As we entered 2023, economic uncertainties and raising concerns about market volatility extended into the New Year. However, as the year progressed, markets rebounded, and earnings reports showed strength and resilience quarter over quarter. While Weatherly cannot control the economy, markets, or future tax environments, we can focus on helping our clients build well-structured plans to achieve financial goals.

We think the new year is an opportune time to pause and take inventory of your overall financial health. To help guide our clients along that process, we’ve outlined a framework with 20 key, tangible steps to consider.

Using the new year as an excuse to pause and perform a personal financial planning assessment allows individuals to optimize tax strategies, align financial goals with current circumstances, review and adjust investment portfolios, manage debts effectively, ensure financial security, assess retirement plans, and stay informed about relevant financial changes.

By taking advantage of the year-end period for a comprehensive financial review, you position yourself to start the new year with a well-informed and adjusted financial plan. Consider consulting your Weatherly advisor if you believe you could benefit from any of the following strategies.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

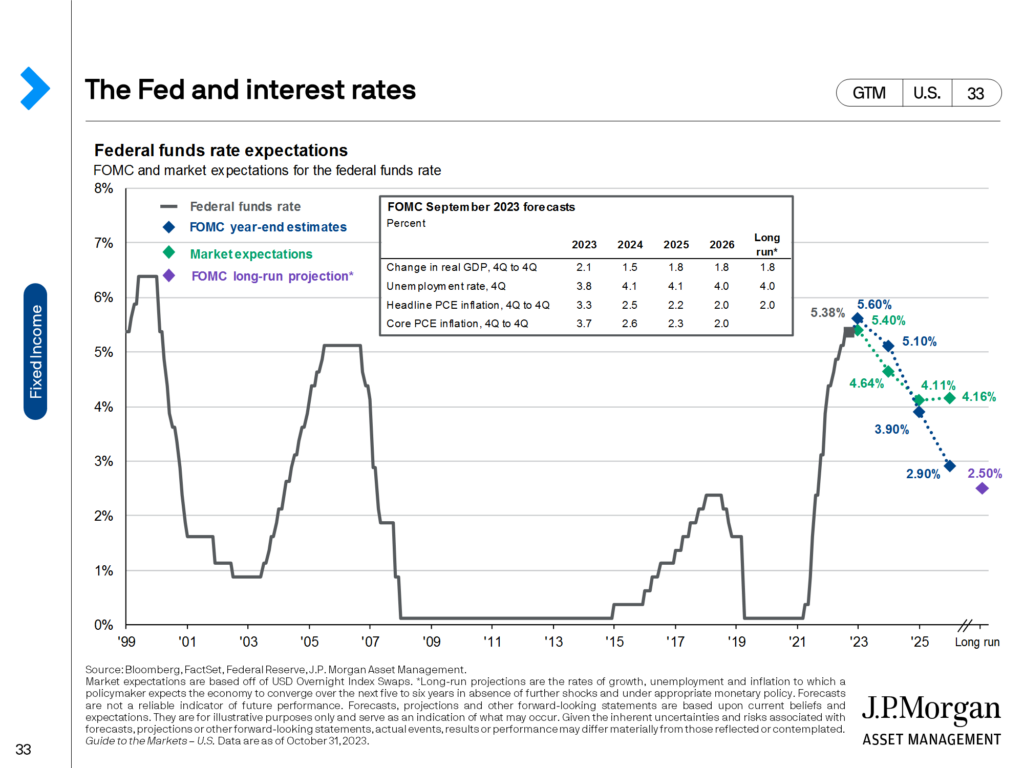

Thorough financial planning and a well-diversified portfolio provide some of the best resources to handle volatile interest rates and inflation. These rates affect everything from spending and borrowing costs to mortgage rates, making it relevant for every level of consumer. Throughout history, the Federal Reserve, the central bank of the United States, has used different tools and data points to foster the US economy and to mitigate financial crises. Used by the Federal Reserve, the federal funds rate is the interest rate that financial institutions use to make loans to one another. The federal funds rate is also the tool the Fed uses to maintain stability in inflation and unemployment, leaving inflation and interest rates tightly intertwined. The Federal Reserve will lower rates to spur the economy and raise them to keep an inflating economy in check.

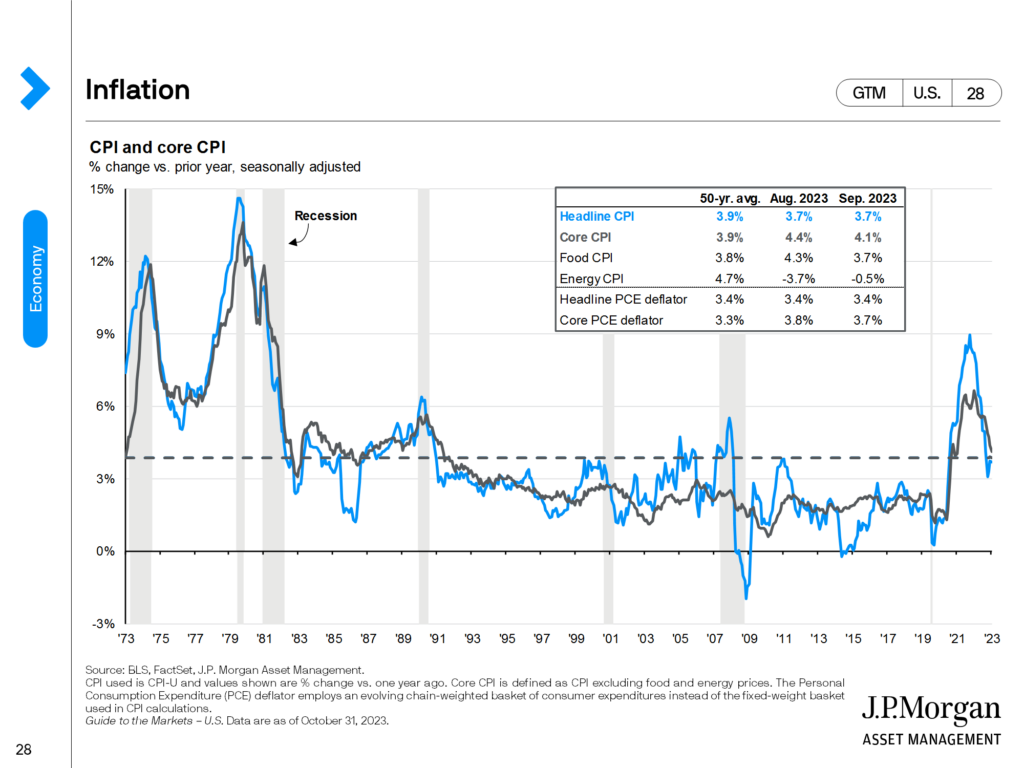

The Federal Reserve also uses Consumer Price Index and Personal Consumption Expenditures data to gauge inflation. Core CPI is another useful gauge as it provides the same data as CPI, less food and energy, the prices that tend to be the most volatile. CPI data is categorized as a lagging indicator, meaning its data points are known after they have occurred. Additional lagging indicators such as unemployment and rent provide information on the direction of the economy.

Source: J.P. Morgan Bonds are back

Understanding previous periods of volatility, and the goal of the Fed, provides groundwork for understanding the state of today’s current environment. The following will look at periods of times with high volatility in inflation and interest rates and how they coincided with periods of expansion and recession.

Great Depression (1929-Late 1930s)

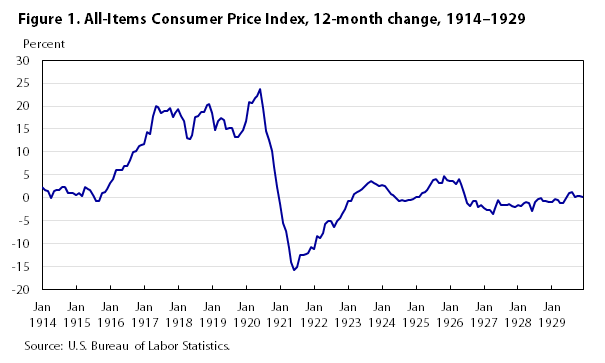

After a long period of expansion, the stock market crashed in October of 1929 due to an overpricing of assets. After the crash, the United States economy saw a rapid economic decline across the board. The price of goods in the 1939 CPI were cheaper than the basket seen 20 years earlier, while people still struggled widely to afford them . From October 1929 to April 1933, the price of the CPI basket declined over 27%, leaving the Fed to navigate a deflationary period of the economy. Leading up to the crash, interest rates were around 6.25%, Interest rates were increased to 4% due to global macroeconomic factors such as the UK abandoning the gold standard, putting a deeper dampening on the US economy. The gold standard is a monetary system where a country bases the value of its currency in direct relation to the value of gold. Using the gold standard can curb the phenomena of inflation, but it comes with its challenges like supply and demand issues. The US, feeling the global pressure, moved to abandon the gold standard in 1933. Interest rates remained low until mass economic expansion post WWII, and the CPI basket did not reach pre-depression prices until 1943.

Source: U.S. Bureau of Labor Statistics

The Great Inflation (1965-1982)

The Fed spent the period between the Great Depression and the Great Inflation introducing policies and efforts that raised the money supply, stimulating the economy, while also creating record levels of inflation. The federal funds rate rose to its highest level in history during the 1980s. The United States was heading towards record levels of inflation with CPI being over 14% and core CPI being above 13%. To combat the rising interest rates, the Fed set their target rate to 14% in January of 1980. Shortly after, raising the target rate to the highest it has ever been, just under 20%. Due to the increase, the cost to borrow also went through the roof, as 30-year fixed-rate mortgages hit nearly 20% for a short period of time. There are similarities between The Great Inflation and now. In October 1981, there was a 5% increase on mortgage rates YoY, while November of 2022 saw a 4.1% increase YoY. Home sales dropped over 20% in 1980, not unlike the trend seen in 2022. Leading up to this inflationary period, the Fed held rates around 5%, the common target rate also seen today, while CPI hovered between 5-6.5%. Between 1978 and May 1980, there were several rate hikes put into effect by the Fed, raising rates from 6.5% to 20%. The quick and steady increase of rates was needed to reestablish price stability within the US economy with an inflation rate over 12%. From September 1981 to September 1983, inflation dropped 8% but bounced around throughout the rest of the decade. Interest rates were ultimately lowered to 3% in the early 90s through a long series of rate cuts by the Fed.

The Dot Com Bubble (Late 1990s-2002)

A period of long economic growth in the 90s followed the Great Inflation. The Fed was able to reduce interest rates and keep them stable to promote economic growth and create huge levels of growth in the stock market. The Dot Com bubble was an overvaluation of internet-based companies, causing a large influx of investments into lower quality companies. The economic loosening of the Fed mixed with the overpricing of these assets caused the Nasdaq 100 index to increase over 500% from 1995-2000. Interest rates rose slightly during this time from 5% to 6.5%. Following the bubble burst, the Fed dropped interest rates from 6% to 1% in hopes of stimulating a stock market that saw some of its indices lose over 70% of their value. CPI data rose slightly during the build-up of the bubble but declined steadily after, settling in around the Fed’s goal of 2%. The dot-com recession lasted from March to November 2001, but the Fed was initially worried that the economic recovery was lacking as measures of consumer confidence continued to drop till early 2003. The 9/11 terrorist attacks also added to the continued negative outlook, causing more rate cuts due to geopolitical tensions. By mid-2003, inflation was extremely low—core PCE was at 1.78% in January and bottomed out at 1.3% towards the end of 2003.

The Great Recession (2008-2015)

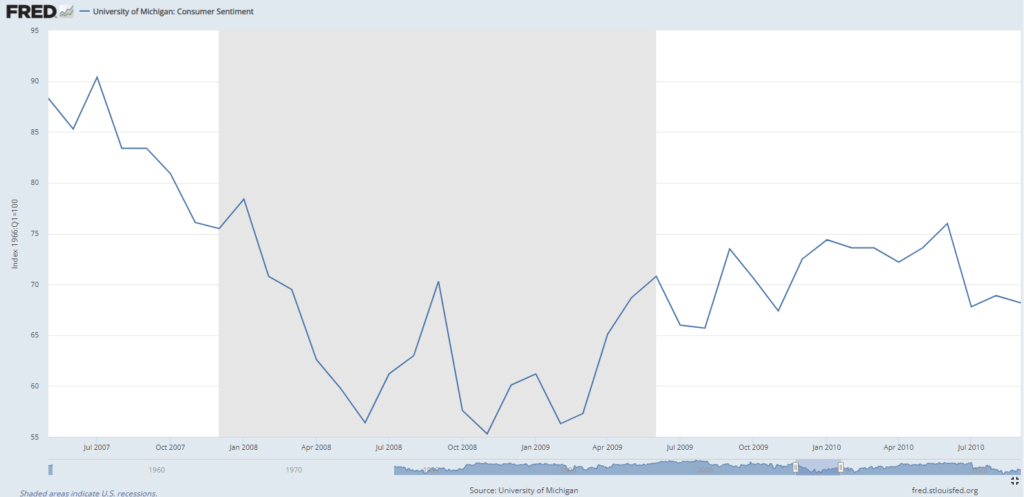

The mid-2000s were a recovery phase for the United States economy, the stock market slowly recovered, mortgage rates came down, and Core CPI remained between 2-3%. During this recovery period, the Fed systematically raised rates 17 times between 2004 and 2006, each time by 25 basis points, from 1.25% to 5.25%. The rate increases were designed to tame the bubbling housing market that ultimately came to a head at the end of 2007. The Fed quickly tried to cut rates in the last quarter of 2007, with the funds rate ultimately reaching near-0% in December 2008. The recession caused CPI data to experience a short deflation period as parts of the stock market lost over 50% of their value in the span of 18 months. Consumer sentiment in the middle of 2008 was extremely low and comparable to feelings had in mid-2022 during the bear market. Crude oil at the start of the recession cost over $140 a barrel, dropping to $70 by the end of the recession. This price movement is also very similar to what was experienced during the bear market, inflationary period in 2022. With low rates and disinflation periods, unemployment doubled to over 10% causing one of the most widely felt recessions in quite some time.

Source: FRED. Shaded in portion of the graph is designated as the Great Recession.

COVID Pandemic (2020-2022)

After leaving rates near-zero, the Fed slowly raised their target rate throughout the mid-to-late 2010s. Core PCE inflation was 1.1% in December 2015, well below the Fed’s target of 2%. It would slowly rise as the Fed raised rates, reaching its target level in March of 2018. Following conflicts stemming from a trade war with China, the Fed cut rates a total of 0.75% during the end of 2019 to mitigate any negative geopolitical catalysts. The COVID-19 pandemic struck early in 2020 and immediately shut down the globe. Production, trade, employment, and markets plummeted as public safety and recovery came to the forefront. The Federal Reserve dropped rates to zero and congress introduced stimulus packages to help a declining economy. The stock market and consumers responded well as the market climbed throughout the remainder of 2020 and into 2021. While the economy was growing again by May 2020, marking the shortest recession on record, the fallout from the economic measures to cope with the COVID pandemic are still being felt. Supply chain issues, a shortage of labor, and low rates with a large influx of cash being injected into the economy raised CPI to its highest levels since the Great Inflation in the 1980s . In turn with this the Fed began raising rates in March 2022, with the last raise coming in August 2023. These rate hikes have been able to wrangle inflation as the October 2023 CPI data came back at 3.2%, down from the almost 9% inflation seen in mid-2022. Consumer sentiment is slowly on the rise from its lowest level since 1980 as economic data continues to show recovery from the fallout of the COVID pandemic.

Post Pandemic and the Now

As we enter a period post pandemic, consumers and businesses budgets are feeling the heat of higher borrowing costs, easing but higher inflation, and resumption of student loans repayments. Each central bank around the world is continuing to evaluate data and current policies to define their policies moving forward. During the pandemic we saw globalization trends regress a bit with global supply chain issues coming to the forefront. While many of the world’s activities have resumed, such as travel and discretionary spending, we have seen dramatic volatility of demand worldwide impacted by inflation and interest rates. Moving forward, the economic outlook, spending and hiring will continue to ebb and flow with the variation of inflation and interest rates.

Inflation, Interest Rates and Your Individual Financial Plan

Having a successful financial plan, along with a well-diversified portfolio puts you in a better position to weather the storm in volatile environments. Long-term financial success is driven by an accurate financial evaluation that successfully manages cash flows and future expenses, accounting for inflation. Your advisory team is here to review and modify your financial plan to adjust for economic circumstances while offering you peace of mind. Continually reviewing items like your debt/interest rates, income projections and asset allocation are paramount to a successful long-term plan.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Why is Equity Compensation Used?

In today’s competitive landscape companies of all sizes, both private and public, look for innovative ways to attract top talent. One of the most common ways in which companies entice employees to join their teams is through a special form of payment called equity compensation, colloquially referred to as stock options or stock awards. Equity compensation is defined as a form of non-cash compensation that awards an employee with stock (equity) in their company allowing them to participate in the ownership of their firm.

From a company’s perspective, equity compensation can provide many benefits such as:

- Attracting talent

- Retaining employees

- Performance motivations

- Conserving cash

There are also many benefits that equity compensation packages can provide an employee:

- Ownership Stake

- Alignment of Interests

- Potential wealth accumulation

- Potential tax benefits

While there are many benefits to receiving an equity compensation package, they can often be very complex and affect an individual’s financial plan from many different angles. Below we highlight the main types of equity compensation packages, their nuances, and important considerations for each.

The Types of Equity Compensation

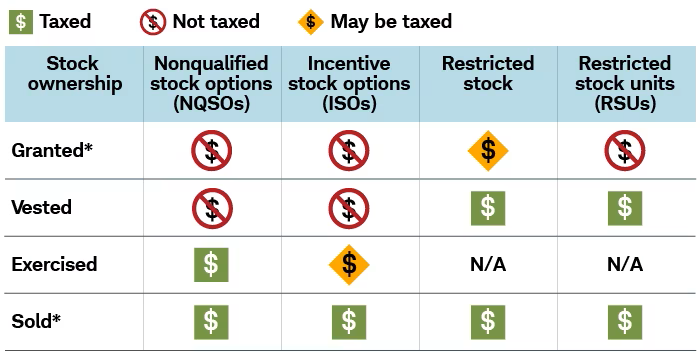

There are many forms that equity compensation packages can take. The most common forms of equity awards are stock options, which can take the form of incentive stock options (ISOs) and non-qualified stock options (NQSOs), and restricted stock units (RSUs). Each vehicle carries its own nuances and mechanics that are important to consider for anyone’s financial plan.

Stock Options

Whether you are granted ISOs or NQSOs it is important to understand the mechanics in which stock options operate. Stock options allow the recipient the right, but not the obligation, to purchase company shares at a pre-determined price often referred to as the grant price or strike price. Since there is a pre-determined price options will only have value if the value of the company is higher than the grant price. If that is the case, an employee has the option to purchase company stock at a discount which can potentially provide enormous financial benefits.

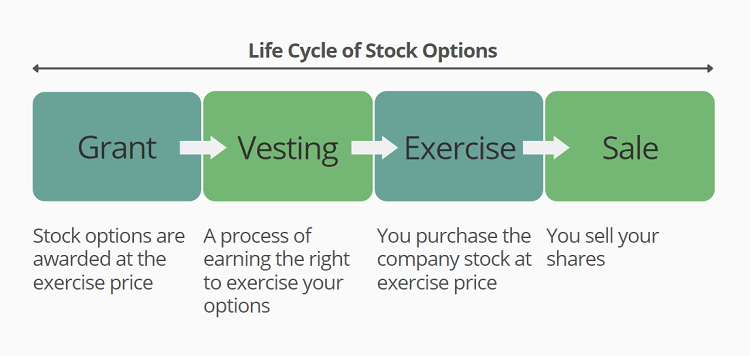

It is important to note that stock options are a formal contract between employer and employee with specific rules and stipulations. The contract will clearly define the vesting schedule, the grant date and price, rules surrounding when an employee can exercise the options, and more. Below is a general outline of the stock option lifecycle.

Also, within the contract the company will define which type of option they are granting the employee, an incentive stock option (ISO) or a non-qualified stock option (NQSO). The type of option offered to an employee can have a major impact on their overall financial plan and decision-making.

Incentive Stock Options (ISOs):

Incentive or Statutory Stock Options can provide the opportunity for preferential tax treatment if certain requirements are met. This benefit can potentially provide enormous savings as gains are taxed at capital gains rates rather than ordinary income tax rates. With an ISO package, there are items to consider before you exercise or sell the stock.

Important considerations with ISOs:

- Holding Period Requirements & Taxation: To receive the preferred tax treatment with ISOs, an individual cannot sell their stock within 2 years of the grant date and the stock must be held for at least one year after exercise. If an individual sells their ISO shares before meeting the required holding period, this is referred to as a disqualifying disposition and any gains will be taxed as ordinary income rather than long-term capital gains. Visit Weatherly’s Key Financial Data Chart for 2023 for a more detailed breakdown of tax rates and capital gains rates.

- Alternative Minimum Tax (AMT): Although ISOs offer preferential tax treatment, it is important to mention that an AMT adjustment may be necessary upon exercising options. With ISOs you may need to file an AMT adjustment on the “bargain element”, the difference between the fair market value of the options and what you paid for the stock (the grant price/strike price).

- $100,000 Per Year Limitation: Per the Internal Revenue Code 422(d), the fair market value of stock exercised in any calendar year cannot exceed $100,000. Anything in excess of $100,000 will be treated as a non-qualified stock options (NQSOs).

- Estate Planning: Generally, an individual is not allowed to transfer or gift ISOs during their lifetime, and if they do, that could potentially disqualify them as ISOs which forfeits the tax benefits. However, ISOs can be transferred upon an individual’s passing to their heirs or beneficiaries through their estate.

Non-Qualified Stock Options (NQSOs):

Non-Qualified Stock Options are the most common form of stock option offered in equity compensation packages. NQSOs are much simpler in nature relative to ISOs, they have straightforward tax events and are not subject to the same stringent rules. The major difference between NQSOs and ISOs revolves around taxation because gains from NQSOs are taxed as ordinary income rather than long-term capital gains rates.

Important considerations for NQSOs:

- Tax Implications: When you exercise NQSOs the difference between the grant price and the fair market value of the stock is treated as ordinary income. With NQSOs, you will owe taxes in the year you decide to exercise your options.

- Holding Period: Once exercised, depending on the length of time you hold onto your company stock you may be subject to either short-term or long-term capital gains rates.

- Timing of Exercise: Since taxes are owed in the year you exercise your options, it is important to consider your entire financial situation in order to minimize your tax liabilities. Weatherly often works with our clients’ tax team in order to ensure that our clients are utilizing their stock options optimally.

- Estate Planning: NQSOs are generally more flexible when it comes to gifting to heirs, family members, or other individuals than ISOs. During an individual’s lifetime, subject to rules from the employer, NQSOs can be easily gifted or transferred to family members, heirs, or beneficiaries.

How to Exercise Stock Options:

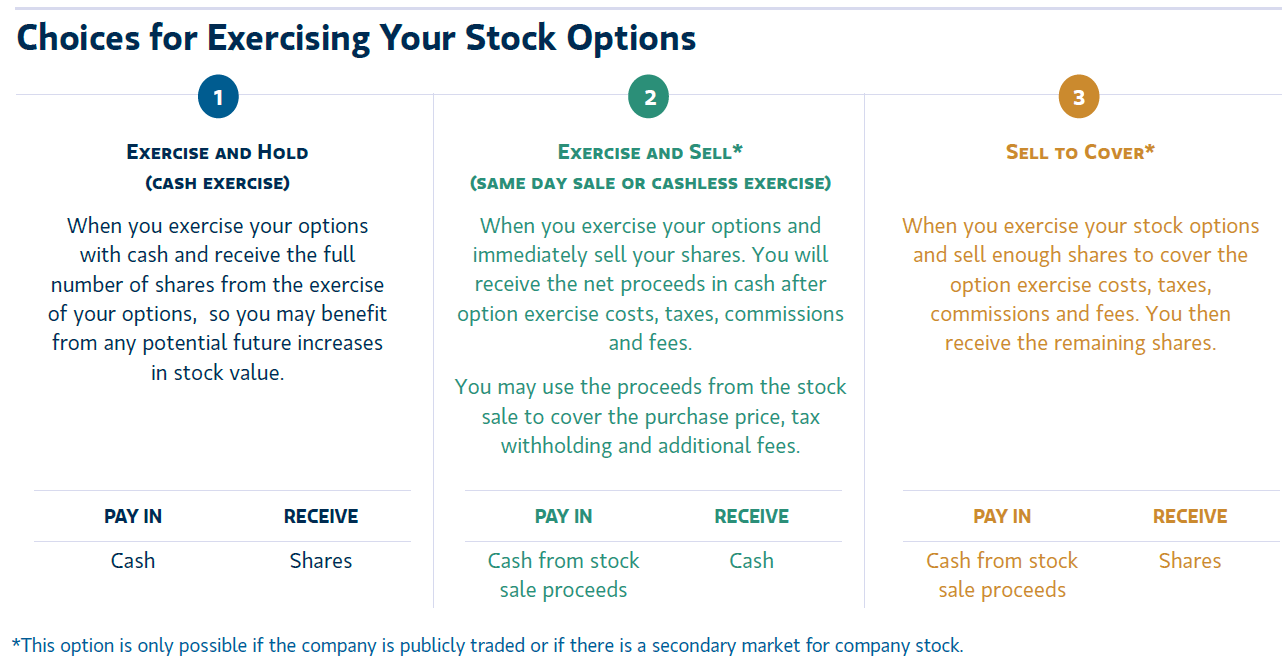

Both ISOs and NQSOs can potentially provide significant financial benefits to employees based on the ability to purchase company shares at a pre-determined price which would ideally be lower than the market value when exercised. When preparing to exercise options, it is important to keep in mind any specific blackout periods imposed by your company that dictate when and when you cannot exercise or trade company stock. Most importantly, with stock options, the employee is responsible for funding the purchase of their shares, and oftentimes this can mean a significant outlay of cash. Our team at Weatherly can assist you in navigating your choices when it comes to exercising your options. We can walk you through your options and tailor the advice to your specific situation considering cash flow needs, investment assets, and financial goals to ensure that you make a well-informed decision. Below we highlight the most common strategies when it comes to handling stock options:

Sourced from: https://www.morganstanley.com/cs/pdf/NQSO-Basics.pdf

Restricted Stock Units (RSUs):

Restricted stock units are another common form of equity compensation offered by companies. With this form of compensation, a company will provide an employee with a specified number of shares at a future date. Like stock options discussed above RSUs are granted under a vesting schedule for a specified period of time or can be tied to performance metrics. Unlike stock options, RSUs are delivered outright meaning that there is no choice granted to the employee with regards to receiving shares. RSUs are converted to stock and awarded on a set series of dates during a vesting period, and once delivered the employee can then decide whether to hold or sell the shares.

Important considerations for RSUs:

- Taxation: With RSUs, you are taxed when the shares are delivered on the specified vesting date. Taxation is based on the market value of the shares received and is treated as ordinary income. Typically, a company will withhold a certain amount of shares for tax purposes, and you will receive the net amount of shares thereafter.

- Holding Period: Once the shares are received the employee has the decision to either sell the shares immediately and receive cash or hold the shares as part of their investment portfolio. If shares are sold immediately there will likely be minimal to non-existent capital gain considerations. If shares are held then any increase in the fair market value from the time shares are received to when they are ultimately sold will be subject to either short or long-term capital gains taxes.

- Estate Planning: While RSUs are subject to vesting, they cannot be transferred or gifted to heirs or beneficiaries. Once vested and shares are delivered to an individual, they can be included as part of an estate plan and pass through to heirs and beneficiaries according to an individual’s estate planning documents.

Important Considerations for Your Financial Plan:

At Weatherly we have a team of dedicated professionals with deep knowledge and experience in the world of equity compensation packages and how to utilize them optimally to accomplish a client’s financial goals. We often work with our clients outside financial team of tax advisors and estate planners to coordinate the various moving pieces when it comes to receiving RSUs or exercising and managing stock options. From a financial planning perspective there are several factors to consider if you have an equity compensation package.

- What do I own?: Often times equity compensation packages may include a combination of ISOs, NQSOs, or RSUs. It is important to identify the various types of vehicles that are provided to you by your employer because there are various implications for your personal financial situation. Our team at Weatherly will request all the documentation associated with your equity compensation package to understand your benefits to begin implementing a plan appropriate for you.

- When do I pay taxes?: With the various vehicles available in an equity compensation package it can be very confusing to keep track of all the various tax implications and the timing of when taxes are owed. Our team of financial advisors often consults with your tax professionals to ensure that all parties are on the same page. We want to ensure that you have a clear picture of how exercising your options or receiving your RSUs will affect your tax liability.

- How does my equity compensation package affect my overall portfolio?: If you are receiving stock awards as part of your overall compensation, those awards need to be considered when it comes to your overall investment assets. Decisions regarding selling the shares and holding the shares, and the timing associated with that, can have major implications to your overall portfolio and asset allocation. There may come a point in time where you have been awarded a sizeable amount of company stock which could expose your portfolio to concentration risk and lack of diversification. Our portfolio managers at Weatherly have extensive experience and strategies for navigating your stock awards in the context of your overall financial situation.

- How do my stock awards affect my overall financial plan?: Each client is unique with their own financial situation and goals. At Weatherly one of our core pillars is customized holistic financial planning. Our team of financial planners can incorporate your equity compensation package into your overall financial plan to understand how your stock awards can potentially impact your financial situation. Oftentimes times we run various scenarios providing our clients with different options they can take in order to ultimately achieve their goals and aspirations.

Our team of dedicated advisors at Weatherly are here to answer your questions and ensure that you are making informed decisions regarding your equity compensation package. We are here to understand your specific needs and circumstances to ensure that your financial goals and aspirations can become a reality.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

For those in or approaching retirement, cash flow and healthcare planning remain a top priority, and understanding the resources available is essential to developing a successful financial plan. Social Security (SS) benefits help retirees supplement cash flows and in turn, the withdrawal rate on their portfolio. Social Security can also provide benefits for individuals that cannot work due to disability or injury. Individuals become eligible for SS benefits by having 10 years of work history in which payroll taxes are collected and may draw on their retirement benefits beginning at age 62. While this is the most common way to meet SS eligibility requirements, there are a few alternatives to obtain benefits that we’ll expand on later.

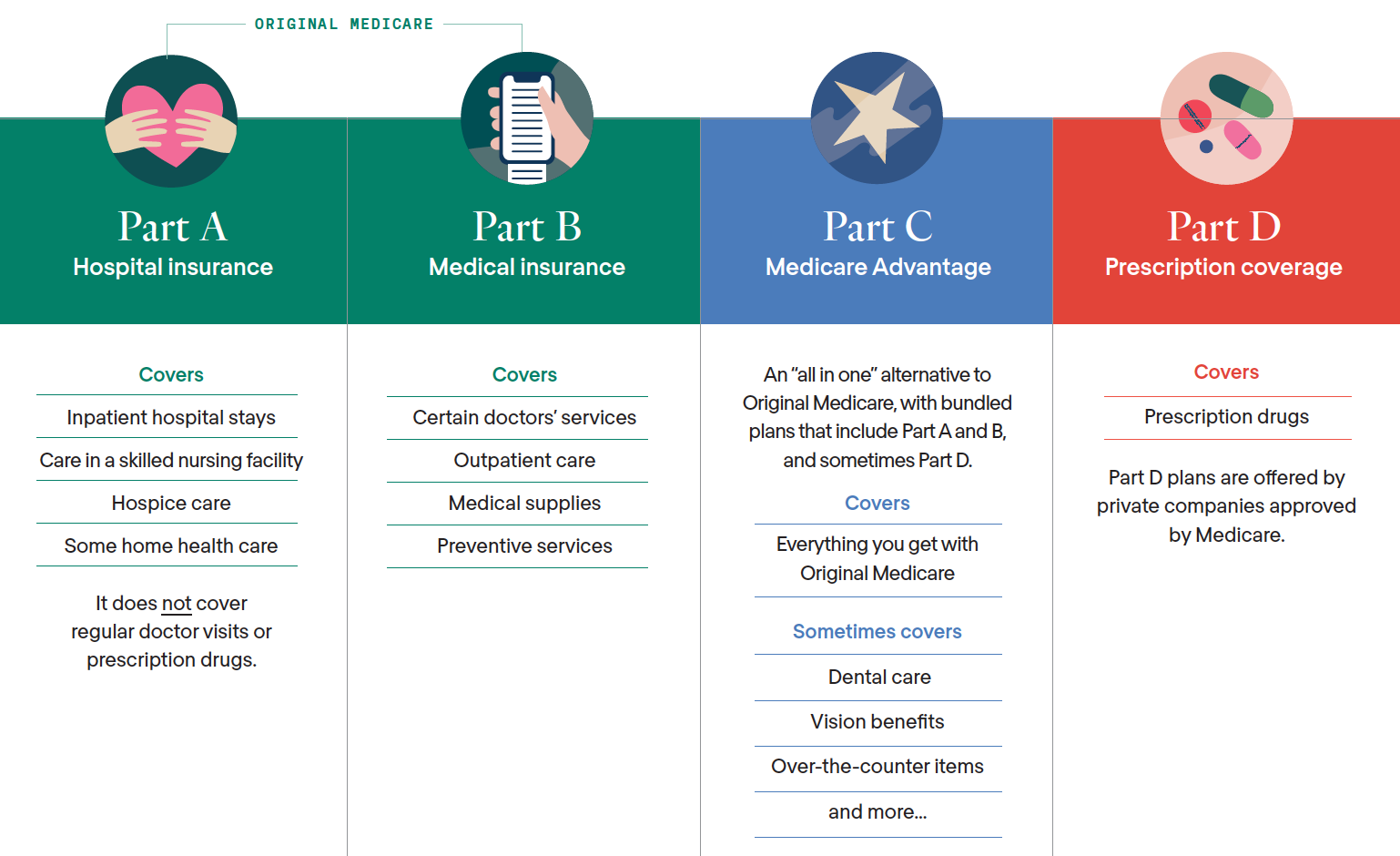

Medicare is another program offered by the federal government, providing healthcare coverage for those aged 65 or older and individuals with disabilities. The Medicare program features four parts, Part A-D, each providing a different aspect of coverage. Eligibility for Medicare coverage is determined by one’s eligibility for Social Security and enrolling in Medicare can begin three months prior to an individual turning 65 and will be automatically enrolled in Medicare Part A & B.

Social Security

Social Security benefits are primarily based upon the age at which benefits begin and the individual’s historical wages. Taxation of SS benefits can range between 0%- 85% and is based upon the individual/couple’s income each year. For those not yet receiving benefits you can look up projected benefits on SSA website here. Individuals that do not qualify for their own retirement benefit or have minimal earnings history may still be entitled to receive benefits.

Access to Benefits

- A non-working spouse may be eligible for spousal benefits up to 50% of their partner’s full retirement age (FRA) if age requirements are met.

- Divorced individuals may be entitled to 50% of their former partner’s benefit if married for at least 10 years, divorced for more than 2 years, and are unmarried.

- Surviving spouses may receive reduced benefits beginning at age 60 while retaining the ability to claim their own benefit at a later date, if eligible. Surviving spouses are also entitled to receive their former spouses benefit if higher than their own.

- Minor children may be entitled to a percentage of their parent’s benefits in certain circumstances.

- Individuals may be eligible for Disability and Supplemental Social Security benefits depending on needs, income and resources.

Before filing for Social Security benefits, it’s important to take inventory of your cash flow and needs to supplement income. According to the Social Security Administration, Social Security makes up 33% of an individual’s post-retirement monthly income. One of the biggest questions with Social Security is when to take it, however, there is no one-size-fits-all answer and ultimately depends on each individual/couple’s financial situation. This highlights the need for proper planning that incorporates a cost-benefit analysis on the timing to collect benefits. Individuals are entitled to an 8% simple increase in benefits for each year benefits are delayed past their FRA up to age 70. Weatherly can help highlight the pros and cons as to whether claiming benefits prior to or after obtaining their FRA is beneficial.

SS benefits are funded through the Social Security Trust that is overseen by the federal government. The future of Social Security has been a contested topic as recent projections have the fund being depleted in 2033. To help address this shortfall it is likely that changes will need to be made with regards to taxation of earnings, extending the FRA or reduction in benefits. Weatherly understands the importance of Social Security, and our ultimate goal is to maximize benefits for you.

Medicare

Healthcare expenses during retirement can become one of the largest costs and highlights the need for proper planning. Medicare provides healthcare coverage for individuals starting at age 65 along with additional coverage for those with extenuating health circumstances. Medicare covers a variety of care needs such as prescription drugs, in-patient treatment, out-patient treatment, and various types of hospital care.

While employed an individuals’ healthcare coverage is often provided through their employer and retiring before age 65 can create a lapse in coverage if COBRA or alternative insurance is unavailable. Certain life events may qualify an individual for a Special Enrollment Period (SEP) such as losing health coverage, having a child and getting married to name a few. A lapse in healthcare coverage can be supplemented by public marketplace insurance, private insurance, COBRA, or spousal coverage.

Medicare coverage is broken up into four parts, A-D. Parts A & B cover hospital visits, routine check-ups, and medical equipment, among other things. You are not automatically enrolled in parts C & D which provide different types of coverage. Part D provides prescription drug coverage in addition to what is already provided. Part C, known as Medicare Advantage, is an additional option that can enhance your Medicare coverage. Medicare Advantage allows you to utilize a private company for health coverage and these plans usually come bundled with parts A, B and D.

Source: HiOscar.com

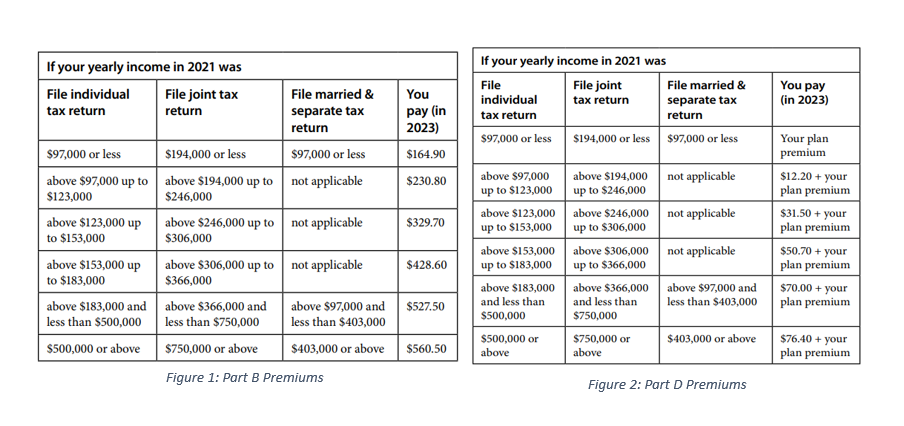

Premiums for the different parts of Medicare are based upon your taxable income and subject to a 2-year lookback.

Important Considerations

Social Security and Medicare can be a confusing process to navigate. Weatherly is here to help guide you through your unique situation and we’ve outlined a few common considerations to be aware of.

Spousal Benefits: It is not uncommon to see spouses, especially ex-spouses, not realize the full benefit they are entitled to. As a spouse, you can claim a Social Security benefit based on your own earnings record or collect a spousal benefit in the amount up to 50% of your spouse’s Social Security benefit, but not both. You are automatically entitled to receive whichever amount is higher.

Windfall Elimination Period: The Windall Elimination Period can reduce Social Security benefits for individuals participating in pension that did not pay SS taxes. WEP can reduce benefits by up to 50%.

Registration Window: The registration window for Medicare begins three months leading up to your 65th birthday and three months following. It is important to register in the window to avoid late penalties.

IRMAA Premiums: Single filers with income above $97,000 and joint filers with income above $194,000 are subject to increased premiums for Part B & D.

Returning to Work: A decision to return to work may not always be financially motivated. It is key to understand the implications of how returning to work can affect your Social Security benefits that are currently being received. For those individuals, they may experience a withholding of benefits prior to their FRA but will be recaptured once FRA is reached. Before returning to work, we recommend reaching out to SSA to understand the implications for your benefits.

Wrap Up

Social Security and Medicare are essential aspects of post-retirement income and healthcare coverage. Weatherly can help analyze the options available to you and ultimately what is most beneficial for your unique situation. This analysis expands beyond a breakeven analysis of total benefits received to include, but not limited to, cash flow needs, health history, family longevity, and type of portfolio assets available. Roth conversions during gap years may provide an opportunity to help reduce taxes over time and enhance legacy planning for those beneficiaries. Your trusted Weatherly advisors are here to educate and guide you through these complexities to help achieve the goals for you and your family.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

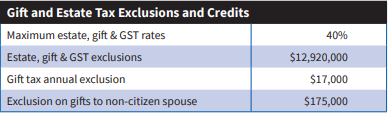

The much anticipated “Great Wealth Transfer” is looming on the horizon. Over the next few decades, an estimated $30 to $68 trillion will be passed down from baby boomers to their Gen X and millennial children (source: Forbes). Additionally, the current federal estate tax exemption is $12.92 million per person, or just shy of $26 million per couple. However, this high exemption is set to sunset at the end of 2025, reverting to an estimated $7 million per person, or $14 million per couple, depending on inflation (source: Fidelity).

As the Great Wealth Transfer and the estate exemption change approach, now is the time to prepare. The best first step is to review your financial plan with your trusted advisors to ensure you have a nest egg to last your lifetime. It’s equally important to review your will, trusts, power of attorney designations, and beneficiary selections and initiate conversations with your successor trustee(s)/executors.

Planning early and having ongoing conversations with your financial professionals and successors can help ensure your assets and personal values are transferred smoothly. Here are some key conversation topics and steps to take when starting dialogues about money, estate planning, and your legacy.

Where to Begin?

Many individuals put off important money conversations with their successors because they aren’t sure where to start. Begin with the big picture—the Who, the Where, the What, and the How. This provides a good starting point to educate your successor trustee and/or your executor without divulging specific financial details or monetary values.

The Who?

- Who Are Your Key Professionals: Share information about your team of professionals, such as your financial advisor, attorney, and accountant. Provide their contact information and explain how to access important documents if needed. This simple list can help your executor know who to reach out to for guidance and support. Our Weatherly Client Information Release Authorization Letter (CIRAL) can act as a template for this exercise.

- Who Are Your Designated Beneficiaries: Review who the designated beneficiaries are on your accounts, insurance policies, and retirement plans. This information is crucial for the smooth transfer of assets after your passing. Make it a point to have an annual check-in with your key professionals, as we know beneficiaries and wishes can change along with updates to tax and estate law.

- Who are your Executors/Successor Trustees: This role is crucial to the overall administration of your estate and may impact family dynamics. Explore options such as responsible individuals, family or friends, private fiduciaries, or corporate trustees to manage estate distributions down the road. Evaluate the pros and cons of a professional trustee to relieve family members or friends of distribution duties. Once this decision is made, make an effort to have a conversation with your chosen successor.

The Where?

- Where Are Your Assets Custodied: Identify where your assets are currently held or custodied. If you have a safety deposit box, note its location and provide details about accessing it when necessary

The What?

- What Are Your Assets and How Are They Titled: Without revealing specific market values, give an overview of your assets, including both liquid and non-liquid assets. Explain the nature of each asset and how they are titled (jointly owned, held in a trust, individually owned, retirement vs nonretirement assets, etc.).

And the How?

- How to Have the Money Conversation: Lean into your team of professionals to help navigate the conversation. Weatherly often facilitates the initial conversation to introduce successors to big-picture concepts about your estate without divulging market values. We also act as a resource for ongoing money conversations as your needs and situation evolve.

Express Your Wishes, Family Values, and Charitable Intentions

Depending on your unique situation and desire to incorporate your next generation or heirs, some families hold meetings to discuss values around wealth and philanthropy and set shared goals for social impact and creating a legacy.

We often see charitably inclined individuals utilize Donor Advised Funds (DAF) to hone in on charitable values and build a legacy via grants to causes they care about. This process can be as formal as a meeting with all individuals to discuss charities they care about or as informal as giving each person a certain dollar amount to grant to a charity of their choosing year over year. The key is to find what works for you and make it your own.

Gifting to the Next Generation: Empowering the Future with Smart Choices

Another effective way to empower your successors with financial responsibility is through annual gifting. As of 2023, the annual gift exclusion amount is $17,000 per person- meaning you can gift up to $17,000 to each individual without incurring gift tax.

Weatherly is happy to review your own personal financial plan to help determine what gifting amount may be appropriate and subsequently help set up investment accounts for your heirs. By involving a financial advisor, the next generation gains access to valuable resources and professional guidance to make informed financial decisions.

For 5 additional Estate Planning Strategies to Consider, please read our past blog post on the subject.

How WAM Can help?

Starting these in-depth conversations now can help ensure you and your successors are unified in handling the complex transition of resources and responsibilities successfully. The Weatherly team is here to help start the conversation without overwhelming your successors with intricate financial information. We can further assist you by creating an open and supportive forum to discuss your estate, financial planning and focus conversations on how you can thoughtfully prepare for the future while making a positive impact together.

As always, we welcome your questions, calls and the opportunity to schedule a conversation with you and your next generation or beneficiaries.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Making decisions about your financial life can be daunting and difficult no matter the stage, but the choices you make now can have a major positive impact over time. Whether you are just thinking about getting started with professional financial advice, actively interviewing candidates or even heading into a quarterly review with your current advisor, discussing the right topics can offer you great peace of mind.

At Weatherly, we encourage open dialogues and value honest communication at every stage of our relationships with our current and prospective clients, their families, and their trusted professionals. We sat down and created a comprehensive list of questions that not only covered the basics, but also looked beyond at the relationships we build and the extent of the work we accomplish together. These questions are not only useful in the “due diligence” phase of interviewing, but impactful to review at least annually with your Weatherly advisor.

- Are you a Fiduciary and what does that mean?

A Fiduciary is a term in the financial services industry that refers to a financial advisor that serves under fiduciary duty, meaning that the advisors have pledged to make recommendations or collaborate with you on solutions with your best interest in mind, not for their own personal gain or financial benefit. You can learn more about our commitment to our fiduciary duty and view our regulatory filings on our ADV, Compliance and Disclosures page.

- Who is your custodian?

Weatherly primarily uses Fidelity Investments, but also works with Charles Schwab, and National Advisors Trust Company as custodians for client accounts. This separation of RIA (Registered Investment Advisor) and custodian is in place to protect the investor from loss or misuse of funds due to the Investment Advisers Act of 1940 as well as subsequent updates in 2009 by the Securities and Exchange Commission in the aftermath of Bernie Madoff’s Ponzi Scheme. A benefit of this distinction for clients is “side by side” reporting. As a client, you receive reporting directly from Weatherly focusing on investment performance and separate reports from your custodian, allowing you to cross-reference for additional transparency on account activity.

The importance of choosing the right custodian to work with is paramount to both your experience as a client and the safety of your assets. High quality custodians will be protected through SIPC insurance and even go above and beyond for investors by providing additional coverage, like the expanded comfort that Fidelity offers through Excess of SIPC insurance. In addition to annual reviews, Weatherly performs ongoing due diligence on third parties, including custodians, their insurance, and areas of potential risk. Weatherly prides itself on extensive vetting of our custodians to ensure the highest level of service for our clients.

- How do you make money?

Our comprehensive list of services is extensive, but Weatherly’s two core competencies are investment management and financial planning. Using these two pillars as a foundation, our team works with you and your trusted team of professionals on all aspects of your financial life from customized portfolio management to business, estate, retirement, and tax planning. For this holistic service approach, Weatherly charges a fee based on Assets Under Management (AUM,) 1% for equities and .5% for fixed income. We do not charge hourly fees for planning or other advice; our services are covered by your quarterly fee. For more information on our services and fees, you can review our Firm’s Form CRS.

- Who is your ideal client, do I fit in?

While we do not limit ourselves to these categories, organically over time our client base grew into three main groups with whom we feel we do our best work. Our three niches are Entrepreneurs and Small Business Owners, the Working Wealthy and Women. Each of these groups presents unique planning opportunities and their own unique complexities.

For an in-depth case study on the first of these groups, check out the first installment of our Weatherly Client Series.

- How often will I hear from you if I become a client?

Weatherly aims to have full reviews with clients quarterly, though we do not limit conversations to this cadence. Our team-based approach ensures that you always have access to a professional familiar with your financial picture via phone, email or dropping by the office. Depending on each individual client’s situation, we may look to increase the frequency of communication beyond quarterly. New client relationships often require a higher volume of conversation as we get to know your full financial picture, align, and implement our efforts to achieve your goals through our core competencies of investments and financial planning.

Also, life changes such as job transitions, business succession and opportunities, new children, the loss of a family member, marriage or divorce are all catalysts for more frequent communication. These events are impactful in all facets of life, but our advisors are here to lean on throughout these changes and ensure your financial world evolves to support your current situation.

- What are you and your team’s qualifications?

Under Carolyn’s leadership, Weatherly’s partners’ and team members’ commitment to education is top tier amongst local and national averages, enabling best-in-class continuity of client service. 100% of Weatherly’s staff has a minimum of a bachelor’s degree, with several team members holding post-graduate degrees. In addition, our team consists of multiple CFPs, a certified CPA, and multiple team members with industry-related subject matter specific credentials. All investment and planning-focused team members hold either a Series 65 or Series 7 license*. We lead by design in our industry for focusing on perpetual innovation, technology, mentoring, and human capital development.

Our team fosters a culture of education and evolution by prioritizing asking questions, sharing knowledge and ongoing collaboration with our clients, each other, and centers of influence in our professional community. You can read more about each team member, their background, and their qualifications on Our Team page.

- What is your investment philosophy and how do you pick positions?

Weatherly’s investment strategy focuses primarily on individual equity and fixed income securities and may use ETFs (Exchange Traded Funds) or no-load mutual funds for diversification in select sectors. We take a thematic approach to security selection, first identifying areas of potential through ongoing research and collaboration of our investment committee, then drilling down to determine specific companies where we see opportunity or risk. Our focus on individual securities lends itself to reducing overall fees a client pays in the form of expense ratios. Client portfolios typically include a mix of growth and dividend paying stocks, both domestic and international. For fixed income, we monitor yield curves for areas of opportunity and will deploy capital to maximize after-tax return while managing duration and credit risk. Fixed income investments may include Treasuries, Agencies, CDs, investment grade municipal and corporate bonds. Each client portfolio is managed to target asset allocation guidelines with flexibility to deviate plus or minus 10%.

Beyond general asset allocation guidelines, our security selection for each individual account and family aims to incorporate factors like retirement time horizon, withdrawal needs, saving rate, tax implications and business and community goals. These variables, among others, work in conjunction with your financial plan, which is monitored and adjusted as your situation evolves. Our goal is to determine the most attractive after-tax, after-fee return for you and your family, and let that factor into security selection, achieving solid long-term returns while also adapting to your risk tolerance and ongoing needs.

- How do you collaborate with my trusted professionals?

Weatherly works closely with a client’s team of professionals on all aspects of their financial life. Our team approaches planning and investment management with a broad and encompassing lens, considering estate, business, tax planning and much more. We view having a team of experts working on your behalf as essential. If you do not already have professionals in place, Weatherly taps into its network of highly qualified COIs to provide referrals that would be the best fit for your individual situation.

Given the breadth of information we gather and the intimate relationship we have with each client, our advisors are often the catalyst in development of specific strategies and can help further refine questions or simply talk through an issue before heading to your CPA (Certified Public Accountant) or attorney. We always recommend getting guidance from your trusted professionals, but it can be helpful to workshop scenarios with an advisor prior, to achieve total alignment as we work towards your goals.

- How can you help me stay on track with my goals?

Our planning model begins with a Dialogue for Impact. We believe that the value of our advice is driven by the amount we can learn about your individual situation. We appreciate the interconnectedness of life and livelihood and the dynamic nature of planning beyond just your finances. We begin with a comprehensive financial plan, considering your current situation as well as your future goals and run through multiple scenarios to determine the best options. Through quarterly update conversations with you (along with your family, and your trusted professionals as needed) we adapt the plan, provide recommendations, and implement solutions to ensure the health of your plan.

In line with planning, our team provides best practices and works directly with you, often one-on-one, setting up and maintaining healthy cybersecurity habits. Protecting your personal data is our priority, and our team employs elevated technology like our secure Weatherly portal to ensure your privacy. Our client service team is skilled in both teaching and technology to guide you along this journey.

As with most aspects of our service, we favor a comprehensive approach to planning for impact. Incorporating the next generation into ongoing dialogues can set you up for success as you age and ensure your goals and wishes are met even after your passing.

- How do you work with the next generation?

We consider working with the next generation to be a vital part of our long-term relationship and what we build together for clients as their advisor. Spanning our professional financial advice across generations can be one of the most impactful gifts you can give to both your loved ones, and your own peace of mind. Whether you are contributing to a 529 or UTMA account, helping a first-time home buyer or even ensuring clarity of your wishes in the event of a health crisis or your passing, our team is here to help.

To assist with this, as part of our onboarding, Weatherly has each client fill out what we call a CIRAL (Client Information Release Authorization Letter). This document helps our team support you and your loved ones in times of transition by indicating your team of trusted professionals, family members, and emergency contact and giving Weatherly permission to communicate with them on your behalf if it is in your best interest to do so.

Final Thoughts

Armed with these questions, you can enter a discussion with your advisor at Weatherly knowing that you will have all the answers you require on your side and the knowledge that you have us in your corner through all of life’s evolutions. Change is constant, but you can rest assured with Weatherly as a resource to help you outline optimal choices, detail benefits and drawbacks and help you make informed decisions as you enter new stages of life. Our team utilizes data, tax and legal guidance and innovative technology to ensure your path forward is the right one for you, your family, business, and community.

If you are still deciding to seek professional financial advice, it can feel like a big decision, yet considering these options can help ensure you are aligned with your chosen team. At Weatherly, we aim to inspire that confidence and foster transparency and alignment through the work we do with each of our clients so they may go on to achieve a positive impact on their families, businesses, and communities.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

*updated 2024

If you find taxes confusing, then you are not alone. Albert Einstein once said, “the hardest thing in the world to understand is the income tax.” While we outline many useful tax details in our Key Financial Data Sheet and even observed the US history of taxes in a prior blog post, it is truly the IRS’ job to fully understand and enforce the tax code. We also find the tax return essential to our services and we like to receive a secure copy each year.

Within your tax return is a wealth of information that we utilize to support our two core competencies – financial planning and investment management. Our goal is to get to know your full financial picture so we can tailor our advice to your specific situation to increase overall tax-efficiency. While we prefer to analyze your full tax return, the following sections give us specific insights into how we can best serve you.

1040

The 1040 gives our team a summary of your full tax picture. Numbers on your 1040 that are of particular interest to our team are your Adjusted Gross Income (AGI) and your Taxable Income. Your Taxable Income, in conjunction with your Filing Status, help us determine your Marginal Federal Tax Bracket. Your tax bracket drives the types of securities we purchase for your taxable portfolio, like a Trust or individual account. For example, a person in a very high marginal tax bracket may benefit from tax-exempt municipal bonds. Alternatively, a person in a low tax bracket has less of a need for tax-free income and may benefit from an allocation to taxable corporate bonds. Weatherly always looks at the Taxable Equivalent Yield (TEY) to compare a taxable bond to a tax-exempt bond to determine which offers the most attractive after-tax return per client account.

Tax brackets are also useful within financial planning to determine if it is a good year for a Roth conversion. This strategy can take advantage of a low-income year by leveraging current lower income tax brackets to enhance after-tax returns over time. Since Roth assets can grow tax free, they often become a desirable source of funds in legacy planning for beneficiaries.

This first page is also useful when onboarding new clients. It provides our team with your full name, Social Security Number, address, and lists any dependents you claim. This information facilitates us in filling out new client paperwork and expedites the client onboarding process. We also track your tax preparer as listed at the bottom of form 1040, as we may need to contact them with any questions that may come up regarding your tax situation and various tax strategies. With your consent, we can also contact them to directly and securely send your tax forms to assist them in filing your return.

Schedule 1

Schedule 1 outlines any additional income you earned throughout the tax year as well as adjustments to your income. Our team appreciates having a full outline of your revenue streams and how much you receive. It can be overwhelming to have to keep track of this information independently, so it is often easier to send this summary to your advisor to give them some context on your cashflow. We can also model the income into a financial evaluation and build out various scenarios.

Schedule A

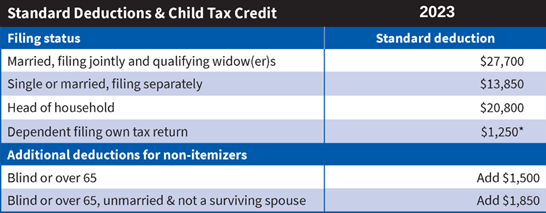

If you itemize your deductions, instead of taking the standard deduction, you will need to fill out a Schedule A. The Tax Cuts and Jobs Act (TCJA) in 2018 made significant changes to the deductions you can itemize. The main deductions are medical costs (that exceed 7.5% of AGI), state and local taxes (now capped at $10,000), mortgage interest and gifts to charities. The TCJA also significantly increased the standard deduction which dramatically reduced the amount of Americans itemizing their deductions. For the 2023 tax year, the standard deductions are mainly based on filing status but can also be affected by other factors. Please see the chart below for details:

Sourced from: https://www.weatherlyassetmgt.com/wp-content/uploads/2023/01/2023_KEY_FINANCIAL_DATA_CHART.pdf

Many of our clients itemize their deductions because their large donations to charities throughout the year frequently exceed the standard deduction. One of the strategies we utilize includes appreciated stock contributions to a Donor Advised Funds (DAF). If you have philanthropic goals, then our team can help evaluate timing and security selection for tax aware giving methods. Your generosity not only helps those in need but can decrease your taxable income for the year. It is important to note, if you do not itemize, your charitable contributions are not deductible but other strategies like Qualified Charitable Distributions (QCDs) may be an alternative.

Schedule C

If you are a sole proprietor, you should also have Schedule C included in your tax return. This form indicates any profit or loss your business experienced throughout the year. We use this to help us determine if it would be beneficial to take any gains or losses in your account to offset the profits or losses from your business. We can also incorporate the income streams and a future business sale into your financial evaluation. Seeing Schedule C typically leads into a conversation about retirement contributions and if a self-employed 401K or other retirement plan is appropriate.

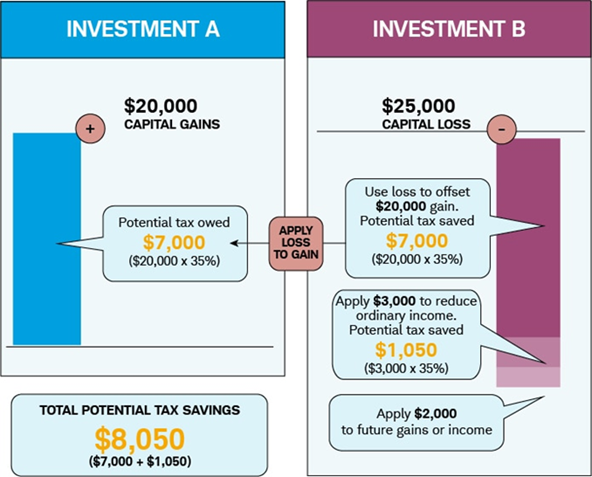

Schedule D

Schedule D reports capital gains and losses. Our team actively seeks to limit capital gains each year, through tax loss harvesting. This strategy includes taking losses (if available) to offset capital gains in taxable accounts. Occasionally, a client will have capital losses that exceed gains. In this instance you may deduct up to $3,000 ($1,500 if married filing separately) against ordinary income on your 1040 and carry forward the remaining losses to future years.

Sourced from: https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

In periods of extreme volatility, this strategy can be used proactively so unused losses can be used to offset future gains when the market recovers. This method along with other tactics are used to successfully reduce concentrated positions over time while limiting adverse tax consequences. As part of our ongoing investment management services, we actively seek to buy and sell securities with a tax conscious approach.

Schedule E

Many of our clients own rental properties, receive royalties, own S corporations, or receive income from estates and trusts. Schedule E is where the income and losses from those avenues are reported. Our advisors review this form to gain better understanding of your financial situation and can work different scenarios into financial evaluations.

1040-ES and Vouchers

These vouchers help our team plan out cash flows throughout the year. Understanding your cash needs allows our team to accumulate cash and send funds to your bank proactively to help cover quarterly tax estimated payments.

How Weatherly Can Help

The Weatherly team takes pride in our ability to create tax efficient strategies specific to each client so they can ultimately keep more money in their pockets. Each client not only has their own unique situation, but tax and estate laws can change. A current tax return allows us to identify any new planning opportunities for the year and assists in our tax conscious investment approach.

If you haven’t already done so, please send us your tax return by utilizing our secure portal or another secure method. If easier, feel free to connect us with your tax preparer and we can request the return directly from them. We work closely with many tax professionals to securely share tax documents and to collaborate on any tax planning initiatives.

As always, we welcome your questions and look forward to saving you money!

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

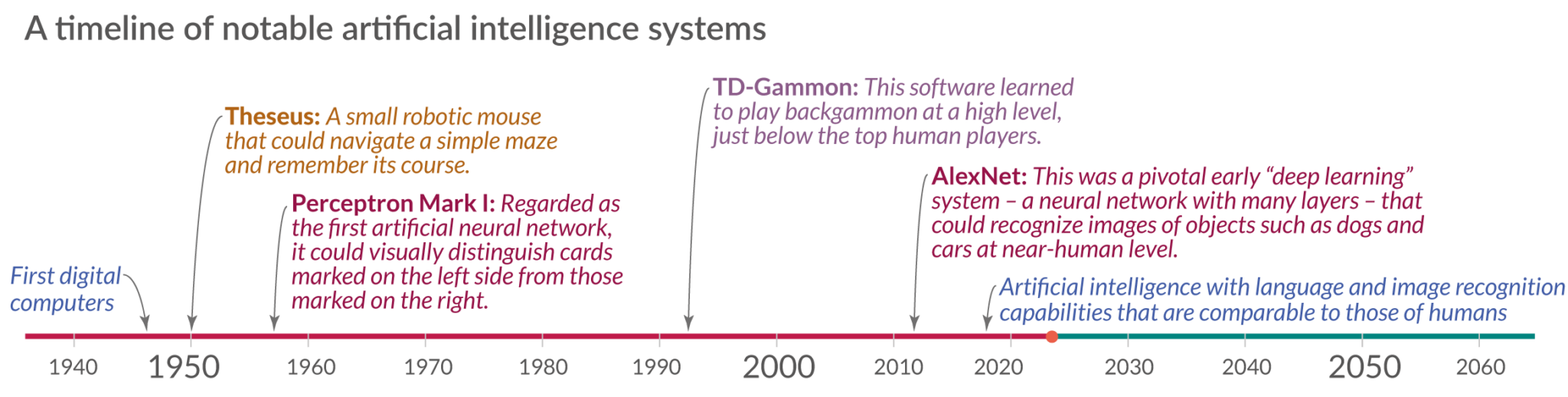

Artificial Intelligence, or its short form AI, is a term new to many people, but did you know that it has been around since the 1950s? In fact, AI has already woven itself into our day to day lives. While it is easier to identify certain technology that has been considered “life changing” such as the internet, social media and smart phones, AI helps drive these technological advancements. The broader technology sector has grown from the smallest sector by weight in the S&P500 to the largest sector within a handful of decades, and the spillover effect of technology has transformed other industries leading to overall growth in the global economy.

Timeline sourced from: Our World in Data

Today, AI is being popularized once again with large companies spending billions of dollars to back chatbot programs like ChatGPT, Microsoft’s revamp of Bing and Google’s newly released Bard. While AI and technology have had a relatively short existence, the snowball effect is leading to new opportunities and concerns for what the future might hold. With more companies beginning to weigh in on the potential impact of this new tech landscape, Weatherly has been observing opportunities for investment, identifying potential concerns and embracing ways to enhance our client experience.

The Good – AI Present and Future

With new applications and possibilities, advancements in artificial intelligence have impacted almost every industry and profession.

Education – Today, AI is being used to improve courses, grade papers and create interactive exams. The future holds a more personalized education system which can identify weaknesses and create teaching methods and adaptive programs specific to a student’s special education needs and learning styles. With AI to assist, students can have a more well-rounded knowledge base or choose to specialize in a certain area.

Legal – Though AI is more likely to aid than replace attorneys in the near term, its use to review contracts, find relevant documents in the discovery process, and conduct legal research has helped to eliminate some of most tedious tasks for lawyers. The use of AI in the legal sector has the potential to improve the efficiency and accuracy of legal services, while also reducing the cost for clients.

Health Care – While not a replacement for human doctors and healthcare providers, AI technologies have created unprecedented opportunities in the medical field. Currently, AI is being used to automate administrative tasks such as pre-authorizing insurance, following up on unpaid bills, and maintaining records. Additionally, the capabilities for AI powered programs to analyze vast amounts of data and detect information that may not be apparent to the human eye, can facilitate targeted cancer therapies such as radiation, and could lead to a radical impact on early detection of diseases, diagnosis, and treatment recommendations.

Travel/Transportation – At present, AI is very involved with how we get from point A to point B. Whether it’s a navigation app on a smart phone or an airline company using AI to determine ticket prices. With AI technology people can even be physically moved in a self-driving car. While this future is already here, it is still evolving and some consumers remain skeptical.

The Bad – The Consequences and Concerns of AI in Society

Despite its benefits, there are serious concerns about the impact of AI. Some of the major potential negatives to consider are:

Job displacement – As machines and algorithms are able to perform tasks previously done by humans with superior speed and accuracy, there could be a potential for job losses in many industries.

Bias and discrimination – AI systems have the potential to be biased and discriminatory if the data they are trained on is biased or designed with implicit biases. This can lead to unfair treatment and negative unintended consequences.

Privacy- AI systems thrive on collecting and analyzing large amounts of data, including personal data. This raises major concerns about privacy and security.

Lack of transparency – AI systems are complex and difficult to understand, making it especially difficult to determine how decisions are being made. This also raises concern for how to hold companies and organizations accountable for their actions when artificial intelligence was a factor in the decision-making process.

Ethical – Should machines and other AI software be granted legal rights? Can AI be trusted with decision making despite its lack of ethical, moral, and other human considerations?

Although advancements are continuously occurring, it remains clear that technologies struggle to provide the meaning, value, and creativity that real humans can.

AI and Weatherly

At Weatherly, it is our intent to embrace the good technology has to offer and protect ourselves (and you) against the bad. We seek to identify new technology to advance our business and serve our clients in the most efficient way possible while remaining cognizant of overall risk.

Our reporting tools are used to enhance what we do by analyzing a wide scope of data so that we can stay informed and provide accurate real-time updates. To help ensure our clients don’t outlive their assets, we use financial planning software and create alternative scenarios to outline future risks and opportunities. While we can generate countless reports and scenarios the true value and real understanding occurs when we verbalize the key outcomes.

We have also fully embraced automation in processes such as account opening and document verification. We have seen huge successes and advances in the turnaround times of account establishment through our custodian’s e-tools, as well as document verification through DocuSign e-signature.

Additionally, we remain on high alert to the threat of cyber-attacks. It is our best practice to utilize the Weatherly Portal for the secure exchange of information and are always happy to serve as a resource of how to protect yourself and loved ones against the ongoing threat of cybercrime. Check out our 7 Steps to Better Cyber Security for some quick tips!

At Weatherly we pride ourselves on providing high quality, holistic, and innovative wealth management service. It is our duty to use and embrace technology in a responsible and ethical manner to enhance what we do, not as a replacement to our expertise and experience.

We strive to pair human knowledge and common sense with modern technology to maximize efficiency and deliver information in an easy to digest way.

Resources –

https://ourworldindata.org/brief-history-of-ai

https://builtin.com/artificial-intelligence

https://www.pwc.com.au/digitalpulse/report-pwc-global-ceo-survey-ai-skills.html

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

During times of slowing growth and economic uncertainty the thought of one’s own employment can come into question. Whether you have another job lined up, are transitioning to retirement or planning to take a break between careers, there are several emotional and financial items to carefully consider. For some it’s an opportunity and others an obstacle to overcome. In either event, being prepared and having a plan of action will set you on a road to success. Once the decision is made, the next step is to take inventory of your financial life, including benefits offered by your employer.

What is the financial impact of this change?

If you have already sought out employment, is the move lateral or are you receiving a bump in salary and other benefits? If you are retiring or considering gap years before re-entering the workforce, do you have the assets and income to support your living expenses?

The answers to these questions will impact your financial plan, which is a dynamic way to review multiple outcomes in your savings/spending equation.

It’s also prudent to review your personal balance sheet and review opportunities to improve your debt-to-equity ratio. For example, if you were considering a financing home or car purchase, refinancing or obtaining a home equity line of credit (HELOC), you may want to take steps to secure a loan prior to making a change.

If you were laid off from your employer, you may also be able to collect unemployment benefits.

Take an inventory of the benefits provided by your current employer.

Benefits include more than salary, retirement plans and health care coverage. Many companies also offer compensation in the form of stock options, bonuses, pension plans and deferred compensation. It critical to review the following:

☐ Salary and bonus structure – are you able to receive severance pay or a partial bonus if the transition occurs mid-year?

-

-

- Many employers also compensate for unused vacation and PTO days.

-

☐ Retirement plans – did you max out your retirement plan contribution for the year? The current year contribution limits can be found on our website here.

-

-

- If you have an employer match, are the matches fully vested?

-

☐ Stock options – vesting schedules also apply to stock options. There are numerous types of options and some of the more common types can be found here. Complexity and planning opportunities can vary per individual so it’s an opportunity to work with your advisor to help navigate.

☐ Other executive compensation packages – incentive packages can also include things like pensions and deferred compensation. Depending on if you are retiring or leaving a job involuntarily, these benefits may be accelerated (paid out early) or eliminated. If benefits are paid out immediately upon retirement or resignation, this may create a tax liability for the departing employee.

☐ Health care – if you are covered by your employers’ heath care plan and not moving immediately to a new company, you may be able to continue benefits under COBRA.

☐ Parental and family leave – if you are considering growing your family or may need time off to care for dependents, it’s important to know what options your company supports for paid leave.

There are also intangible considerations when moving to a new company.

Tangible benefits, like those listed above, provide financial security. Intangible benefits offer personal fulfillment. It’s important to weigh the pros and cons of both benefit types when considering a change.

Examples of intangible benefits include:

- Company culture – do the company’s values align with your own values and ethics?

- Aside from strong values, many companies have well-being programs that are supportive of healthy living.

- Opportunities for education and collaboration – many employers reimburse for higher education expenses and offer growth trajectories to advance careers.

- Flexible work hours and/or hybrid work set up – after the abrupt shift to remote work at the start of 2020, many workplaces retained a hybrid work set up or offered flexible work hours so employees can maintain control their schedules.

- If you are required to work on site, and the company is located somewhere other than where you currently reside, what is the difference in cost of living?

- Work/life balance – do the new company’s expectations and work place policies allow for a work/life balance?

Be prepared for your current employer to counter your new opportunity if you are continuing in the workforce. Employers want to retain good talent, and they may be able to increase salaries or offer more benefits in order to do so.

What to account for when transitioning from your prior employer

Whether you’re transitioning to another employment opportunity or heading into the golden years there are various items to be aware of from a professional and personal standpoint that should be reviewed, including:

☐ Open communication with your employer and manager.

-

-

- Set time with HR

- Employers will often need to backfill your position which takes time and resources to train or hire your replacement and providing sufficient notice allows them to plan accordingly.

- This will also help ensure that you leave on good terms with the company and avoid burning bridges on your way out.

-

☐ Archiving any personal or permissible resources.

-

-

- Whether by design or accident people often commingle their personal life and work devices so it is important to review that you have transferred or saved these items elsewhere.

- Additionally, there may be useful company resources that may be allowed for you to take with you. Be sure to run these by HR to avoid any legal issues.

-

☐ Employer sponsored plans and benefits to review with HR.

-

-

- If you have a retirement plan or other benefits with the employer such as a 401(k), profit sharing or stock options for example it is important to review what options are available to you.

- In general, you can either keep retirement accounts within the company plan, roll it into an IRA, or transfer it to your new employer.

-

☐ Stock options: Reviewing whether they are transferable or if they would need to be exercised prior to leaving. It’s likely unvested shares will be forfeited and should be accounted for in the pros and cons list we spoke to earlier.

☐ Health Care: Life happens and it’s critical to ensure there is no gap in your health care coverage.

-

-

- If you are leaving the workforce or have a gap in employment, be sure to review your coverage options. Common options available are COBRA, purchasing a plan through a private marketplace, or enrolling in Medicare if 65 or older.

- Premiums will vary between these options so it’s important to review based on your situation and level of coverage.

- If you have life insurance through your employer, it may be portable and allow you to continue coverage and take over premium payments. Check with HR if this option is available to you.

- If you are leaving the workforce or have a gap in employment, be sure to review your coverage options. Common options available are COBRA, purchasing a plan through a private marketplace, or enrolling in Medicare if 65 or older.

-

☐ Review your final paycheck to verify that any accrued PTO or sick days have accounted for and that any pro-rated compensation is accurate.

Considerations if you are Starting your own Business

As small business owners ourselves, Weatherly works closely with entrepreneurs and business owners on their own planning.

For solo practitioners, self-employed 401ks can be an attractive way to continue to build on retirement assets. Many expenses may also be deductible on your tax return, including home office square footage, utilities, and some health insurance premiums.

Sailing off into the Sunset

You’ve worked hard throughout your career and with retirement on the horizon there is much to look forward to. Many of the items we’ve touched on in this blog apply to retirees from running a Financial Plan, taking inventory of your assets, cash flow planning, and securing health care coverage post-employment.

Social Security plays a critical role in the transition to part-time work or retirement. Be sure to review your retirement benefits and cash flows for planning opportunities such as claiming benefits at your Full Retirement Age or potentially delaying. You can review your eligibility and benefits at different ages here.

Whether you’re retiring partially through the year or the end we often recommend individuals max out their employer sponsored retirement plans reducing taxable earnings and continue to build savings. You may need to change your contribution rate in order to max out the plan if you’re not working the full year. We also recommend checking in with your tax professional to confirm if any withholding adjustments are needed.

An equally important aspect of transitioning to retirement and often overlooked is aligning the portfolio’s asset allocation based on the time horizon and risk tolerance. Many individuals will rely on the portfolio to fund their goals and expenses over their lifetime so it’s essential to ensure the asset allocation is appropriate for the needs of the investor.

How Weatherly can help

As we’ve outlined in this blog there is much to consider when transitioning either to a new employer or into retirement. While these are some of the more common topics to review, the dynamics of each individual’s professional and personal life will differ in some way. Weatherly is here to help bridge the gap and work with you to identify the impact of your options over the short and long-term.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

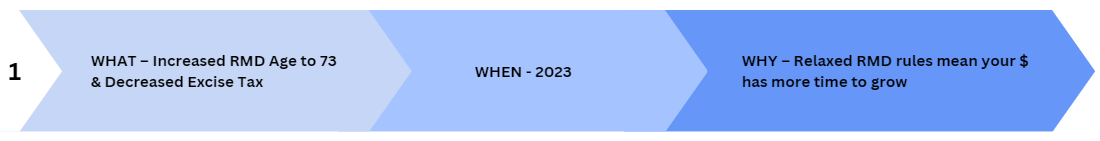

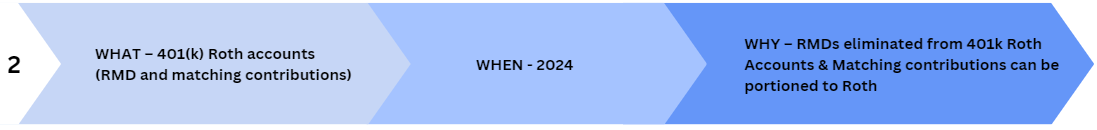

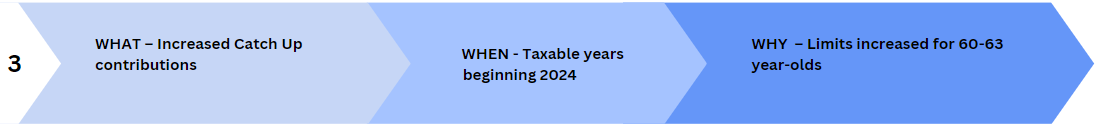

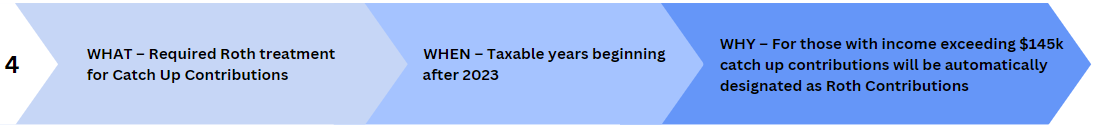

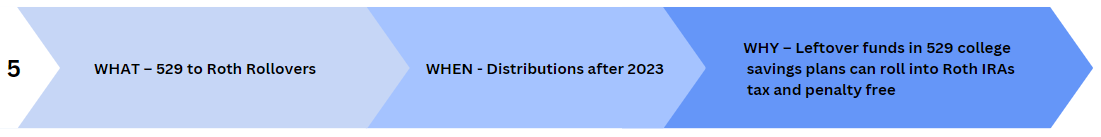

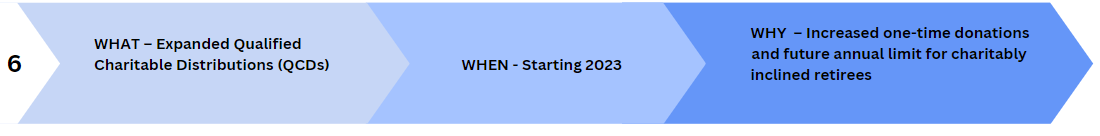

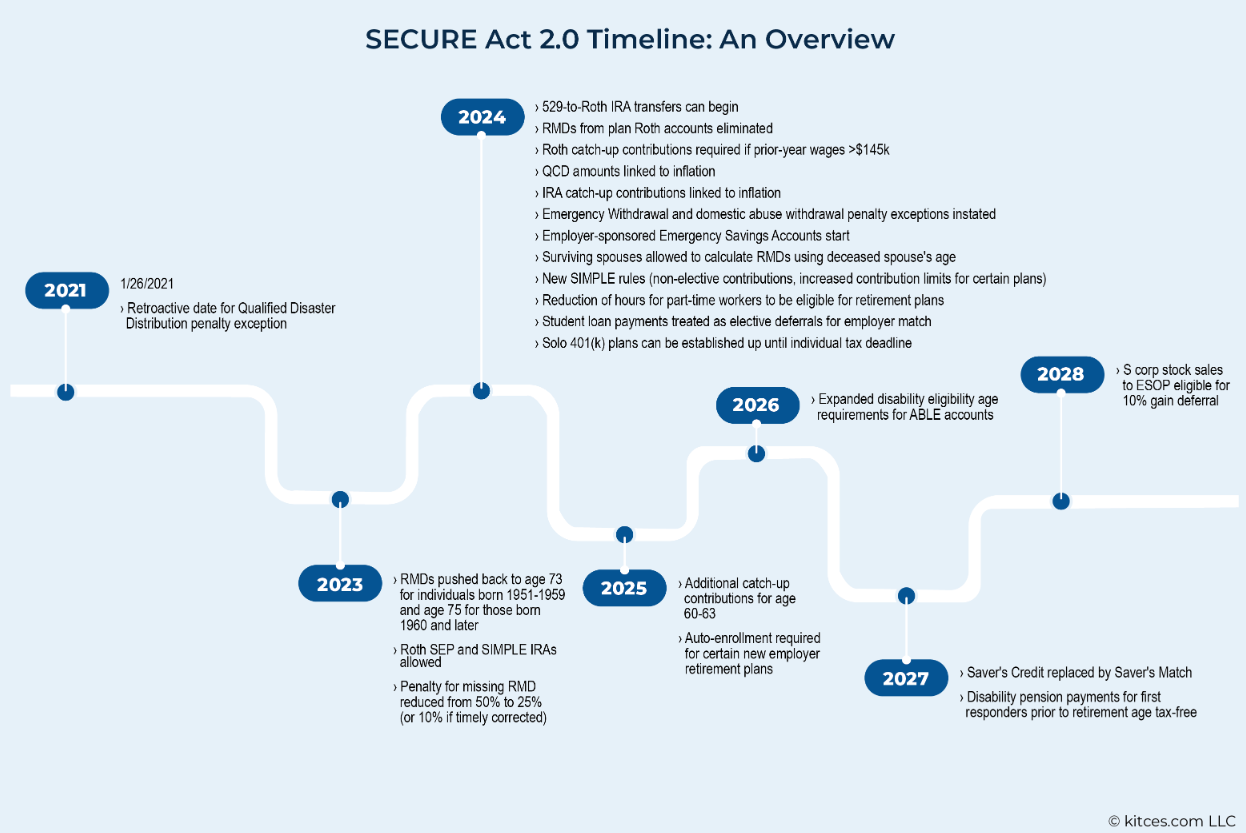

The Secure Act 2.0 is the newest version of the Setting Every Community Up for Retirement Enhancement (SECURE) Act, which was originally signed into law in December 2019 and recently updated in December 2022. It is important to note- the Secure Act is designed to help Americans save for retirement and will create more flexibility for retirement savers. These 92 provisions will make it easier to access retirement savings and increase the amount one can save for retirement. Additionally, the Secure Act 2.0 provides incentives for employers to offer retirement plans by expanding employer benefits and tax credits. In this blog, we will review the six key features of The Secure Act 2.0, its effect on clients, and how Weatherly can help navigate the planning opportunities that are created.

The Secure Act 2.0 is an important piece of legislation that has been passed to help