to find common ground by concluding with a quote from famous historian, Albert Bushnell Hart, – “Taxation is the price which civilized communities pay for the opportunity of remaining civilized.”

Further Reading:

https://www.gobankingrates.com/taxes/tax-laws/biggest-tax-reforms-in-us-history/#10

https://www.irs.gov/pub/irs-pdf/p1304.pdf

https://www.history.com/news/why-we-pay-taxes

https://www.forbes.com/2010/04/14/tax-history-law-personal-finance-tax-law-changes.html#5dad45da1cf8

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

According to a 2018 study conducted by Personal Capital, the top two stressors in relationships were: 1) Money at 54% and 2) Communication at 26%. Money was at the top of the list across Millennial, Gen Xers, and the Boomer generations. With these stats, we have created a “How to Navigate Finances as Yours, Mine, and Ours” guide when broaching the topic of finances in a relationship.

Monthly Nut

Our Monthly Nut Chart serves as a great conversation starter on the taboo topic of money for couples navigating joint finances for the first time. We suggest each partner complete their separate Monthly Nut to grasp where each other financially stands before tackling your joint financial picture. The “Yours and Mine Monthly Nut Charts” helps shed light on spending or savings habits, debt to asset ratios, and earnings potential of each party. You may find that one individual has more debt than the other. This scenario is not uncommon and may make combining finances even more challenging or in some cases, less appealing. We encourage couples to come up with a plan to pay down that debt by considering: Who is responsible for paying down the debt- the individual, jointly, a combination of both? The charts can also assist couples explore their tax filing options. Married couples may find their state taxes may be lowered by filing separately even if they file jointly at the Federal level. Weatherly is here to help navigate this conversation with your CPA as appropriate.

Once you have a better understanding of each other’s financial situation, you can better focus on building out your financial plan as a couple.

Prioritize for Progress

Create a list of items, big or small, you would like to accomplish with your finances in the short-term, mid-term, and long-term. Your list might include: pay the rent, travel once a year, pay off an auto loan or student debt, buy a home, save for a child’s college or your retirement, have $1mm to pass to the next generation. Once you have your list, sit with your partner and prioritize for progress. If you and your significant other do not see eye to eye on a specific goal or it is specific to you personally- come to an agreement that works for both parties. Maybe you have your own separate debit card/credit card, bank account or investment account to utilize for your specific goal and joint accounts to accomplish your goals as a couple. Please reference this Wall Street Journal article that addresses these topics in further detail.

Retirement Planning

Saving for retirement poses several challenges as some individuals tend to view this bucket of money as yours or mine strictly because of who earned it. To better accomplish your retirement goals as a couple, it is important to:1) understand each other’s views on retirement and 2) recognize that earnings potential may fluctuate as life changes. As highlighted in the “Yours and Mine Monthly Nut Charts”, one partner may be inclined to maximize retirement while the other prefers to spend. Alternatively, one individual’s earnings potential may change because they stay home with the kids, which decreases their ability to save for their own retirement. Viewing retirement savings as “Ours” versus “Yours” or “Mine”, couples typically avoid unnecessary conflict and can focus on saving for Their retirement.

Investments

It may take time to establish an investment philosophy as a couple and that is okay. The key is to build and evolve it into what works for you together. Some items to consider in formulating your investment approach:

- Different Risk Tolerances: Consider separate accounts with each other named as the beneficiary for differences in risk tolerance.

- Who will manage investments and bill pay: Designating one partner as the sole investment manager, can feel like a loss of control for the other. Consider separate individual accounts “Fun” accounts to accommodate.

Estate Planning and Community Property

You know the old joke for married couples – “what’s mine is mine and what’s yours is mine?” While the intent is for this to be humorous, it can be true for assets and debt accumulated during marriage in states that adopt community property laws, like California. It’s important to consider assets that each individual acquired prior to marriage, earnings and income potential and future inheritance; and if individual assets should be designated as Separate Property. This is seen commonly with inherited assets, when a parent designates their individual child (not the couple) as a beneficiary.

There are complex situations that should be addressed prior to marriage – for example, if one spouse owns and runs a business and the other stays home to run the household. While the contribution to the family is similar, the earnings potential varies greatly.

With an increased focus on the value of intangible assets – like intellectual property – new business ideas and student debt among the Millennial Generation, attorneys are seeing more young couples request a pre-nuptial agreement. While it’s a tough discussion to have, the conversation prior to marriage could alleviate stress and attorney fees down the line if divorce occurs. Recall in Community Property states, debt accumulated during marriage can be a 50/50 responsibility even if divorce occurs.

Beneficiary Updates and Wills/POAs

There are 3 basic estate documents that every adult, regardless of marital status, needs:

- Will – designates who will get your assets upon your passing

- Financial Power of Attorney – designates who can access your financial records and bill pay

- Healthcare Power of Attorney and HIPAA Waiver – designates who can speak with your doctors and access your healthcare records

Newly married couples should review these documents – or work with an attorney if they haven’t already created them – to determine who should be named.

Beneficiary reviews are also important – you may have a sibling, family member or friend listed as the beneficiary of old workplace 401ks, current retirement plans or IRAs. Any pension plans should also be reviewed; most offer survivorship benefits to spouses.

As your assets and estate grow, you may consider creating a Family Trust for Community Property assets and/or a Separate Property Trust for individual assets.

Families with young children should also have the discussion of who would take care of your children or act as custodian of your assets if something happens to you. We touched on other considerations for young families in a previous blog post.

How Weatherly Can Help

Marriage is exciting and these areas of discussion shouldn’t feel daunting. Talking through tax, estate and financial discussions and recommendations with your advisor can alleviate concern and “what if” scenarios so you and your spouse can focus on building your lives together. We welcome a dialog on how we can provide guidance on a successful financial future for your family.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.