Carolyn Taylor was nominated for Shook Research’s 2021 Top Women Wealth Advisors list. She was invited to complete an online survey detailing information about her career, as well as Weatherly as a firm. Carolyn was named 396th out of 1,000 advisors in total. The list was published on March 24th, 2021 on Forbes.com at https://www.forbes.com/sites/rjshook/2021/03/24/the-2021-forbes-ranking-of-americas-top-women-wealth-advisors-methodology/?sh=431dfbc42fe0.

The 2021 Top Women Wealth Advisors ranking is based on firms’ AUM as of 9/30/20 and reflects Weatherly’s discretionary AUM of $927 Million.

The Forbes ranking of America’s Top Women Wealth Advisors, developed by SHOOK Research, is based on an algorithm of: qualitative data, such as telephone and in-person interviews, a review of best practices, service and

investing models, and compliance records; as well as quantitative data, like revenue trends and assets under management. All advisors have a minimum of seven years’ experience. Portfolio performance is not a criteria due

to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. In total, 32,810 nominations were received and 16,165 advisors were invited to complete the online survey. Throughout the research process, 13,235 telephone interviews, 2,595 in-person interviews, and 692 web-based interviews were conducted. The ranking listed 1,000 advisors, and Carolyn was ranked 396th.

Basic Requirements to be considered for the “Forbes Top Women Wealth Advisors” included: 1) 7 years as an advisor; 2) minimum 1 year at current firm 3) advisor must be recommended, and nominated, by Firm, 4) completion of online survey; 5) over 50% of revenue/production must be with individuals; and 6) an acceptable compliance record. In addition to the above basic requirements, advisors were also judged on the following quantitative figures: 1) revenue/production; weightings assigned for each; 2) assets under management—and quality of those assets—both custodied and a scrutinized look at assets held away (although individual numbers are used for ranking purposes, the ranking publishes the entire team’s assets); 3) client-related data (i.e.retention.) NOTE: Portfolio performance was not considered – audited returns among advisors are rare, and differing client objectives provide varying returns. Qualitative considerations examined included but were not limited to: 1) telephone and in-person meetings with advisors; 2) compliance records and U4s; 3) advisors that provide a full client experience (factors examined include service model, investing processes, fee structure (higher % of fee-based assets earns more points,) and breadth of services, including extensive use of Firm’s platform and resources; 4) credentials (years of service can serve as proxy); 5) use of team & team dynamics; 6) community involvement; 7) discussions with management, peers, competing peers, and 8)telephone and in-person meetings. Compliance records and U4s were also reviewed in detail as part of the selection process including: 1) infractions denied or closed with no action; 2) complaints that arose from a product, service or advice initiated by a previous advisor or another member or former member of team; 3) length of time since complaint; 4)complaints related to product failure not related to investment advice; 5) complaints that have been settled to appease a client who remained with the advisor for at least one year following settlement date; 6) complaints that were proven to be meritless; and 7) actions taken as a result of administrative error or failure by firm.

Weatherly Asset Management did not pay any fees to SHOOK to be nominated or included in the “Forbes Top Women Wealth Advisors” list and Weatherly was not required to advertise in, or subscribe to, Forbes. As of the time of this disclosure, Weatherly did not elect to pay for reprints of the list.

Inclusion in this ranking is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising the award.

SHOOK Disclosures

SHOOK is completely independent and objective and does not receive compensation from the advisors, Firms, the media, or any other source in exchange for placement on a ranking. SHOOK is funded through conferences, publications and research partners. Since every investor has unique needs, investors must carefully choose the right Advisor for their own situation and perform their own due diligence. SHOOK’s research and rankings provide opinions for how to choose the right Financial Advisor.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit: http://www.adviserinfo.sec.gov/IAPD/IAPDFirmSummary.aspx?ORG_PK=106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507 Carolyn@weatherlyassetmgt.com

We all know the phrase “don’t put all your eggs in one basket” and there is one concept in the world of investing that universally applies to all individuals… diversification. Often, the very asset that has helped generate wealth over times poses the biggest risk to your financial future. We will be exploring highly concentrated positions and what this means to you as an investor.

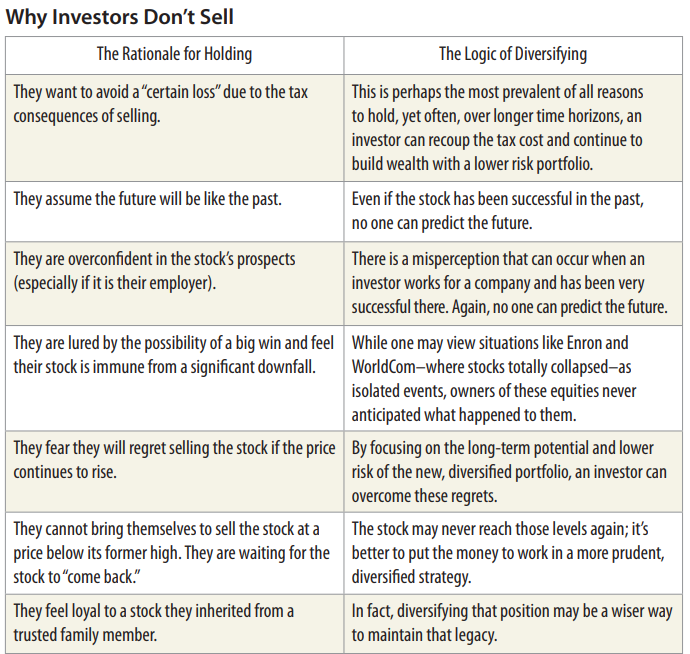

Concentration occurs when an investor owns shares of a stock or other security type that represents a large portion of their overall portfolio or net worth. A position is typically considered to be concentrated when it represents 10% or more of the portfolio. Investors may understand the risk these positions represent but may choose not to take action for a variety for reasons including:

- Tax Ramifications – Often times, it’s as simple as not wanting to pay the capital gains tax associated with selling a portion of a highly appreciated security if held in taxable account. Alternatively, stock options awarded from employers can lead to significant tax liabilities due to supplemental income when exercised, highlighting the need for proper exercise strategies.

- Emotional Bias – Others may experience an emotional or behavioral connection to the company. This could stem from shares received from an employer and a sense of betrayal by selling these shares. Another emotional connection could arise from individuals who inherited concentrated positions from a loved one who felt strongly on the prospects of the company.

- Behavioral Bias – Lastly, investors may fall victim to a behavioral bias of a stock that has outperformed over time and believe past performance will continue into the future.

Chart Sourced From: https://content.rwbaird.com/RWB/Content/PDF/Insights/Whitepapers/Hidden-Cost-Holding-Concentrated-Position.pdf

Portfolios with large concentration in individual holdings can introduce risk that could otherwise be mitigated through proper diversification. Without proper planning, an investor’s overall portfolio performance can be driven by the heavily weighted security. There are copious factors that could put downward pressure on stock prices, such as a deterioration of company fundamentals, shift in public outlook or perception of the company/industry, regulation or change in key leadership to name a few. While not as common, black swan events can occur such as the well-known Enron scandal that evaporated wealth from shareholders and employees seemingly overnight. Additionally, changes in a company’s corporate structure may lead to unintended ramifications for shareholders. For example, Medtronic’s decision to change the location of their headquarters forced employees and shareholders to fully realize (pay tax on) their deferred capital gains without actually transacting the security. You can read more about it here.

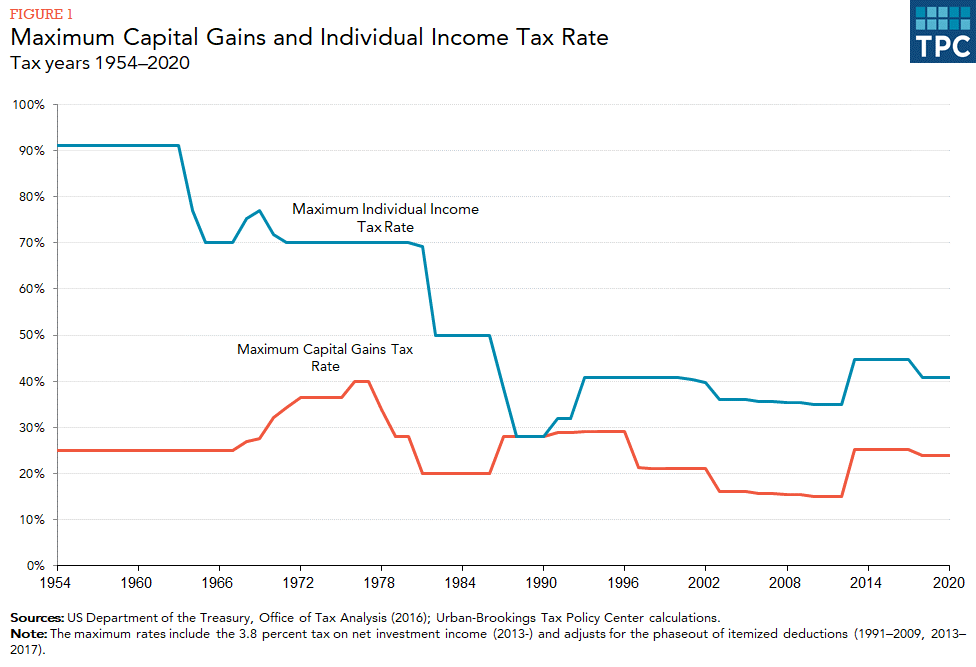

With a better understanding of some factors that lead to security concentration and associated risks, let’s circle back to the tax conversation. As of this posting, the Biden administration has proposed legislation to nearly double the top capital gain rate from the current 20% to 39.6%, excluding the additional 3.8% Medicare surtax. While this would only apply to those individuals with incomes of more than $1 million, current capital gains rates are historically low with most investors falling in the 0%-15% bracket. For context, top capital gain rates were roughly 40% in the late 1970s and have only decreased over the years. Whether the new legislation will be passed by Congress in its current form or if amendments to the rate and/or income limits is still unknown at this time. As a result of COVID-19, roughly $5.3 trillion of fiscal stimulus has been paid out to support the economy with trillions more on the table under the proposed American Families Plan and American Jobs Plan. This level of spending will need to be supported and as such we anticipate taxes to increase into the future. As the saying goes, “there’s no time like the present”, and certainly applies when looking to de-risk the portfolio and chip away at concentrated positions.

Graph Sourced From: https://www.taxpolicycenter.org/briefing-book/how-are-capital-gains-taxed

Aside from the capital gains we spoke to, another key aspect of tax legislation proposed by the Biden administration is the potential to limit the “step-up” in cost basis to the first $1 million of a deceased person’s assets and $2 million for married couples. This could lead to significant tax implications for the heirs looking to diversify concentrated positions as the original cost basis of the deceased will carry over to their beneficiaries.

How WAM Can Help

Through continuous collaboration with our clients, we help identify areas of concentration across your managed accounts in conjunction with your entire investment portfolio, including assets held away, as appropriate. With tax mitigation at the forefront, we can help create a plan of action to strategize the timing of de-risking the portfolio in low tax years or reducing concentration within tax deferred accounts, allowing the funds to be re-deployed into our new thematic ideas. We will continue to work alongside your trusted professionals to explore additional strategies such as tax loss harvesting and potential gifting scenarios for each client’s unique situation.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Benjamin Franklin once said, “In this world, nothing is certain except death and taxes.”

Given the recent shift in presidential power, there has been a renewed focus around potential tax and estate law changes under the Biden Administration. Specific to estates, there is a proposal for the estate exclusion amount to drop from the current record high of $11.7M/person to as low as $5M or $3.5M/person and the amount over these thresholds to be taxed at 45% versus the current 40% rate. In preparation for these potential changes on the horizon, the best first step is to complete a financial evaluation with Weatherly to approximate future net worth and gifting capabilities within a record-low interest rate environment. If you have a good nest egg to support your needs, there are a few estate planning tactics to consider. In this blog post we outline “The What” and “The How” of some gifting and estate planning strategies to proactively discuss with your team of professionals.

1) Annual Gifting, 529s and Forward Gifting

The What – Annual gifting to the next generation or other family members may be a tax savvy way to pass assets to the next generation while also lowering your overall estate value. For 2021 tax year, the gift tax annual exclusion amount is $15,000 per person. The IRS will not require a gift tax return to be filed and the gift will not count against the estate exclusion amount, which is currently set at $11.7M/person. Please reference our 2021 Key Financial Data Chart for further details.

The How – A parent or grandparent who is above the estate exclusion amount and wants to help the next generation save for education, may want to consider a forward gift via a 529 account. As it currently stands, in a given year the IRS will allow an individual to make a forward lump-sum gift equal to five times the annual gift exclusion, or $75,000/person ($150,000/married couple), to a 529 account. If no other gifts are made to the 529 account beneficiary over the next 5 years and you make the 5-year election, it will not count against your estate exclusion amount. Once the funds are in the 529 account, they can be invested, grow tax free and are not taxable at withdrawal if they are used for eligible education expenses.

Please reference the following link for additional information and examples on forward gifting to 529 accounts: https://www.ameriprise.com/financial-goals-priorities/family-estate/estate-planning-and-529-plans

2) Intra Family Loans

The What – Intra-Family loans are agreements between family members to access capital with benefits that may not be available in an institutional relationship. If structured properly, the loan can be advantageous to both parties – the lender can transfer wealth without making an outright gift and the borrower can make smaller interest payments, skip tedious applications, and obtain flexible repayment structures. Loan interest rates must be set at or above the AFR (applicable federal rate) via the IRS website, which is updated monthly.

The How – A parent or grandparent can enter an agreement with a future beneficiary of assets when they are buying a home or starting a business. A written contract is outlined between the parties, with potentially attractive terms for the beneficiary, for example: interest-only payments, lower than market interest rates, or loan forgiveness up to the annual gift exclusion. The lender transfers these dollars out of their estate without tampering with their estate exclusion. Please check with your Advisor to ensure that the signed promissory note meets the IRS requirements for an intra-family loan.

Please reference the following link for additional information and examples on intra-family loans that may help your loved ones: https://www.fidelity.com/viewpoints/wealth-management/insights/intra-family-loans

3) Family Limited Partnerships

The What – A family limited partnership (FLP) is an entity created by family members to run a commercial project, start a venture, or hold assets. A general partner (GP) owns the largest share of the business and is therefore controls the management of the FLP, similar to a trustee. There are also limited partners with some relation to the GP that own shares and have no management responsibilities. FLP interests can be gifted or sold to members of the family via share ownership so that any growth or revenue from the FLP is no longer included in the original depositor’s estate.

The How – A couple that has amassed a significant net worth can create an FLP and name themselves as general partners with their revocable (living) trust as the sole limited partner. Real estate or securities can be held in the FLP with limited partner shares gifted to beneficiaries on an annual basis at a value near the annual gift exclusion amount. Minority or marketability discounts may apply to limit share valuations. The couple maintains control as general partners, but limited partners will receive the benefit of future income and asset growth typically at a lower tax rate as the investments appreciate and return capital. The FLP can also set stipulations to protect against mismanagement.

Please reference the link below for additional information and insight to how and why a Family Limited Partnership may fit your family’s needs: https://www.thebalance.com/family-limited-partnerships-101-357872

4) Outright Gifts to Trusts

The What – A revocable (living) trust is a useful tool for those wishing to avoid probate, provide credit protection for heirs, outline distribution wishes, and maintain the ability to amend their trust. The owner of the revocable trust pays the taxes on assets held within the trust.

The How – While many clients have an active revocable trust, their next generation beneficiaries may not. Beneficiary heirs can establish their own revocable trusts and serve as grantor and trustee, and the trust can be for their benefit. The parents or grandparents can help cover estate attorney expenditures to establish the next gen trust and then fund the new trust with large gifts, most often times over the current annual gift exclusion. The benefits are to both parties. The recipient of the gift is involved in his or her own critical estate planning. The parents or grandparents remove the future appreciation of the asset from their estate and the amount gifted over the annual gift exclusion goes against their estate exclusion.

5) Irrevocable Trusts

The What- An irrevocable trust is a vehicle that can be used to remove assets from the grantor’s taxable estate. The grantor creates the trust and designates another individual or corporation as independent trustee. Once the trust is created, it typically cannot be revoked, amended, or terminated. These vehicles are usually appropriate when the grantor can relinquish control of the assets, does not need the assets during his or her lifetime and does not plan to change the beneficiary designation(s) of the trust.

The How- A high net worth couple with assets over the estate exclusion often have life insurance policies that may not be needed during their lifetimes, but rather needed by their beneficiaries for taxes, estate fees or inheritance at their passing. If structured properly, an Irrevocable Life Insurance Trust (ILIT) enables individuals to exclude a life insurance death benefit from their taxable estate at their passing. Essentially, the insured individual or grantor of the ILIT, transfers the life insurance policy ownership from the grantor to the ILIT. The beneficiary – whether it be a spouse or child – is the individual(s) listed in the ILIT document. The grantor can still pay the policy premiums via annual gift directly to the ILIT and a Crummey Letter stating a gift had been made would be provided to the beneficiary. Assuming the grantor makes no other gifts to the ILIT beneficiary for the year and the premium payment, or gift, is below the annual gift exclusion amount, it would not count against the grantor’s lifetime exclusion amount. If policy ownership is transferred from the grantor to the ILIT three years prior to the grantor’s passing or the ILIT purchases the policy from the grantor, the death benefit is typically excluded from the insured’s taxable estate. Had the policy not been transferred to an ILIT and the insured remained the owner of the policy, the entire death benefit would usually be included in the insured’s taxable estate.

Please reference the following link with additional information on revocable trusts and irrevocable (ILIT) trusts: https://www.wealthadvisorstrust.com/blog/definitive-guide-on-irrevocable-life-insurance-trusts

The When

While there are a number of strategies to plan for an estate, administering an estate also requires a detailed structure to ensure that legacies are fulfilled and needs are addressed. The role of a successor trustee can be complex and taxing, but Weatherly Advisors can serve as a quarterback for optimal collaboration with your team of professionals. Our updated Estate Settlement Checklist catalogues key steps during the nine months of estate administration.

How WAM Can Help

Record-low interest rates, historically high exemption amounts, and unpredictable future tax policy make it more important now than ever to align Estate Planning objectives with desired outcomes. Through collaboration with your trusted professionals and next generation beneficiaries, Weatherly Advisors leverage financial and investment planning techniques to create a Ripple Effect across your interconnected family and community. Please reach out to a Weatherly Advisor for any assistance we can offer your family.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

***Content Updated_Friday, April 23, 2021

Over the past year we’ve had many phrases added to our lexicon – social distancing, flatten the curve, Zoom fatigue, and many others.

For every “can you hear me?” or “you’re on mute” we’ve heard, we’ve also felt concern and hope for our collective communities.

In March of 2020, we were told to shelter-in-place and now twelve months in, we are optimistic about broader re-opening in the near future while the WAM team continues to operate in a hybrid model. The rapid rate at which governments, businesses and scientists worked together to develop and administer a global vaccination is unparalleled.

We wanted to share this blog to keep you up to date on Spring happenings at Weatherly.

Updates on Taxes:

2020: The recent 2020 tax year was unlike any other, with strategies like Roth Conversions and skipping Required Minimum Distributions applying to many of our clients. We’ve found this tax guide as well as this article helpful in highlights the changes that may apply to your unique situation.

The IRS extended the deadline to file for the 2020 tax year to May 17th; taxpayers do not have to take any action to take advantage of the extended deadline. The deadline to make a Q1 estimate remains April 15th.

Prior to filing, you may be eligible to contribute to IRAs (Traditional, Non-deductible, SEP and Roth) or make an employer contribution to a Self-Employed 401k. Our 2020 and 2021 Key Data Chart may be useful in determining the limits that apply to you.

Custodians have rolled out most tax forms at this juncture, and our team has been providing to clients and tax professionals securely. Please let us know if there is anything we can provide for your tax filing, and as always we appreciate a secure copy when completed.

2021: The Biden Administration has been busy working on the $1.9 Trillion stimulus plan, known as the American Rescue Plan passed last week, to aid in boosting the economy and supporting those most impacted by the pandemic.

The American Rescue Plan outlines short-term solutions to aid the economy, however President Biden is now focusing on long-term economic plans and modifying the tax code to help close the funding gap. Bloomberg highlighted the first major tax hike since 1993 in this article, with a focus on raising the corporate tax rate, raising the income tax rate on those earning more than $400,000 and expanding the estate tax reach.

Our team of advisors are available to discuss planning opportunities and how the potential tax bill may impact you and your family.

Updates on Our Team:

The Weatherly team continued to learn and grow over the last year, despite the challenges that were presented working and living in a remote environment.

Aubrey Brown, one of our Wealth Management Associate Advisors, completed his Master of Science Degree in Personal Financial Planning through the College for Financial Planning (CFFP) in 2020. Aubrey continues to develop his expertise in planning for clients.

Yoshi Brownlee, our Team Administrator and Marketing Specialist, obtained a Professional Certificate in Marketing offered through SDSU’s College of Extended Studies and One Club San Diego in September 2020. Yoshi continues to work with the Partners to develop the Firm’s marketing initiatives.

We also onboarded Andrea Taylor as a Wealth Management Associate in February. Andrea’s 4 years with Ernst & Young in audit and accounting coupled with a Masters of Science in Accountancy will augment our team of professionals.

Weatherly in the News:

We have many exciting updates on our the Weatherly Newsroom.

In the March 13th edition of Barron’s, Carolyn was named as a Top 1200 Advisor. She was also listed as one of Forbes 2021 Best-in-State Wealth Advisors.

Carolyn, Brent Armstrong, Kelli Ruby and Ryan Richardson were also named 2021 Five Star Wealth Managers.

Our team is proud of what we have accomplished over the past 26+ years and being able to serve our clients during a global pandemic. Weatherly also surpassed $1 Billion in assets under management at the end of 2020.

ADV and Privacy Policy:

On an annual basis Weatherly Asset Management (WAM), as an SEC Registered Advisor, is required to deliver the following documents to all of our clients either electronically or by US mail; please see attached:

Part 2A of Form ADV (the Firm Brochure)

Part 2B of Form ADV (the Brochure Supplement)

If you have opted for hard copy delivery of compliance communications, you will be receiving these in the mail in the coming weeks. These documents have also been posted to all client portals for future reference.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Carolyn Taylor was included in Barron’s 2021 Top 1200 Advisor Rankings by State list. The full list can be viewed on Barron’s website. View the list here.

The criteria for ranking reflects assets under management as of 09/30/2020, revenue that the advisors generate for their Firms, regulatory record, quality of the advisor’s practices, and philanthropic work. Investment performance is not an explicit criterion because the advisors’ clients pursue a wide range of goals. In many instances, the primary goal is asset preservation. The scoring system assigns a top score of 100 and rates the rest by comparing them with the top-ranked advisor.

Carolyn Taylor was nominated for inclusion in the list. Survey data was submitted by over 4000 advisors, but only 1200 were published in the ranking. Barron’s uses a proprietary method to rank advisors based on the criteria above. Weatherly provides this data to Barron’s in the form of a survey response. Initial ranking is done by Barron’s; publicly available data is verified by Barron’s against SEC and FINRA reports. Barron’s then conducts the next level of ranking. Data that is not independently verified by Barron’s is then sent back to the Firm for verification. Barron’s then incorporates any required changes into the ranking, and finalizes the list for editorial use and publishing. The Top 1,200 are drawn from all 50 states, plus the District of Columbia. This ranking is the largest and most comprehensive of the annual Barron’s advisor listings. It includes a cross section of private-wealth advisors, from independents who own and operate their own practices to advisors from the large Wall Street firms. This special report lists the top advisors in each state, with the number of ranking spots determined by each state’s population and wealth. Carolyn Taylor ranked 87th in the state of California.

No payment was required for nomination or inclusion in the ranking. After receiving notice of inclusion in the top 1200 list, Weatherly plans to pay Dow Jones Reprints and Licensing for custom hard copy reprints and digital access. Wealth Managers do not pay a fee to be considered or placed on the final list.

No organizational memberships were required of the Firm or individuals. Ranking on this list is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit: http://www.adviserinfo.sec.gov/IAPD/IAPDFirmSummary.aspx?ORG_PK=106935 or https://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Carolyn@weatherlyassetmgt.com

In September 2020, Five Star Professional completed an interview process to determine 2021 Five Star Wealth Managers. Several of Weatherly’s team, including Carolyn Taylor, Brent Armstrong, Kelli Ruby, and Ryan Richardson all received this inclusion to participate. Upon completion, all four advisors were named 2021 Five Star Wealth Managers. View Weatherly’s profile here.

The Five Star Wealth Manager award, administered by Crescendo Business Services, LLC (dba Five Star Professional), is based on 10 objective criteria. Eligibility criteria – required: 1. Credentialed as a registered investment adviser or a registered investment adviser representative; 2. Actively licensed as a registered investment adviser or as a principal of a registered investment adviser firm for a minimum of 5 years; 3. Favorable regulatory and complaint history review (As defined by Five Star Professional, the wealth manager has not; A. Been subject to a regulatory action that resulted in a license being suspended or revoked, or payment of a fine; B. Had more than a total of three settled or pending complaints filed against them and/or a total of five settled, pending, dismissed or denied complaints with any regulatory authority or Five Star Professional’s consumer complaint process. Unfavorable feedback may have been discovered through a check of complaints registered with a regulatory authority or complaints registered through Five Star Professional’s consumer complaint process; feedback may not be representative of any one client’s experience; C. Individually contributed to a financial settlement of a customer complaint; D. Filed for personal bankruptcy within the past 11 years; E. Been terminated from a financial services firm within the past 11 years; F. Been convicted of a felony); 4. Fulfilled their firm review based on internal standards; 5. Accepting new clients. Evaluation criteria – considered: 6. One-year client retention rate; 7. Five-year client retention rate; 8. Non-institutional discretionary and/or non-discretionary client assets administered; 9. Number of client households served; 10. Education and professional designations.

The Five Star Wealth Manager award program recognizes and promotes wealth managers. Five Star Wealth Manager candidates were identified by one of three sources; firm nomination, peer nomination or pre-qualification based on industry standing. Five Star Professional notified advisors of their candidacy for the award via an email solicitation. Weatherly provided data in the form of an online survey submission and each advisor participated in a phone interview to confirm personal information. Neither Weatherly nor its employees were required to be a member of an organization to be eligible to receive the award. No payment was required of Weatherly to be considered for the award or to be named a Five Star Wealth Manager. Once awarded, wealth managers may opt to purchase additional profile ad space or related award promotional products. Weatherly purchased additional profile ad space in the Wall Street Journal and digital and hard-copy reprints.

Wealth managers do not pay a fee to be considered or placed on the final list of Five Star Wealth Managers. Award does not evaluate quality of services provided to clients. Once awarded, wealth managers may purchase additional profile ad space or promotional products. The Five Star award is not indicative of the wealth manager’s future performance. Wealth managers may or may not use discretion in their practice and therefore may not manage their client’s assets. The inclusion of a wealth manager on the Five Star Wealth Manager list should not be construed as an endorsement of the wealth manager by Five Star Professional or this publication. Working with a Five Star Wealth Manager or any wealth manager is no guarantee as to future investment success, nor is there any guarantee that the selected wealth managers will be awarded this accomplishment by Five Star Professional in the future. For more information on the Five Star award and the research/selection methodology, go to fivestarprofessional.com. 2,218 San Diego-area wealth managers were considered for the award; 231 (10% of candidates) were named 2021 Five Star Wealth Managers. 2020: 2,018 considered, 219 winners; 2019: 1,885 considered, 224 winners; 2018: 1,498 considered, 228 winners; 2017: 1,349 considered, 349 winners; 2016: 1,337 considered, 349 winners; 2015: 1,639 considered, 350 winners; 2014: 1,838 considered, 368 winners; 2013: 1,675 considered, 417 winners; 2012: 1,014 considered, 284 winners.

Five Star Professional conducts a review of each award candidate as reported by FINRA and the SEC. For wealth managers with a CRD Number, Five Star Professional relies on the wealth manager’s FINRA BrokerCheck Report and/or the SEC Investment Adviser Public Disclosure website. For wealth managers without a CRD Number, Five Star Professional relies on Form ADV for the wealth manager’s firm. Additionally, Five Star Professional promotes, via local advertising and through their website, the opportunity to submit feedback — including whether a consumer had an unsatisfactory experience — regarding a wealth manager. Complaint data submitted in this way serves as an early alert system to unfiled consumer complaints and augments the regulatory review of reported complaints.

Receipt of this award is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the award or the appropriateness of advertising the award.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit: http://www.adviserinfo.sec.gov/IAPD/IAPDFirmSummary.aspx?ORG_PK=106935 or https://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Carolyn@weatherlyassetmgt.com

Carolyn Taylor was nominated for Shook Research’s 2021 Best-in-State Wealth Advisors list. She was invited to complete an online survey detailing information about her career, as well as Weatherly as a firm. Carolyn was named 41st out of the 79 named from Southern California. In total, the list showcased over 5,000 wealth managers. The list was published on February 11th, 2021 on Forbes.com. View the listing here.

The 2021 Best-In-State ranking is based on firms’ AUM as of 6/30/20 and reflects Weatherly’s AUM of $902,402,386.

The 2021 Forbes ranking of Best-In-State Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. The ranking algorithm is designed to fairly compare the business practices of a large group of advisors based on quantitative and qualitative elements. Data are weighted to ensure priorities are given to dynamics such as preferred “best practices”, business models, recent business activity, etc. Each variable is graded and represents a certain value for each measured component. These data are fed into an algorithm that measures thousands of advisors against each other. The algorithm weighted factors including revenue trends, assets under management, compliance records, industry experience and those advisors that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. In total, 32,725 nominations were received and 15,854 advisors were invited to complete the online survey. Throughout the research process, 13,114 telephone interviews, 2,085 in-person interviews, and 619 Web-based interviews were conducted. The ranking listed over 5,000 advisors, 79 of which were located in Southern California.

Basic Requirements to be considered for the “Forbes Best-in-State Wealth Advisors” included:1) 7 years as an advisor; 2) minimum 1 year at current firm 3)advisor must be recommended, and nominated, by Firm, 4) completion of online survey; 5) over 50% of revenue/production must be with individuals; and 6) an acceptable compliance record. In addition to the above basic requirements, advisors were also judged on the following quantitative figures: 1) revenue/production; weightings assigned for each; 2)assets under management—and quality of those assets—both custodied and a scrutinized look at assets held away (although individual numbers are used for ranking purposes, the ranking publishes the entire team’s assets); 3)client-related data (i.e.retention.) NOTE: Portfolio performance was not considered – audited returns among advisors are rare, and differing client objectives provide varying returns. Qualitative considerations examined included but were not limited to: 1) telephone and in-person meetings with advisors; 2) advisors exhibiting “best practices” within their practices and approach to working with clients and 3)advisors that provide a full client experience (factors examined include service model, investing processes, fee structure (higher % of fee-based assets earns more points,) and breadth of services, including extensive use of Firm’s platform and resources; 4)credentials (years of service can serve as proxy); 5) use of team & team dynamics; 6) community involvement; 7)discussions with management, peers, competing peers, and 8)telephone and in-person meetings. Compliance records and U4s were also reviewed in detail as part of the selection process including: 1) infractions denied or closed with no action; 2) complaints that arose from a product, service or advice initiated by a previous advisor or another member or former member of team; 3) length of time since complaint; 4)complaints related to product failure not related to investment advice; 5) complaints that have been settled to appease a client who remained with the advisor for at least one year following settlement date; 6)complaints that were proven to be meritless; and 6) actions taken as a result of administrative error or failure by firm.

Weatherly Asset Management did not pay any fees to SHOOK to be nominated or included in the “Forbes Best-In- State Wealth Advisors” list and Weatherly was not required to advertise in, or subscribe to, Forbes. As of the time of this disclosure, Weatherly did not elect to pay for reprints of the list.

Inclusion in this ranking is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising the award.

SHOOK Disclosures

SHOOK is completely independent and objective and does not receive compensation from the advisors, Firms, the media, or any other source in exchange for placement on a ranking. SHOOK is funded through conferences, publications and research partners. Since every investor has unique needs, investors must carefully choose the right Advisor for their own situation and perform their own due diligence. SHOOK’s research and rankings provide opinions for how to choose the right Financial Advisor.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit: http://www.adviserinfo.sec.gov/IAPD/IAPDFirmSummary.aspx?ORG_PK=106935 or https://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Carolyn@weatherlyassetmgt.com

Carolyn Taylor, Kelli Ruby, Lindsey Fiske-Thompson, and Brooke Boone Kelly were listed as finalists for the 2020 San Diego Business Journal Business Woman of the Year award. Each year, the San Diego Business Journal (“Journal”) recognizes dynamic women business leaders who have contributed significantly to San Diego’s workplaces and communities. For the 2020 program, Carolyn, Kelli, Lindsey, and Brooke were listed among 121 finalists! Not all nominees were finalists.

The San Diego Business Journal solicited nominations via email invitation to their mailing lists and via the paper journal circulation. Members of the Weatherly team nominated included Carolyn Taylor, Kelli Ruby, Lindsey Fiske-Thompson, and Brooke Boone Kelly.

Nominees and finalists were as to provide contact information for professional references, and were evaluated based on their business accomplishments and community involvement. Weatherly supplied the information for the nominations by completing the Journal’s questionnaire.

Weatherly was not required to make payments or purchases to nominate, be nominated, be considered or included on the list related to the award. No organizational memberships were required of the Firm or individuals. The advertisement of nomination for the award is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the award, nominations for the award, or the appropriateness of related advertising.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit: http://www.adviserinfo.sec.gov/IAPD/IAPDFirmSummary.aspx?ORG_PK=106935

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Carolyn@weatherlyassetmgt.com

Happy International Women’s Day from Weatherly! As a wealth management firm majority-owned by women, we witness the ripple effect of influential advances by women across the globe every day. We have the pleasure of working with women across all backgrounds, both as clients and as industry peers, and we continually see the positive change that women create when working together to uplift and support the community. In honor of the 2021 International Women’s Day we will be making donations to The San Diego Women’s Foundation and Catalyst Inc. To learn more about these incredible organizations and the work they do for women, please click on their linked names above!

Brooke Boone Kelly, CFP® also contributed as a co-author on this month’s blog.

The effects of the COVID-19 pandemic are far-reaching, as witnessed by major shifts in how we live, work, socialize and educate. The impact on the educational system in America is profound, as school districts juggle with how to both protect teachers and students from transmission of the virus, particularly as new strains are emerging, and how to protect the integrity of learning in a remote environment.

Getting kids back in school has been a priority of the Biden administration, with a goal of K-8 returning to in-person learning within 100 days if his Inauguration, right around mid-April. According to yesterday’s episode of The Daily Podcast (NY Times), about 1/3 of children are remote learning and 1/3 are hybrid, which may work for some students. However, remote learning tends to be subpar to in-person, and the disadvantaged suffer the most – particularly those effected by cost (hardware, software, wifi), learning disabilities or those that need help from adults who are also working remotely.

While challenging, COVID-19’s impact on education also brings a growing universe of technology, terminology, and metrics; balancing synchronous learning (real time, face to face, in person or video chat if available) vs. asynchronous (blogs, discussion boards, electronic text). While college-aged and postgraduate learners may have experienced asynchronous learning, most traditional experiences consist of a blend. Once a group of mainly in-person learners, now have a whole growing population of 5–12-year-olds evolving into sophisticated consumers of changing technology. The change in the traditional higher education business – which some argue was long overdue – highlights pricing pressures as universities move to a more digitally-driven model and students have more postsecondary educational options.

What this means for our clients:

Parents and grandparents alike want the best possible future for their families. The WAM team saw a boost in gifting in 2020, from family members that have been impacted by COVID-19 and to national and local charities. While there are shifts in the educational system underway, 529 college savings plans and custodial accounts can create a future benefit for young children.

As mentioned above, there has been over a decade of growth in “massively open online courses” (MOOCs), industry-driven certification programs, coding bootcamps, two-year associate degree programs, trade schools and vocational schools. While 529 plans are commonly used to cover costs associated with 4-year universities, there is a good chance many of the alternatives are also covered. As part of the TCJA of 2017, up to $10,000 can also be used annually on elementary, middle or high school tuition.

We’ve touched on the impact of “supercharging” or gifting 5 years upfront to 529 plans in a previous blog. Educational planning opportunities are just as important in a post-pandemic world and can provide an estate planning benefit if there is a change to the current estate tax exclusion amount.

What this means for our team:

We pride ourselves on a culture that values education, continued learning and problem solving. WAM has team members that regularly pursue master’s degrees, certifications, online training, and licensing to elevate their skill set and the client experience. During the last year, our team has shifted to remote learning when appropriate.

We continue to work with our clients in a hybrid remote capacity and strive to bring new investing and planning ideas to our dialogs. With the change in how we work with clients, we often utilize screen sharing capabilities, our secure portal and e-signature as we work together. We’ve taken the opportunity to not only educate ourselves, but often to walk through new tools and systems with our clients too.

What this means for the world:

Over the past two decades, access to 3 meals a day, internet service, and technology hardware have been growing challenges faced by a large percentage of the learning population. Public K-12 schools traditionally have had to combine fundraising, and donations with grant money to outfit the technology learning curriculum, and have comprehensive meal assistance programs. Private institutions may have historically had larger budgets and greater resources, but diverse income levels amongst the student body still posed challenges. The present concerns are mounting, and many nations are gauging the impact on future economies too.

According to a study published by the Organization for Economic Co-operation and Development (OECD), “existing research suggests that students in grades 1-12 affected by the closures might expect some 3% lower income over their entire lifetimes. For nations, the lower long-term growth related to such losses might yield an average of 1.5% lower annual GDP for the remainder of the century.” The effects of lost in-person learning aren’t only economic, the school closures expect to also disrupt emotional, social and motivational development especially in younger children. The impact will fall mainly to disadvantaged students and vulnerable populations. The K-shaped recovery in America will only deepen as the gaps in the educational system widen.

The pandemic has accelerated many trends already in place and disrupted many industries. How people are able to choose to pursue education in the future for work related training, higher and lower education and all age groups, young and old, will influence how we emerge.

How WAM can help:

Our advisors are here to discuss opportunities in the educational space including college funding and estate planning, how we can learn together remotely, or charitable giving. Please contact the team to discuss your unique situation and how we might be of assistance.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.