Carolyn Taylor was included in Barron’s 2023 Top 100 Women Financial Advisors list. The full list can be viewed on Barron’s website. View the list here: https://www.barrons.com/advisor/report/top-financial-advisors/women/?mod=article_inline.

The criteria for ranking reflects assets under management as of 03/31/2023, revenue that the advisors generate for their Firms, regulatory record, quality of the advisor’s practices, and philanthropic work. Investment performance is not an explicit criterion because the advisors’ clients pursue a wide range of goals. In many instances, the primary goal is asset preservation. The scoring system assigns a top score of 100 and rates the rest by comparing them with the top-ranked advisor. Carolyn was ranked 61st.

Carolyn Taylor was invited to participate in the nomination process via email solicitation from Barron’s and nominated by colleagues for inclusion in the list. Barron’s uses a proprietary method to rank advisors based on the criteria above. Weatherly provides this data to Barron’s in the form of a survey response. Initial ranking is done by Barron’s; publicly available data is verified by Barron’s against SEC and FINRA reports. Barron’s then conducts the next level of ranking. Data that is not independently verified by Barron’s is then sent back to the Firm for verification. Barron’s then incorporates any required changes into the ranking and finalizes the list for editorial use and publishing.

No payment was required for nomination or inclusion in the ranking. No organizational memberships were required of the Firm or individuals. Ranking on this list is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Making decisions about your financial life can be daunting and difficult no matter the stage, but the choices you make now can have a major positive impact over time. Whether you are just thinking about getting started with professional financial advice, actively interviewing candidates or even heading into a quarterly review with your current advisor, discussing the right topics can offer you great peace of mind.

At Weatherly, we encourage open dialogues and value honest communication at every stage of our relationships with our current and prospective clients, their families, and their trusted professionals. We sat down and created a comprehensive list of questions that not only covered the basics, but also looked beyond at the relationships we build and the extent of the work we accomplish together. These questions are not only useful in the “due diligence” phase of interviewing, but impactful to review at least annually with your Weatherly advisor.

- Are you a Fiduciary and what does that mean?

A Fiduciary is a term in the financial services industry that refers to a financial advisor that serves under fiduciary duty, meaning that the advisors have pledged to make recommendations or collaborate with you on solutions with your best interest in mind, not for their own personal gain or financial benefit. You can learn more about our commitment to our fiduciary duty and view our regulatory filings on our ADV, Compliance and Disclosures page.

- Who is your custodian?

Weatherly primarily uses Fidelity Investments, but also works with Charles Schwab, and National Advisors Trust Company as custodians for client accounts. This separation of RIA (Registered Investment Advisor) and custodian is in place to protect the investor from loss or misuse of funds due to the Investment Advisers Act of 1940 as well as subsequent updates in 2009 by the Securities and Exchange Commission in the aftermath of Bernie Madoff’s Ponzi Scheme. A benefit of this distinction for clients is “side by side” reporting. As a client, you receive reporting directly from Weatherly focusing on investment performance and separate reports from your custodian, allowing you to cross-reference for additional transparency on account activity.

The importance of choosing the right custodian to work with is paramount to both your experience as a client and the safety of your assets. High quality custodians will be protected through SIPC insurance and even go above and beyond for investors by providing additional coverage, like the expanded comfort that Fidelity offers through Excess of SIPC insurance. In addition to annual reviews, Weatherly performs ongoing due diligence on third parties, including custodians, their insurance, and areas of potential risk. Weatherly prides itself on extensive vetting of our custodians to ensure the highest level of service for our clients.

- How do you make money?

Our comprehensive list of services is extensive, but Weatherly’s two core competencies are investment management and financial planning. Using these two pillars as a foundation, our team works with you and your trusted team of professionals on all aspects of your financial life from customized portfolio management to business, estate, retirement, and tax planning. For this holistic service approach, Weatherly charges a fee based on Assets Under Management (AUM,) 1% for equities and .5% for fixed income. We do not charge hourly fees for planning or other advice; our services are covered by your quarterly fee. For more information on our services and fees, you can review our Firm’s Form CRS.

- Who is your ideal client, do I fit in?

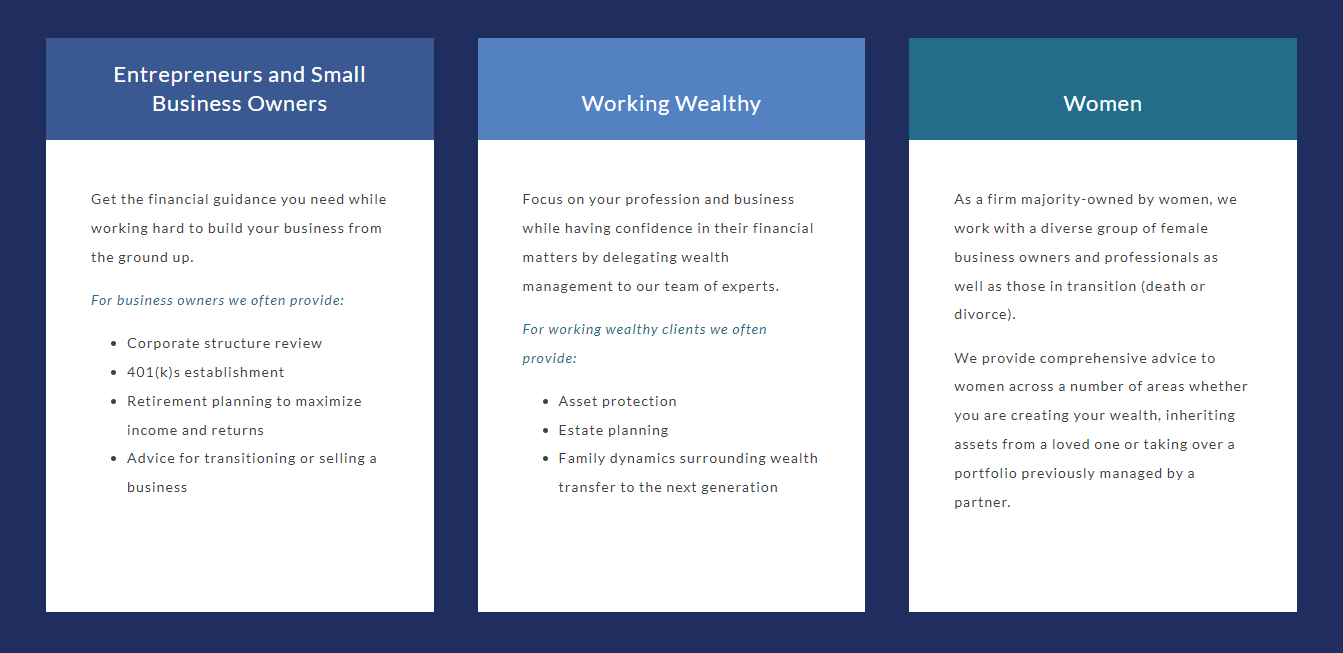

While we do not limit ourselves to these categories, organically over time our client base grew into three main groups with whom we feel we do our best work. Our three niches are Entrepreneurs and Small Business Owners, the Working Wealthy and Women. Each of these groups presents unique planning opportunities and their own unique complexities.

For an in-depth case study on the first of these groups, check out the first installment of our Weatherly Client Series.

- How often will I hear from you if I become a client?

Weatherly aims to have full reviews with clients quarterly, though we do not limit conversations to this cadence. Our team-based approach ensures that you always have access to a professional familiar with your financial picture via phone, email or dropping by the office. Depending on each individual client’s situation, we may look to increase the frequency of communication beyond quarterly. New client relationships often require a higher volume of conversation as we get to know your full financial picture, align, and implement our efforts to achieve your goals through our core competencies of investments and financial planning.

Also, life changes such as job transitions, business succession and opportunities, new children, the loss of a family member, marriage or divorce are all catalysts for more frequent communication. These events are impactful in all facets of life, but our advisors are here to lean on throughout these changes and ensure your financial world evolves to support your current situation.

- What are you and your team’s qualifications?

Under Carolyn’s leadership, Weatherly’s partners’ and team members’ commitment to education is top tier amongst local and national averages, enabling best-in-class continuity of client service. 100% of Weatherly’s staff has a minimum of a bachelor’s degree, with several team members holding post-graduate degrees. In addition, our team consists of multiple CFPs, a certified CPA, and multiple team members with industry-related subject matter specific credentials. All investment and planning-focused team members hold either a Series 65 or Series 7 license*. We lead by design in our industry for focusing on perpetual innovation, technology, mentoring, and human capital development.

Our team fosters a culture of education and evolution by prioritizing asking questions, sharing knowledge and ongoing collaboration with our clients, each other, and centers of influence in our professional community. You can read more about each team member, their background, and their qualifications on Our Team page.

- What is your investment philosophy and how do you pick positions?

Weatherly’s investment strategy focuses primarily on individual equity and fixed income securities and may use ETFs (Exchange Traded Funds) or no-load mutual funds for diversification in select sectors. We take a thematic approach to security selection, first identifying areas of potential through ongoing research and collaboration of our investment committee, then drilling down to determine specific companies where we see opportunity or risk. Our focus on individual securities lends itself to reducing overall fees a client pays in the form of expense ratios. Client portfolios typically include a mix of growth and dividend paying stocks, both domestic and international. For fixed income, we monitor yield curves for areas of opportunity and will deploy capital to maximize after-tax return while managing duration and credit risk. Fixed income investments may include Treasuries, Agencies, CDs, investment grade municipal and corporate bonds. Each client portfolio is managed to target asset allocation guidelines with flexibility to deviate plus or minus 10%.

Beyond general asset allocation guidelines, our security selection for each individual account and family aims to incorporate factors like retirement time horizon, withdrawal needs, saving rate, tax implications and business and community goals. These variables, among others, work in conjunction with your financial plan, which is monitored and adjusted as your situation evolves. Our goal is to determine the most attractive after-tax, after-fee return for you and your family, and let that factor into security selection, achieving solid long-term returns while also adapting to your risk tolerance and ongoing needs.

- How do you collaborate with my trusted professionals?

Weatherly works closely with a client’s team of professionals on all aspects of their financial life. Our team approaches planning and investment management with a broad and encompassing lens, considering estate, business, tax planning and much more. We view having a team of experts working on your behalf as essential. If you do not already have professionals in place, Weatherly taps into its network of highly qualified COIs to provide referrals that would be the best fit for your individual situation.

Given the breadth of information we gather and the intimate relationship we have with each client, our advisors are often the catalyst in development of specific strategies and can help further refine questions or simply talk through an issue before heading to your CPA (Certified Public Accountant) or attorney. We always recommend getting guidance from your trusted professionals, but it can be helpful to workshop scenarios with an advisor prior, to achieve total alignment as we work towards your goals.

- How can you help me stay on track with my goals?

Our planning model begins with a Dialogue for Impact. We believe that the value of our advice is driven by the amount we can learn about your individual situation. We appreciate the interconnectedness of life and livelihood and the dynamic nature of planning beyond just your finances. We begin with a comprehensive financial plan, considering your current situation as well as your future goals and run through multiple scenarios to determine the best options. Through quarterly update conversations with you (along with your family, and your trusted professionals as needed) we adapt the plan, provide recommendations, and implement solutions to ensure the health of your plan.

In line with planning, our team provides best practices and works directly with you, often one-on-one, setting up and maintaining healthy cybersecurity habits. Protecting your personal data is our priority, and our team employs elevated technology like our secure Weatherly portal to ensure your privacy. Our client service team is skilled in both teaching and technology to guide you along this journey.

As with most aspects of our service, we favor a comprehensive approach to planning for impact. Incorporating the next generation into ongoing dialogues can set you up for success as you age and ensure your goals and wishes are met even after your passing.

- How do you work with the next generation?

We consider working with the next generation to be a vital part of our long-term relationship and what we build together for clients as their advisor. Spanning our professional financial advice across generations can be one of the most impactful gifts you can give to both your loved ones, and your own peace of mind. Whether you are contributing to a 529 or UTMA account, helping a first-time home buyer or even ensuring clarity of your wishes in the event of a health crisis or your passing, our team is here to help.

To assist with this, as part of our onboarding, Weatherly has each client fill out what we call a CIRAL (Client Information Release Authorization Letter). This document helps our team support you and your loved ones in times of transition by indicating your team of trusted professionals, family members, and emergency contact and giving Weatherly permission to communicate with them on your behalf if it is in your best interest to do so.

Final Thoughts

Armed with these questions, you can enter a discussion with your advisor at Weatherly knowing that you will have all the answers you require on your side and the knowledge that you have us in your corner through all of life’s evolutions. Change is constant, but you can rest assured with Weatherly as a resource to help you outline optimal choices, detail benefits and drawbacks and help you make informed decisions as you enter new stages of life. Our team utilizes data, tax and legal guidance and innovative technology to ensure your path forward is the right one for you, your family, business, and community.

If you are still deciding to seek professional financial advice, it can feel like a big decision, yet considering these options can help ensure you are aligned with your chosen team. At Weatherly, we aim to inspire that confidence and foster transparency and alignment through the work we do with each of our clients so they may go on to achieve a positive impact on their families, businesses, and communities.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

*updated 2024

If you find taxes confusing, then you are not alone. Albert Einstein once said, “the hardest thing in the world to understand is the income tax.” While we outline many useful tax details in our Key Financial Data Sheet and even observed the US history of taxes in a prior blog post, it is truly the IRS’ job to fully understand and enforce the tax code. We also find the tax return essential to our services and we like to receive a secure copy each year.

Within your tax return is a wealth of information that we utilize to support our two core competencies – financial planning and investment management. Our goal is to get to know your full financial picture so we can tailor our advice to your specific situation to increase overall tax-efficiency. While we prefer to analyze your full tax return, the following sections give us specific insights into how we can best serve you.

1040

The 1040 gives our team a summary of your full tax picture. Numbers on your 1040 that are of particular interest to our team are your Adjusted Gross Income (AGI) and your Taxable Income. Your Taxable Income, in conjunction with your Filing Status, help us determine your Marginal Federal Tax Bracket. Your tax bracket drives the types of securities we purchase for your taxable portfolio, like a Trust or individual account. For example, a person in a very high marginal tax bracket may benefit from tax-exempt municipal bonds. Alternatively, a person in a low tax bracket has less of a need for tax-free income and may benefit from an allocation to taxable corporate bonds. Weatherly always looks at the Taxable Equivalent Yield (TEY) to compare a taxable bond to a tax-exempt bond to determine which offers the most attractive after-tax return per client account.

Tax brackets are also useful within financial planning to determine if it is a good year for a Roth conversion. This strategy can take advantage of a low-income year by leveraging current lower income tax brackets to enhance after-tax returns over time. Since Roth assets can grow tax free, they often become a desirable source of funds in legacy planning for beneficiaries.

This first page is also useful when onboarding new clients. It provides our team with your full name, Social Security Number, address, and lists any dependents you claim. This information facilitates us in filling out new client paperwork and expedites the client onboarding process. We also track your tax preparer as listed at the bottom of form 1040, as we may need to contact them with any questions that may come up regarding your tax situation and various tax strategies. With your consent, we can also contact them to directly and securely send your tax forms to assist them in filing your return.

Schedule 1

Schedule 1 outlines any additional income you earned throughout the tax year as well as adjustments to your income. Our team appreciates having a full outline of your revenue streams and how much you receive. It can be overwhelming to have to keep track of this information independently, so it is often easier to send this summary to your advisor to give them some context on your cashflow. We can also model the income into a financial evaluation and build out various scenarios.

Schedule A

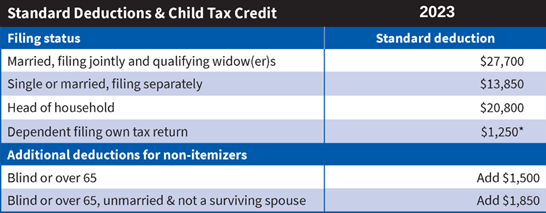

If you itemize your deductions, instead of taking the standard deduction, you will need to fill out a Schedule A. The Tax Cuts and Jobs Act (TCJA) in 2018 made significant changes to the deductions you can itemize. The main deductions are medical costs (that exceed 7.5% of AGI), state and local taxes (now capped at $10,000), mortgage interest and gifts to charities. The TCJA also significantly increased the standard deduction which dramatically reduced the amount of Americans itemizing their deductions. For the 2023 tax year, the standard deductions are mainly based on filing status but can also be affected by other factors. Please see the chart below for details:

Sourced from: https://www.weatherlyassetmgt.com/wp-content/uploads/2023/01/2023_KEY_FINANCIAL_DATA_CHART.pdf

Many of our clients itemize their deductions because their large donations to charities throughout the year frequently exceed the standard deduction. One of the strategies we utilize includes appreciated stock contributions to a Donor Advised Funds (DAF). If you have philanthropic goals, then our team can help evaluate timing and security selection for tax aware giving methods. Your generosity not only helps those in need but can decrease your taxable income for the year. It is important to note, if you do not itemize, your charitable contributions are not deductible but other strategies like Qualified Charitable Distributions (QCDs) may be an alternative.

Schedule C

If you are a sole proprietor, you should also have Schedule C included in your tax return. This form indicates any profit or loss your business experienced throughout the year. We use this to help us determine if it would be beneficial to take any gains or losses in your account to offset the profits or losses from your business. We can also incorporate the income streams and a future business sale into your financial evaluation. Seeing Schedule C typically leads into a conversation about retirement contributions and if a self-employed 401K or other retirement plan is appropriate.

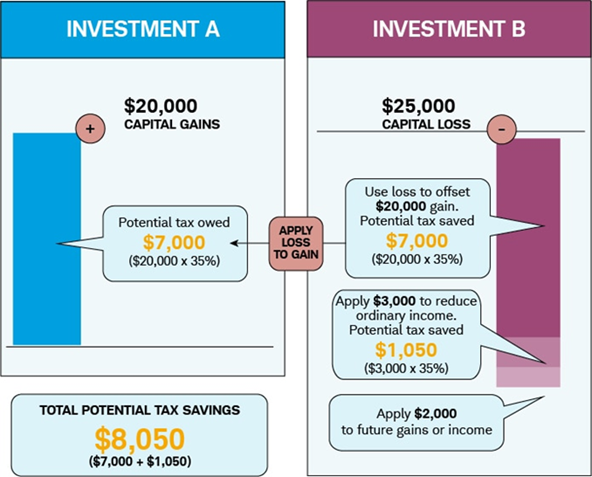

Schedule D

Schedule D reports capital gains and losses. Our team actively seeks to limit capital gains each year, through tax loss harvesting. This strategy includes taking losses (if available) to offset capital gains in taxable accounts. Occasionally, a client will have capital losses that exceed gains. In this instance you may deduct up to $3,000 ($1,500 if married filing separately) against ordinary income on your 1040 and carry forward the remaining losses to future years.

Sourced from: https://www.schwab.com/learn/story/how-to-cut-your-tax-bill-with-tax-loss-harvesting

In periods of extreme volatility, this strategy can be used proactively so unused losses can be used to offset future gains when the market recovers. This method along with other tactics are used to successfully reduce concentrated positions over time while limiting adverse tax consequences. As part of our ongoing investment management services, we actively seek to buy and sell securities with a tax conscious approach.

Schedule E

Many of our clients own rental properties, receive royalties, own S corporations, or receive income from estates and trusts. Schedule E is where the income and losses from those avenues are reported. Our advisors review this form to gain better understanding of your financial situation and can work different scenarios into financial evaluations.

1040-ES and Vouchers

These vouchers help our team plan out cash flows throughout the year. Understanding your cash needs allows our team to accumulate cash and send funds to your bank proactively to help cover quarterly tax estimated payments.

How Weatherly Can Help

The Weatherly team takes pride in our ability to create tax efficient strategies specific to each client so they can ultimately keep more money in their pockets. Each client not only has their own unique situation, but tax and estate laws can change. A current tax return allows us to identify any new planning opportunities for the year and assists in our tax conscious investment approach.

If you haven’t already done so, please send us your tax return by utilizing our secure portal or another secure method. If easier, feel free to connect us with your tax preparer and we can request the return directly from them. We work closely with many tax professionals to securely share tax documents and to collaborate on any tax planning initiatives.

As always, we welcome your questions and look forward to saving you money!

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

San Diego Business Journal included Weatherly Asset Management in the 2023 listing of Wealth Management Firms, published on April 24th, 2023. Placed among the best in San Diego County, WAM lands the 17th spot of 44 firms in total.

Eligibility requirements to participate included being a registered investment adviser with either the Securities Exchange Commission or the California Department of Corporations. The criteria by which Firms were ranked was based on assets managed in San Diego County for fiscal year 2022.

After receiving an email invitation from the Journal to participate in the list, Weatherly completed a brief online survey.

It is not the intent of the list to endorse the participants nor to imply a firm’s size or numerical rank indicates its quality. There was no fee to participate in the list ranking, and Weatherly was not required to advertise in, or subscribe to, the San Diego Business Journal.

No organizational memberships were required of the Firm or individuals. Inclusion in the ranking is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Past performance is not necessarily indicative of future results. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

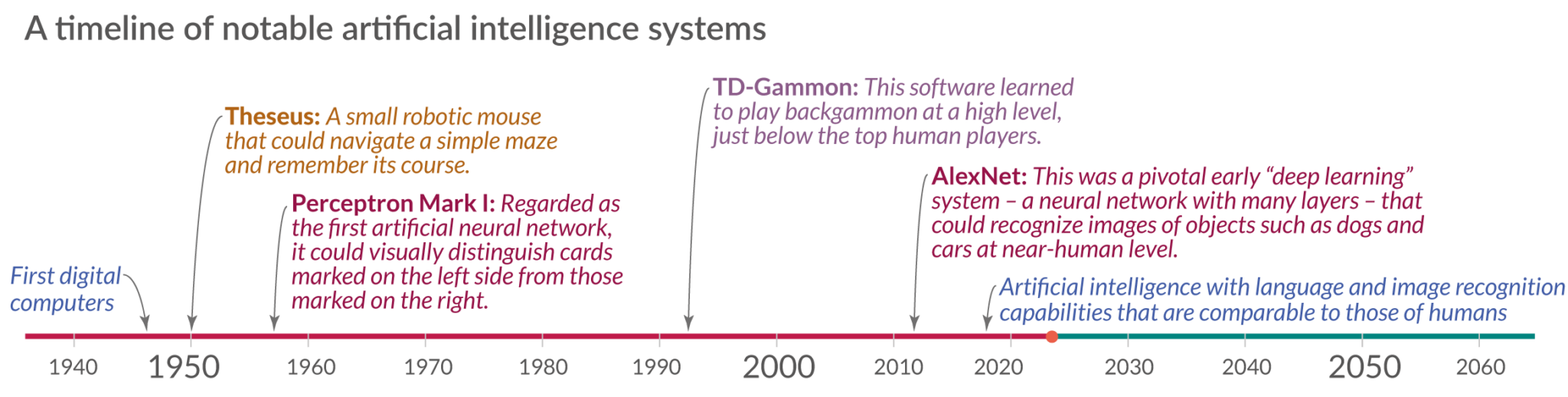

Artificial Intelligence, or its short form AI, is a term new to many people, but did you know that it has been around since the 1950s? In fact, AI has already woven itself into our day to day lives. While it is easier to identify certain technology that has been considered “life changing” such as the internet, social media and smart phones, AI helps drive these technological advancements. The broader technology sector has grown from the smallest sector by weight in the S&P500 to the largest sector within a handful of decades, and the spillover effect of technology has transformed other industries leading to overall growth in the global economy.

Timeline sourced from: Our World in Data

Today, AI is being popularized once again with large companies spending billions of dollars to back chatbot programs like ChatGPT, Microsoft’s revamp of Bing and Google’s newly released Bard. While AI and technology have had a relatively short existence, the snowball effect is leading to new opportunities and concerns for what the future might hold. With more companies beginning to weigh in on the potential impact of this new tech landscape, Weatherly has been observing opportunities for investment, identifying potential concerns and embracing ways to enhance our client experience.

The Good – AI Present and Future

With new applications and possibilities, advancements in artificial intelligence have impacted almost every industry and profession.

Education – Today, AI is being used to improve courses, grade papers and create interactive exams. The future holds a more personalized education system which can identify weaknesses and create teaching methods and adaptive programs specific to a student’s special education needs and learning styles. With AI to assist, students can have a more well-rounded knowledge base or choose to specialize in a certain area.

Legal – Though AI is more likely to aid than replace attorneys in the near term, its use to review contracts, find relevant documents in the discovery process, and conduct legal research has helped to eliminate some of most tedious tasks for lawyers. The use of AI in the legal sector has the potential to improve the efficiency and accuracy of legal services, while also reducing the cost for clients.

Health Care – While not a replacement for human doctors and healthcare providers, AI technologies have created unprecedented opportunities in the medical field. Currently, AI is being used to automate administrative tasks such as pre-authorizing insurance, following up on unpaid bills, and maintaining records. Additionally, the capabilities for AI powered programs to analyze vast amounts of data and detect information that may not be apparent to the human eye, can facilitate targeted cancer therapies such as radiation, and could lead to a radical impact on early detection of diseases, diagnosis, and treatment recommendations.

Travel/Transportation – At present, AI is very involved with how we get from point A to point B. Whether it’s a navigation app on a smart phone or an airline company using AI to determine ticket prices. With AI technology people can even be physically moved in a self-driving car. While this future is already here, it is still evolving and some consumers remain skeptical.

The Bad – The Consequences and Concerns of AI in Society

Despite its benefits, there are serious concerns about the impact of AI. Some of the major potential negatives to consider are:

Job displacement – As machines and algorithms are able to perform tasks previously done by humans with superior speed and accuracy, there could be a potential for job losses in many industries.

Bias and discrimination – AI systems have the potential to be biased and discriminatory if the data they are trained on is biased or designed with implicit biases. This can lead to unfair treatment and negative unintended consequences.

Privacy- AI systems thrive on collecting and analyzing large amounts of data, including personal data. This raises major concerns about privacy and security.

Lack of transparency – AI systems are complex and difficult to understand, making it especially difficult to determine how decisions are being made. This also raises concern for how to hold companies and organizations accountable for their actions when artificial intelligence was a factor in the decision-making process.

Ethical – Should machines and other AI software be granted legal rights? Can AI be trusted with decision making despite its lack of ethical, moral, and other human considerations?

Although advancements are continuously occurring, it remains clear that technologies struggle to provide the meaning, value, and creativity that real humans can.

AI and Weatherly

At Weatherly, it is our intent to embrace the good technology has to offer and protect ourselves (and you) against the bad. We seek to identify new technology to advance our business and serve our clients in the most efficient way possible while remaining cognizant of overall risk.

Our reporting tools are used to enhance what we do by analyzing a wide scope of data so that we can stay informed and provide accurate real-time updates. To help ensure our clients don’t outlive their assets, we use financial planning software and create alternative scenarios to outline future risks and opportunities. While we can generate countless reports and scenarios the true value and real understanding occurs when we verbalize the key outcomes.

We have also fully embraced automation in processes such as account opening and document verification. We have seen huge successes and advances in the turnaround times of account establishment through our custodian’s e-tools, as well as document verification through DocuSign e-signature.

Additionally, we remain on high alert to the threat of cyber-attacks. It is our best practice to utilize the Weatherly Portal for the secure exchange of information and are always happy to serve as a resource of how to protect yourself and loved ones against the ongoing threat of cybercrime. Check out our 7 Steps to Better Cyber Security for some quick tips!

At Weatherly we pride ourselves on providing high quality, holistic, and innovative wealth management service. It is our duty to use and embrace technology in a responsible and ethical manner to enhance what we do, not as a replacement to our expertise and experience.

We strive to pair human knowledge and common sense with modern technology to maximize efficiency and deliver information in an easy to digest way.

Resources –

https://ourworldindata.org/brief-history-of-ai

https://builtin.com/artificial-intelligence

https://www.pwc.com.au/digitalpulse/report-pwc-global-ceo-survey-ai-skills.html

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Carolyn Taylor represented Weatherly in a Barron’s Advisor interview focused on how advisors have changed their approach to portfolio management since 2022. The interview occurred over the phone on February 27th, 2023 and appeared in their 2023 Top 1,200 Barron’s Advisor ranking in the print editions of Barron’s (March 13) and The Wall Street Journal (March 21); the interview was also published online (March 10).

Carolyn received an email invitation from Barron’s Advisor to be a part of the interview. The interview process was Q&A style and was conducted over the phone. Questions were sent to Carolyn in advance via email and covered how Weatherly’s investment approach has changed, if at all, in the past couple of years, including Weatherly’s ideas about active vs. passive investing, and how much Weatherly relies on individual securities vs. funds. The interview also covered Weatherly’s thematic approach to investing.

There was no fee to be interviewed, and Weatherly was not required to advertise in (or subscribe to) Barron’s Advisor. Barron’s Advisor authorizes the use of the public URL for sharing purposes at no cost to Weatherly and licensing is not required. Weatherly paid Dow Jones for a 12-month HTML web reprint that expired in April of 2024 and was not renewed. No organizational memberships were required of the Firm or individuals. Inclusion in this interview is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of inclusion in this interview.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Carolyn Taylor was included in Barron’s 2023 Top 1200 Advisor Rankings by State list. The full list can be viewed on Barron’s website. View the list here.

The criteria for ranking reflects assets under management as of 09/30/2022, revenue that the advisors generate for their Firms, regulatory record, quality of the advisor’s practices, and philanthropic work. Investment performance is not an explicit criterion because the advisors’ clients pursue a wide range of goals. In many instances, the primary goal is asset preservation. The scoring system assigns a top score of 100 and rates the rest by comparing them with the top-ranked advisor.

Carolyn Taylor was nominated for inclusion in the list. Survey data was submitted by around 6,000 advisors, but only 1200 were published in the ranking. Barron’s uses a proprietary method to rank advisors based on the criteria above. Weatherly provides this data to Barron’s in the form of a survey response. Initial ranking is done by Barron’s; publicly available data is verified by Barron’s against SEC and FINRA reports. Barron’s then conducts the next level of ranking. Data that is not independently verified by Barron’s is then sent back to the Firm for verification. Barron’s then incorporates any required changes into the ranking, and finalizes the list for editorial use and publishing. The Top 1,200 are drawn from all 50 states, plus the District of Columbia. This ranking is the largest and most comprehensive of the annual Barron’s advisor listings. It includes a cross section of private-wealth advisors, from independents who own and operate their own practices to advisors from the large Wall Street firms. This special report lists the top advisors in each state, with the number of ranking spots determined by each state’s population and wealth. Carolyn Taylor ranked 72nd in the state of California.

No payment was required for nomination or inclusion in the ranking. After receiving notice of inclusion in the top 1200 list, Weatherly plans to pay Dow Jones Reprints and Licensing for custom hard copy reprints and digital access. Wealth Managers do not pay a fee to be considered or placed on the final list.

No organizational memberships were required of the Firm or individuals. Ranking on this list is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Weatherly Asset Management, L.P. was listed as a winner for the 2023 InvestmentNews Best Places to Work award. InvestmentNews recognized standout employers in the financial advice industry in the United States. There were 75 winners overall, and the list was segmented by employer size categories: 1) Small Employer Category (15-29 US Employees); 2) Medium Employer Category (30-49 US Employees); and 3) Large Employer Category (50+ US Employees). Of the 35 employers in the Small Employer Category, Weatherly was ranked 31. Not all nominees were named winners. To view the full list, click here.

To qualify as one of InvestmentNews’ Best Places to Work for Financial Advisors, an advice firm must be a registered investment adviser (RIA), affiliated with (but not an employee of) an independent broker dealer (IBD), or a hybrid/dually-registered firm affiliated with an IBD and doing business through an RIA, be based in the US, have at least 15 employees, and have been in business for one year. InvestmentNews solicited nominations via email invitation. Participating organizations completed a two-part process to be considered for inclusion on the list. Part 1 consisted of an employer assessment and was worth approximately 25% of the total evaluation. Part 2 consisted of an employee feedback survey and was worth approximately 75% of the total evaluation. Surveys were conducted online. Both the employer and employee data sets are combined to determine the best workplaces. Best Companies Group (BCG) manages the overall registration and survey process and also analyzes the data and uses their expertise to determine the final rankings.

Weatherly was not required to make payments or purchases to nominate, be nominated, be considered, or included on the list related to the award. No organizational memberships were required of the Firm or individuals. Weatherly paid Pars International Corp. (the official logo licensing agent for InvestmentNews) for a wood plaque. The advertisement of nomination for the award is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the award, nominations for the award, or the appropriateness of related advertising.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Carolyn Taylor was named in the Shook Research’s 2023 Top Women Wealth Advisors Best-In-State list. She was invited to complete an online survey detailing information about her career, as well as Weatherly as a firm. Carolyn was named 15th out of 124 advisors in Southern California. The list was published on February 2nd, 2023 on Forbes.com. To view the list, click here.

Weatherly’s discretionary AUM as of 12/31/22, as disclosed in form ADV1 (https://www.weatherlyassetmgt.com/adv/), is $1,004,920,165. The 2023 Top Women Wealth Advisors Best-In-State ranking is based on Weatherly’s discretionary AUM as of 9/30/22, which was $957 Million.

The Forbes ranking of Top Women Wealth Advisors Best-In-State, developed by SHOOK Research, is based on an algorithm of: qualitative data, such as telephone and in-person interviews, a review of best practices, service and investing models, and compliance records; as well as quantitative data, like revenue trends and assets under management. All advisors have a minimum of seven years’ experience. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. In total, 38,314 nominations were received, and 22,106 advisors were invited to complete the online survey. Throughout the research process, 17,143 telephone interviews, 3,453 in-person interviews, and 1,361 web-based interviews were conducted. The ranking listed 124 advisors in Southern California, and Carolyn was ranked 15th.

Basic Requirements to be considered for the “Forbes Top Women Wealth Advisors Best-In-State” included: 1) 7 years as an advisor; 2) minimum 1 year at current firm 3) advisor must be recommended, and nominated, by Firm, 4) completion of online survey; 5) over 50% of revenue/production must be with individuals; and 6) an acceptable compliance record. In addition to the above basic requirements, advisors were also judged on the following quantitative figures: 1) revenue/production; weightings assigned for each; 2) assets under management—and quality of those assets—both custodied and a scrutinized look at assets held away (although individual numbers are used for ranking purposes, the ranking publishes the entire team’s assets); 3) client-related data (i.e. retention.) NOTE: Portfolio performance was not considered – audited returns among advisors are rare, and differing client objectives provide varying returns. Qualitative considerations examined included but were not limited to: 1) telephone and in-person meetings with advisors; 2) compliance records and U4s; 3) advisors that provide a full client experience (factors examined include service model, investing processes, fee structure (higher % of fee-based assets earns more points,) and breadth of services, including extensive use of Firm’s platform and resources; 4) credentials (years of service can serve as proxy); 5) use of team & team dynamics; 6) community involvement; 7) discussions with management, peers, competing peers, and 8)telephone and in-person meetings. Compliance records and U4s were also reviewed in detail as part of the selection process including: 1) infractions denied or closed with no action; 2) complaints that arose from a product, service or advice initiated by a previous advisor or another member or former member of team; 3) length of time since complaint; 4)complaints related to product failure not related to investment advice; 5) complaints that have been settled to appease a client who remained with the advisor for at least one year following settlement date; 6) complaints that were proven to be meritless; and 7) actions taken as a result of administrative error or failure by firm.

Weatherly Asset Management did not pay any fees to SHOOK to be nominated or included in the “Forbes Top Women Wealth Advisors Best-In-State” list and Weatherly was not required to advertise in, or subscribe to, Forbes. As of the time of this disclosure, Weatherly did not elect to pay for reprints of the list.

Inclusion in this ranking is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising the award.

SHOOK Disclosures

SHOOK is completely independent and objective and does not receive compensation from the advisors, Firms, the media, or any other source in exchange for placement on a ranking. SHOOK is funded through conferences, publications and research partners. Since every investor has unique needs, investors must carefully choose the right Advisor for their own situation and perform their own due diligence. Rankings are based on the opinions of SHOOK Research, LLC and not indicative of future performance or representative of any one client’s experience; the firm’s research and rankings provide opinions for how to choose the right financial advisor. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Remember, past performance is not an indication of future results. For more information and complete details on methodology, go to www.shookresearch.com. Data provided by SHOOK® Research, LLC — Data as of 9/30/22.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Weatherly Asset Management was named on WealthManagement.com’s RIA Edge 100 list. The list was published on February 6th, 2023 on WealthManagement.com. To view the list, click here.

The 2023 RIA Edge 100 list reflects Weatherly’s discretionary AUM as of 09/30/2021, which was $1,140,527,688 and total number of clients as of 12/31/2021, which was 372 clients.

The list was developed by the Wealth Management IQ team in partnership with Discovery Data. Analyzing the ADVs of all SEC-registered investment advisors, Wealth Management IQ and Discovery looked at AUM growth, ratio of employees to clients, ratio of advisors to clients, percentage of advisors with CFP certification and average client account size. Qualifying firms were limited to those that provide financial planning services, have high-net-worth individuals as more than half of their client base and manage at least $250 million in assets as of June 30, 2022.

Weatherly did not apply for consideration or inclusion in the list. There was no fee to participate in the list, and Weatherly was not required to advertise in, or subscribe to, WealthManagement.com. No organizational memberships were required of the Firm or individuals. Inclusion in this list is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high net worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507