Carolyn Taylor and Brent Armstrong were featured in Barron’s Fall 2024 Big Money Poll of professional investors article. This poll allowed professionals to share their views on the financial markets, the economy, and the developments that will shape both in the year ahead. Barron’s has been conducting the Big Money Poll for nearly 30 years. The Fall 2024 Big Money Poll was published in Barron’s and on barrons.com in late October. As in the past, the Fall 2024 poll surveyed a cross-section of the nation’s top money managers.

Carolyn and Brent received an email inviting them to participate in Barron’s Fall 2024 Big Money Poll. Barron’s solicits the investment opinions of professional investors every spring and fall.

Barron’s conducted the Big Money Poll with the assistance of Erdos Media Research in Ramsey, NJ. The latest poll drew 110 respondents. Weatherly responded to the invitation by submitting answers to the online survey. As with past polls, interviews with several money managers who completed surveys were conducted. After Weatherly submitted the online survey, the team was contacted to schedule a phone interview with Barrons. The phone interview with Barron’s took place in mid-October with Weatherly’s Carolyn Taylor and Brent Armstrong. The resulting article is available here and features comments from Carolyn, Brent and a variety of other money managers: https://www.barrons.com/articles/stocks-market-prediction-big-money-poll-5ffbe89b.

There was no cost to participate in the survey or interview process. Weatherly was not required to advertise in or subscribe to Barrons to participate in the survey or article.

Inclusion in this article is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising the award.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Carolyn Taylor was included in Barron’s 2024 Top 100 Independent Advisors list. The full list can be viewed on Barron’s website. View the list here: https://www.barrons.com/advisor/report/top-financial-advisors/independent?page=1.

The ranking reflects data as of 06/30/2024 including the volume of assets overseen by the advisors and their teams, revenues generated for the firms, and the quality of the advisors’ practices. In many instances, the primary goal is asset preservation. The scoring system assigns a top score of 100 and rates the rest by comparing them with the top-ranked advisor. Carolyn was ranked 99th.

Carolyn Taylor was invited to participate in the nomination process via email solicitation from Barron’s. Barron’s uses a proprietary method to rank advisors based on the criteria above. Weatherly provides this data to Barron’s in the form of a survey response. Initial ranking is done by Barron’s; publicly available data is verified by Barron’s against SEC and FINRA reports. Barron’s then conducts the next level of ranking. Data that is not independently verified by Barron’s is then sent back to the Firm for verification. Barron’s then incorporates any required changes into the ranking and finalizes the list for editorial use and publishing.

No payment was required for nomination or inclusion in the ranking. No organizational memberships were required of the Firm or individuals. Ranking on this list is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Over the past few years Artificial Intelligence (AI) has become a hot topic commanding the world’s attention. Although the field of AI research began in the 1950s, many consider us to be in an AI renaissance. The excitement around AI has ignited a gold rush mentality, driving unprecedented levels of investment into the AI sector. However, amidst the excitement and promise, it’s important to wade through the hype and identify true opportunities.

Key AI Trends

With public interest in AI being at an all-time high, people are eager to experience and benefit from AI powered systems. This high demand has helped the AI landscape evolve rapidly, with new advancements and applications being released daily. Some of the most prominent real-world AI trends currently driving the industry are:

- Generative AI: Arguably the hottest trend with models like ChatGPT and Midjourney capturing the public’s attention. Generative AI programs are defined by being able to create new content from human prompts. The most common content created with Generative AI is text and images, however, new generative programs are able to create music, code, and even video content.

- Multimodal AI: This is the ability of AI models to process and understand multiple forms of data (text, images, audio, video, etc.) This trend is leading to a deeper understanding of content and more human-like interactions.

- AI for Good: There is a growing emphasis on using AI to have a social impact by addressing global challenges such as climate change, healthcare, and education. This can include Ethical AI which prioritizes developing AI systems that are fair, unbiased, transparent, and accessible.

- AI in the Enterprise: Enterprise AI strives to create operational efficiency by automating routine tasks and optimizing processes. Many companies are working towards embracing Enterprise AI to create an augmented workforce where AI is used as a tool to enhance human capabilities rather than replace.

Understanding the AI Landscape

Although AI was born nearly 70 years ago, its recent boom in popularity has the whole world talking about it. AI has become a trending topic, and with companies slapping the “AI” label on nearly everything, it can create a distorted picture of the market, making it difficult to differentiate between genuine invocation and overhyped promises. The AI landscape is a complex ecosystem, and in order to make informed decisions, it’s crucial to understand some of the components essential to any AI value chain.

- Infrastructure: The software and hardware necessary to power AI applications. This includes high- performance computing systems, data centers, and chips.

- Data Management and Analytics: High volumes of quality data are the fuel for AI. Accessing, handling, and extracting insights from vast datasets is crucial for AI’s success.

- Algorithms: These are the core of AI systems. Developing cutting-edge algorithms is a key area of focus for many AI companies. Some recent breakthroughs include deep learning, reinforcement learning, and generative models.

- Applications: This encompasses the end products and services powered by AI. AI driven solutions span across various sectors. Some real- world applications include healthcare, finance, transportation, and customer service.

Investing in AI

Key Considerations

When considering investments in AI, it’s important to focus on several key areas:

- Scalability: The ability of a company’s AI solutions to scale effectively as demand grows is crucial for long-term success.

- Data Management: Effective data management practices are vital, as the quality and volume of data directly impact the performance of AI systems. Good data in equals good data out.

- Cost: The cost of developing and implementing AI technologies can be high. Investors should assess whether companies have a sustainable financial model.

- Talent Recruitment/Retention: The competitive landscape for AI talent is intense. Companies that can attract and retain top talent will have a strategic advantage.

Challenges

Despite the immense potential, investing in AI comes with its own set of challenges:

- Overvaluation: The hype around AI can lead to inflated valuations. Investors should be wary of overpaying for companies with unproven technologies or track records.

- Regulatory Risks: The regulatory environment for AI is still evolving. Companies may face significant hurdles related to data privacy, security, and ethical considerations.

- Ethical Concerns: As AI technologies become more prevalent, ethical considerations around bias, fairness, and transparency become increasingly important.

Navigating the AI Investment landscape requires a careful balance of enthusiasm and skepticism. By focusing on genuine opportunities and understanding the inherent risks, investors can position themselves to benefit from the transformative potential of AI.

AI’s Broader Impact

Economic Growth

AI’s impact on economic growth is profound, with predictions estimating its contribution to be up to $15.7 trillion to the global economy by 2030. This staggering figure likely surpasses the combined current output of China and India, driven significantly by $6.6 trillion worth of enhanced productivity and consumer demand from AI-based products and services. (Sizing the prize (pwc.com))

Job Market Transformation

The job landscape is set for a major transformation due to AI, affecting almost 40% of jobs globally. This shift will require carefully balanced policies to manage the transition effectively, ensuring that workforce disruptions are minimized while new opportunities are created.

Investment Surge

The flow of investments into AI development is robust, reflecting its perceived high value and potential to disrupt various industries. This surge underscores the crucial need for investors to identify genuine opportunities and avoid fleeting trends.

Beyond Economic Impact

AI’s influence stretches beyond economic factors to affect national security, politics, and culture, establishing its role as a transformative force across all societal facets.

Identifying Real Opportunities in AI Investments

Investors are urged to focus on sectors where AI could cause significant disruption. Notable areas include healthcare, finance, transportation and logistics, manufacturing, and retail.

- Healthcare

- Disruption: AI can significantly enhance diagnostic accuracy, predict patient outcomes, and personalize treatment plans.

- Profitability: Investing in AI-driven healthcare startups and companies focusing on AI-based diagnostics tools and personalized medicine can lead to substantial returns as these technologies become standard in medical practice.

- Finance

- Disruption: AI is transforming finance through fraud detection, algorithmic trading, personalized financial planning, and Risk Management.

- Profitability: The use of AI to improve fraud detection can lead to reduced financial losses and increased customer trust, while Algorithmic trading enhances trading efficiency, and AI tools are able to enhance risk assessment by analyzing various risk factors and predict potential issues to help institutions make informed decisions.

- Transportation and Logistics

- Disruption: AI optimizes route planning, autonomous vehicles, and predictive maintenance.

- Profitability: Companies developing AI for autonomous driving and logistics optimization like self-driving truck startups and AI-based fleet management systems, offer promising investment opportunities.

- Manufacturing

- Disruption: AI-driven automation improves production efficiency, quality control and predictive maintenance.

- Profitability: Investing in AI firms specializing in industrial automation and robotics can be lucrative as manufacturers adopt AI to enhance productivity and reduce costs

- Retail:

- Disruption: AI enhances customer experience through personalized shopping, inventory management, and sales forecasting.

- Profitability: Investing in retail companies leveraging AI for customer analytics and supply chain optimization can be highly profitable as they gain a competitive edge in the market.

Risks and Challenges in AI Investments

The emerging nature of AI technology brings with it risks such as algorithmic bias and data privacy issues. Investors must conduct thorough due diligence to sidestep investments in overhyped “fake AI” or “AI washing.” This refers to the practice where companies claim to use AI technologies to boost their appeal and attract investment, but they lack the substantial AI capabilities to back these claims.

Investment Strategies for AI

A strategic approach to AI investment involves a blend of short-term tactical moves and long-term vision. This includes staying vigilant of AI advancements and learning from both triumphs and failures within the AI sector.

Energy Intensity of AI

While AI offers significant benefits, it is also energy intensive. Training large AI models requires substantial computational power, leading to high energy consumption. For instance, data centers housing AI systems consume vast amounts of electricity, contributing to the carbon footprint of AI technologies. Efforts are being made to develop more energy-efficient AI algorithms and use renewable energy sources to power data centers, aiming to mitigate the environmental impact of AI.

Conclusion

AI has undeniably captured the world’s attention. With every passing day, we witness groundbreaking advancements. From self-driving cars to medical innovations, the potential applications of AI are seemingly limitless. However, amidst the excitement and promise, it is crucial to navigate the hype and identify genuine opportunities. Navigating the AI investment landscape requires a balanced approach of enthusiasm and caution. With a deep understanding of AI’s technological underpinnings, legal considerations, and market readiness, investors can successfully leverage the countless opportunities presented by this dynamic technology. Through our portfolios Weatherly is embracing AI by adding to the sector in diverse ways. We continue to discuss new opportunities and risks as they relate to our individual clients’ accounts and look forward to new advancements in this sector.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

Brent Armstrong, Kelli Burger and Brooke Boone Kelly were listed as finalists for the 2024 San Diego Business Journal 40 Business Leaders under 40 award. The San Diego Business Journal (“Journal”) recognized 40 dynamic business leaders under 40 who have contributed significantly to San Diego’s workplaces and communities.

The San Diego Business Journal solicited nominations via email invitation to their mailing lists and via the paper journal circulation. Members of the Weatherly team nominated include Kelli Burger, Brent Armstrong, and Brooke Boone Kelly. Not all nominees were named finalists.

Nominees were asked to provide a profile on the nominee’s specific career and accomplishments. Weatherly supplied the information for the nomination by completing the Journal’s questionnaire.

Weatherly was not required to make payments or purchases to nominate, be nominated, be considered, or included on the list related to the award. No organizational memberships were required of the Firm or individuals. The advertisement of nomination for the award is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the award, nominations for the award, or the appropriateness of related advertising.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

Avocados for the win! Weatherly continues to celebrate our 30th Anniversary by partaking in 30 charitable events this year. It was truly inspiring to be part of Feeding San Diego’s mission to end hunger. The charity’s mission involves food rescue initiatives to support various programs like the School Pantry Program to serve local San Diegans experiencing hunger. The WAM team were fortunate to be a part of this mission by helping rescue and pack 1400 pounds of avocados at a volunteer event yesterday afternoon. We believe community efforts as such go a long way as Feeding San Diego serves millions of meals each year. Learn more about Feeding San Diego here: https://feedingsandiego.org/.

Carolyn Taylor was included in Barron’s 2024 Top 100 Women Financial Advisors list. The full list can be viewed on Barron’s website. View the list here: https://www.barrons.com/advisor/report/top-financial-advisors/women?page=1.

The criteria for ranking reflects assets under management as of 03/31/2024, revenue that the advisors generate for their Firms, regulatory record, quality of the advisor’s practices, and philanthropic work. Investment performance is not an explicit criterion because the advisors’ clients pursue a wide range of goals. In many instances, the primary goal is asset preservation. The scoring system assigns a top score of 100 and rates the rest by comparing them with the top-ranked advisor. Carolyn was ranked 41st.

Carolyn Taylor was invited to participate in the nomination process via email solicitation from Barron’s and nominated by colleagues for inclusion in the list. For this year’s Top 100 Women Advisors ranking, 1,094 advisors submitted data. Barron’s uses a proprietary method to rank advisors based on the criteria above. Weatherly provides this data to Barron’s in the form of a survey response. Initial ranking is done by Barron’s; publicly available data is verified by Barron’s against SEC and FINRA reports. Barron’s then conducts the next level of ranking. Data that is not independently verified by Barron’s is then sent back to the Firm for verification. Barron’s then incorporates any required changes into the ranking and finalizes the list for editorial use and publishing.

No payment was required for nomination or inclusion in the ranking. No organizational memberships were required of the Firm or individuals. Ranking on this list is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

We’ve all heard the old cliché “Don’t put all your eggs in one basket,” and that couldn’t be more evident than in the realm of investing. In the field of investing, putting all your eggs in one basket is often referred to as “portfolio concentration,” and can be a very risky investment strategy that can leave your portfolio vulnerable. Portfolio diversification, on the other hand, is an investment strategy that aims to reduce overall portfolio risk by investing in various types of assets knowing that they will behave differently than each other. There are many ways to achieve diversification within your portfolio, from investing in stocks, bonds, real estate, cash, etc., each of which behaves differently over time depending on the underlying economic conditions. Achieving proper diversification in your portfolio is a time-tested and prudent investment strategy that can provide reduced risk and peace of mind.

There is one factor of a properly diversified portfolio that can often be overlooked by investors. “Home bias” is a common pitfall amongst investors in which they prefer their domestic assets rather than assets from outside their own country. Many reasons can explain this home bias, but one of the most common reasons is investors feel more comfortable investing in securities that they are more familiar with. Unfortunately, this bias is limiting investors in their ability to achieve proper diversification within their portfolios and oftentimes leaves them overly concentrated in their own country’s assets and their country’s dominant sectors. This blog will explore international investing and the role it plays in your portfolio. We will discuss the benefits, opportunities, and items to be aware of when considering adding an international allocation to your holdings.

Diversification Matters:

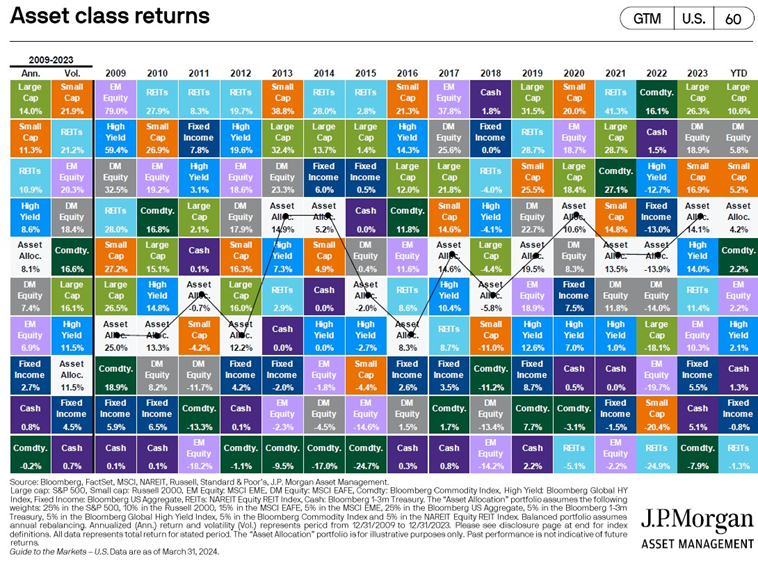

As we discussed above, diversification is a vital aspect of developing a resilient investment strategy that can assist you with achieving your financial goals while spreading your risk amongst various asset classes. Below is a helpful representation as to why diversification matters in an investment portfolio. Just as it is extremely hard to time the market, it is also a challenge to predict which asset class will outperform another in any given year. The below chart illustrates the performance of different asset classes in each calendar year from 2009 to the second quarter of 2024. What you’ll notice is asset classes perform differently from year to year, primarily due to underlying economic conditions. Diversification comes into play when you have exposure to various asset classes to ensure you reduce risk and smooth out your returns over time.

The logical question to ask next is how does diversification work in practice. The answer lies in the correlations of assets, the degree to which two assets move with each other. This is especially true when it comes to investing internationally and thinking globally rather than being laser-focused on domestic assets.

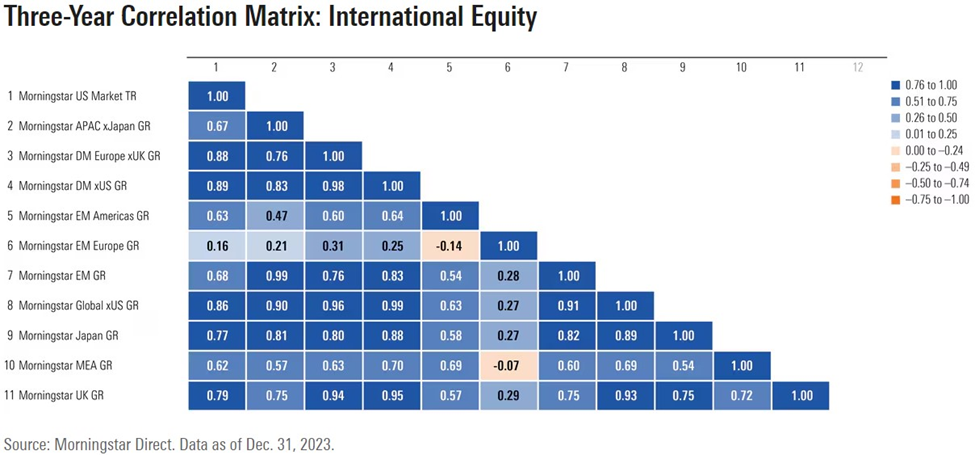

Below is a correlation matrix provided by MorningStar illustrating the degree to which international equities move with each other.

In the above chart, the darker the rectangle, the more highly correlated the assets are. As an example, the MorningStar US Market TR is highly correlated to the MorningStar Developed Market Europe xUK index at .88 but has a low correlation to the MorningStar Emerging Markets Europe index. To put it simply, when the US market moves in a certain direction, most of the time so do the developed markets of Europe. However, emerging markets in Europe are not highly correlated with the US market providing diversification benefits since those asset classes behave differently.

In recent years, the correlation between US equities and international equities has become more correlated as we have experienced a more globalized economy. However, historically this has not always been the case, and diversification benefits are still present within international markets.

Home Bias & Sector Comparison:

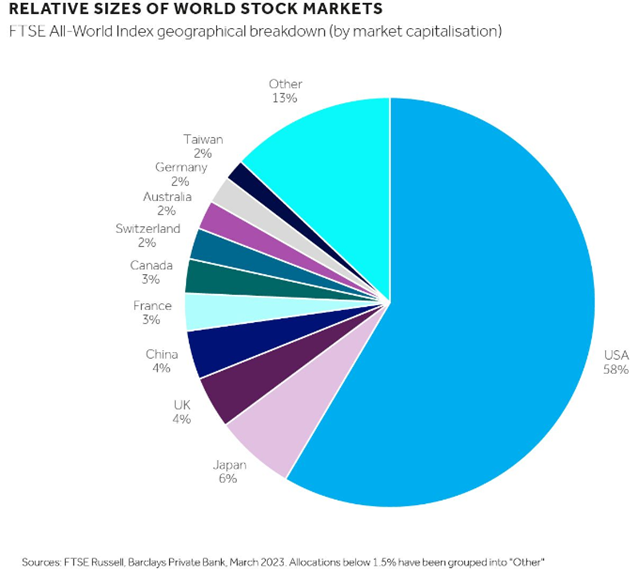

Investors often fall into the trap of preferring their own domestic assets and ignoring the larger global picture. As an example, according to Barclays in the United Kingdom, it is estimated that on average approximately 25% of portfolio allocations are in UK assets despite UK assets comprising only 4% of the global market index.

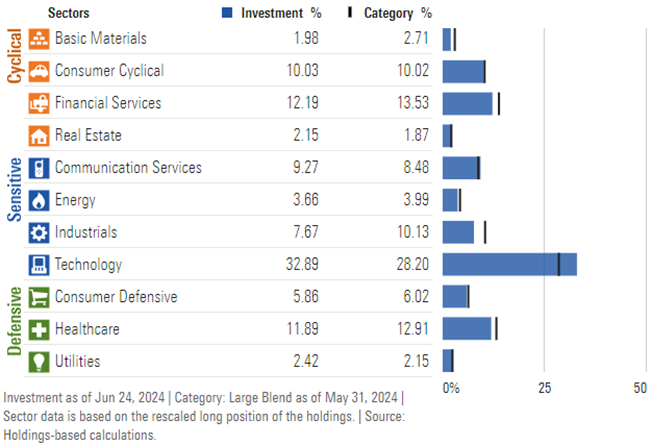

This example of home bias demonstrates an investor’s inability or apprehension to invest outside of their borders. This causes a few different problems and lack of diversification is chief among them. There is also another, more granular, issue with home bias that has to do with the composition of each country’s equity markets. For example, in the United States, roughly 32% of the S&P 500 is comprised of growth-oriented technology companies.

S&P 500 index sector weights as demonstrated by SPY

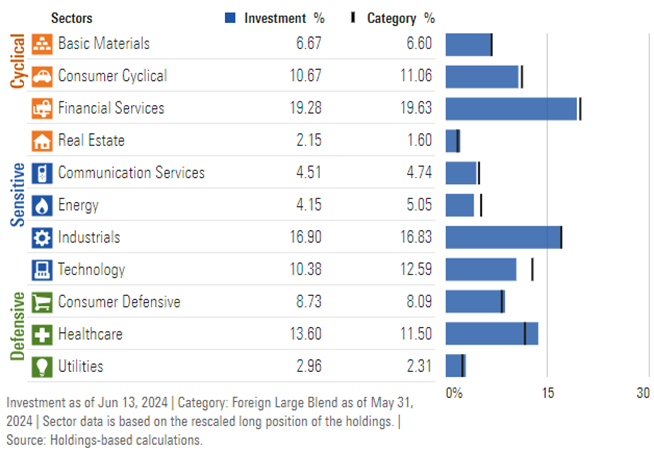

However, if we look at a broad-based international index as demonstrated by the MSCI EAFE, which is an index that tracks Europe, Australasia, and East Asia, we can see that the market composition is completely different. As demonstrated by the below chart, the sector composition for the MSCI EAFE is not as overly concentrated in any one sector to the degree the S&P 500 is. Additionally, the composition of this international index is more heavily tilted towards companies that would be considered value stocks as opposed to the US that is tilted heavier toward growth stocks.

MSCI EAFE index sector weights as demonstrated by EAFE

By having your portfolio heavily concentrated in your domestic markets, you may be missing opportunities and diversification benefits present from international exposures. As we can see from the index comparisons of the S&P 500 and the MSCI EAFE, there are concrete differences in each’s sector composition. Without some international exposure, you could be missing out on opportunities abroad in sectors that aren’t highly represented in your own domestic market and have too much exposure to a particular sector.

US vs. International Historical Performance:

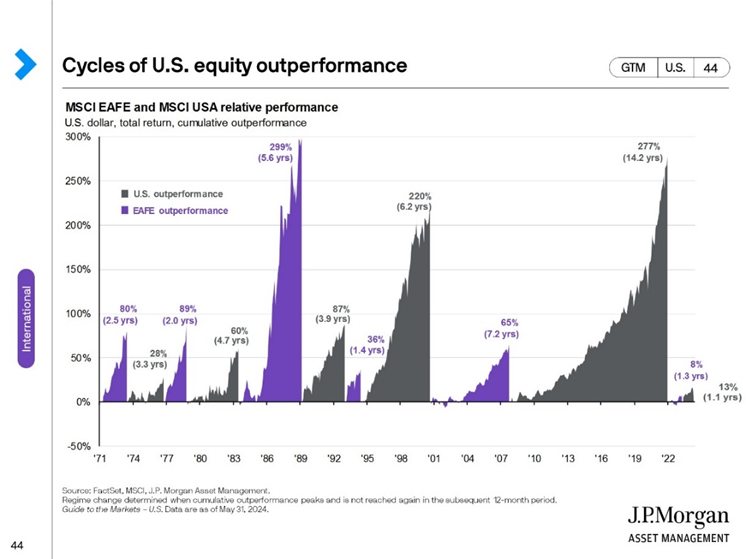

The performance of US vs. International equities are cyclical in nature. There are periods when International markets outperform their US counterparts and vice versa. The below chart shows an illustration of the various cycles of US vs. International performance and the corresponding years that outperformance lasted and the return differential.

As demonstrated by the above chart, in recent history, the US experienced the longest period of outperformance since 1971 at just over 14 years. However, there are periods when having international exposure in your portfolio would have been a real benefit. The most recent period of international outperformance came in 2022 when the MSCI EAFE beat the MSCI USA index for 1.3 years with a return differential of 8%. And again, just like it’s extremely difficult to time the market, predicting when the international vs. US pendulum swings is just as difficult. By having some international exposure, you may be able to participate in upside potential even if the US market is not doing well, demonstrating another benefit to a globally diversified portfolio.

International Valuation as of 2024

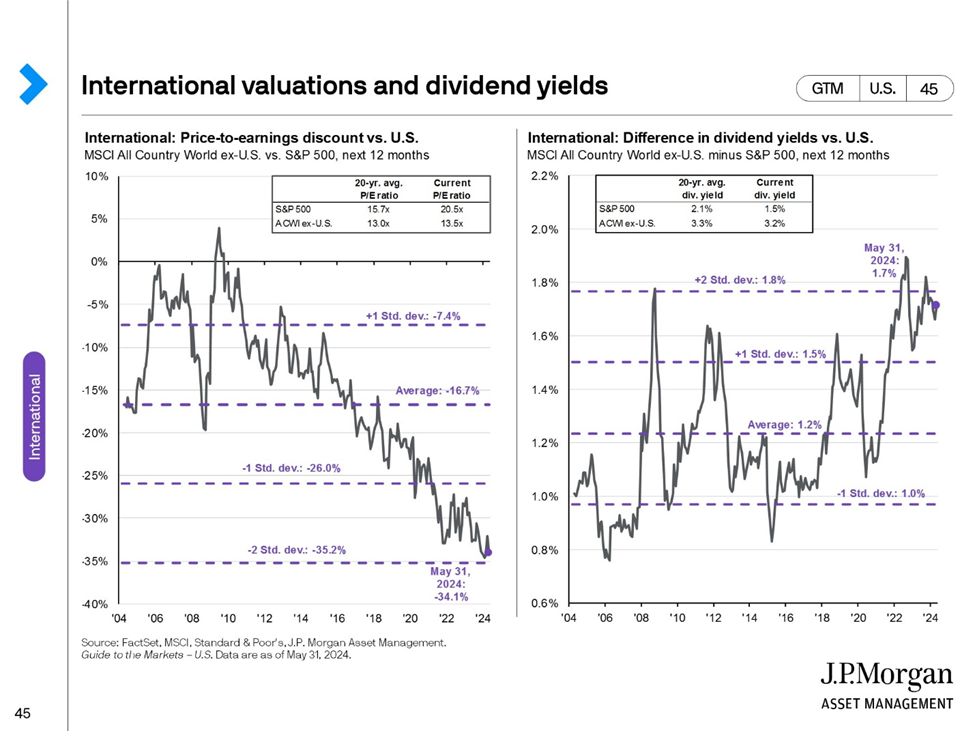

Another compelling reason to add international exposure to your portfolio stems from the current valuation differences between US equities and international equities. The below chart from JP Morgan demonstrates the differences in pricing as demonstrated by the price-to-earnings ratio (P/E). The P/E ratio is a measurement of a company’s current stock price to its earnings per share allowing for comparisons between companies, sectors, and even countries. Historically, the US market has demanded a higher P/E ratio due to the quality and growth of the companies within the S&P 500. However, at this point, international equities are cheap relative to historical averages, and the US is expensive relative to historical averages. Additionally, for income-seeking investors, international equities provide a higher dividend yield relative to their US counterparts making for an attractive investment given the valuation of US to international stocks.

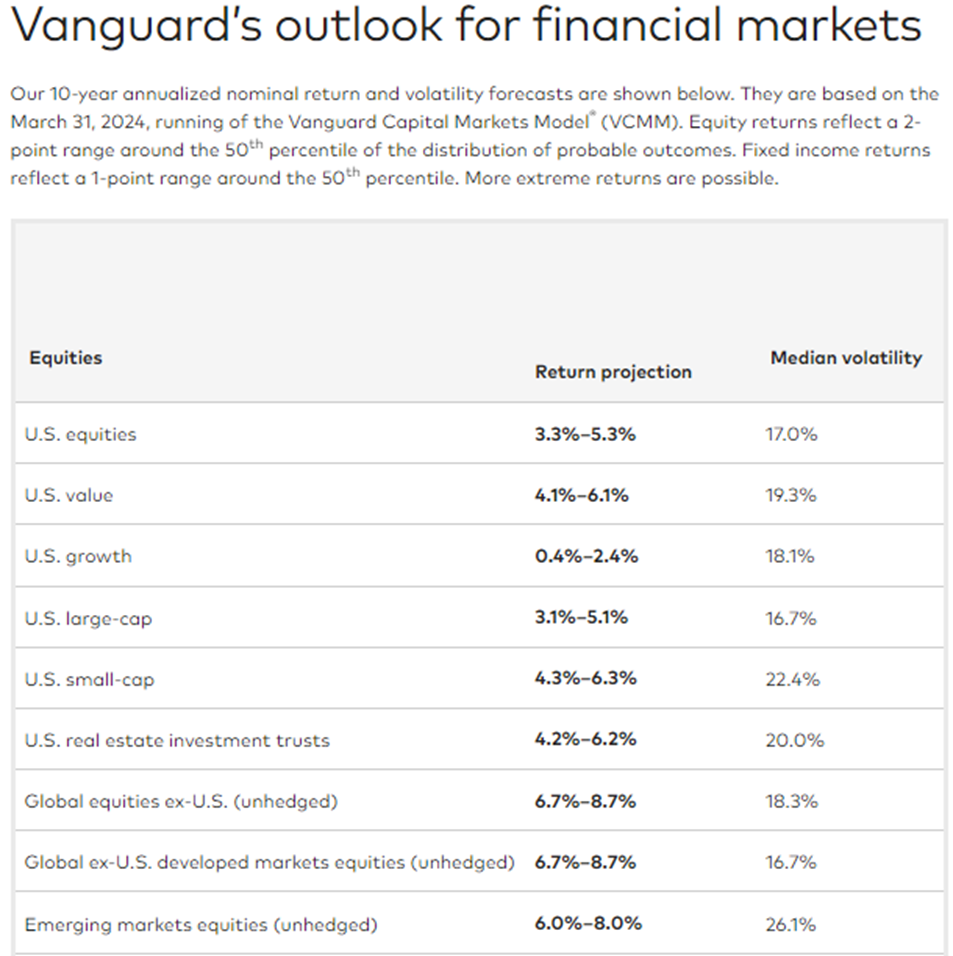

Additionally, several large asset managers such as Vanguard and Blackrock continue to argue for the inclusion of international equity given the long outperformance of the US market along with opportunities abroad. Vanguard also provides their forward 10-year return and volatility forecasts for various asset classes. Based on their research and models, they are forecasting international equities to outperform US equities over the next 10-years.

Challenges and Considerations

With every investment, there are inherent risks and challenges. Below we would like to outline a few to be aware of when considering investing internationally.

- Fees & Expenses: If you are a domestic US investor looking to invest internationally be aware that some mutual fund and ETF providers may have higher fees associated with their international offerings. This is due to different transaction costs in international markets along with the need to invest significant time and resources to understand international markets and recommended investments.

- Geo-political risks: Political, economic, and social dynamics vary from country to country and can be hard to understand and foresee for domestic investors. Additionally, differences in legal systems from country to country could cause potential issues for investors internationally.

- Currency: If you are a US-based investor looking to invest directly in international stocks, you would be required to exchange your dollars for foreign currency. This would bring in currency risk for the holding period as the value of each country’s currency appreciates or depreciates relative to the other. Generally, utilizing a vehicle like a fully hedged international ETF or mutual fund is the preferred route.

- Liquidity: Liquidity risk refers to the risk of not being able to sell your investment quickly and convert it to cash. This risk is present when investing directly in international markets, especially emerging markets. Here again, utilizing an ETF or mutual fund with ample liquidity is preferred if you want exposure to these asset classes.

Conclusion

Keeping a global perspective when constructing your diversified portfolio may help to reduce overall portfolio risks and help you take advantage of opportunities abroad. Countries vary in the composition of their markets and it’s important to consider this granular detail to understand the risks and opportunities you have exposure to. Although US equities have outperformed international in the recent past, it’s important to remember that this relationship is cyclical and it’s very hard to predict when international or US markets will outperform the other.

At Weatherly, we specialize in personalized financial planning and creating customized portfolios to meet the needs of our clients. As part of our portfolio construction, Weatherly has maintained an overweight to US equities over the last decade due to favorable economic conditions in the United States and the historic period of outperformance relative to international equities. However, within client portfolios, we retain exposure to international equity given all the reasons mentioned in this blog post.

Our team of experienced advisors are here to discuss your financial needs and goals. Through our financial planning and investment management services, we seek to offer you clarity and confidence on your financial journey.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

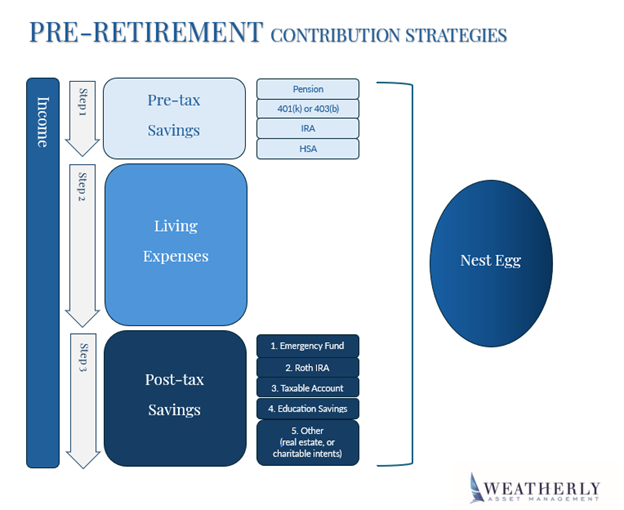

In the journey toward financial security, the intersection of saving and spending plays a pivotal role- irrespective of income or assets. This blog post delves into the significance of a well-structured budget and offers key insights for those saving for retirement or already retired. It emphasizes the crucial steps individuals should take to secure their financial future, including strategies for pre-retirement saving and post-retirement withdrawal. Understanding these principles is vital for anyone aiming to nurture and grow their nest egg effectively.

Saving Buckets Pre-Retirement

Step 1: Pay Yourself First

During your working years, it’s easy to overlook the importance of a detailed budget, relying instead on a regular paycheck to support your lifestyle. As careers progress and income increases, many people fall victim to lifestyle creep—spending more as they earn more without increasing their savings.

Fidelity advises aiming for a savings rate of 15% of your pre-tax pay, with the goal of saving enough to replace at least 45% of your pre-retirement income (Retirement Guidelines). While this is a recommended minimum, each household is different and retirement goals will vary. The motto “pay yourself first” is incredibly important. Setting up automatic, recurring savings to an employer-sponsored plan, such as a 401k or other pre-tax accounts like an IRA, ensures your income isn’t spent frivolously and helps reduce your taxable income. Depending on your employer, additional savings vehicles such as Health Savings Accounts (HSA) or Deferred Compensation plans may be available, allowing you to shield additional income from taxation and build your retirement nest egg. HSAs are particularly beneficial for healthcare savings, offering triple tax benefits: contributions are deductible, growth is tax-deferred, and qualified withdrawals are tax-free. Self-employed individuals have similar retirement options, which we explored in a previous blog post- Finding A Balance. Each of these plans have different annual contribution and income thresholds that can be found on the Key Financial Data chart.

Step 2: Understanding your Expenses

Once you’ve contributed to tax-deferred accounts, focus on managing your after-tax income for monthly living expenses and potential after-tax savings for investment accounts. Living expenses can often be broken down into two categories: non-discretionary and discretionary expenses. Non-discretionary represents expenses required to be paid, such as a mortgage, utilities, healthcare, or insurance. Discretionary expenses capture everything else that individuals or families spend to maintain their lifestyles. It’s common for people to mistakenly treat discretionary expenses as essential, such as multiple streaming services. Reviewing your monthly credit card statement can help identify unnecessary expenditures. Free online budgeting tools can categorize transactions, track spending, and provide insights into duplicative services. Taking the time to analyze your spending can uncover overlooked or frivolous expenses, enabling you to streamline your budget and optimize your savings.

Step 3: Prioritizing Post-Tax Savings Buckets

#1 Emergency Fund

First and foremost, we suggest clients save 3-6 months of expenses for unexpected events. Consider investing in liquid accounts like money market funds or high yield savings accounts.

#2 Roth IRA

Once the emergency fund has accumulated, look to tuck away money in a Roth IRA, if eligible. Roth accounts allow you to make after-tax contributions up to the annual contribution limit ($7,000 and additional $1,000 catch up contribution for those 50 and older in 2024). Roth accounts are attractive as the growth and qualified withdrawals are tax free for owners, beneficiaries, and are not subject to required minimum distributions.

Eligibility Requirements: To be eligible to contribute the maximum amount to a Roth IRA in 2024, your modified AGI must be less than $146K if single and $230K if married and filing jointly. Additionally, you or your spouse must have taxable compensation of at least your contribution amount. The income limits and contribution phase outs are further outlined on our blog post Keys to the Key Financial Data Chart.

#3 Taxable Accounts

Once an emergency fund has been established, contributions have been made to retirement

accounts (pre-tax and Roth), and HSAs are funded (if eligible), additional savings can be allocated to taxable accounts. Often this is in the form of taxable investment accounts- Trusts, Individual TODs (Transfer on Death), and Joint accounts. These accounts are attractive as there are no age-based restrictions and have favorable long-term capital gains rates for securities held for at least 1 year. On the other hand, portfolio income is taxed yearly.

Over time, maintaining a balance between funding retirement accounts and taxable accounts can provide greater flexibility in managing withdrawals and taxes. This mix ensures you have accessible funds for unexpected needs or opportunities while optimizing your overall tax burden throughout retirement.

When accumulated taxable accounts are in excess of needs, we began looking to educational accounts (#4) or charitable gift funds (#5). We will talk more about this below.

#4 Educational Accounts

Contributing to tax-advantaged education-savings accounts, such as 529s, can offer significant benefits to both you and the recipient. By leveraging the annual gift tax exemption amount ($18K per person, per individual for 2024), parents or grandparents can reduce their taxable estate while contributing to qualified educational expenses.

Funding Rules: In general, you can contribute up to $18,000 ($36,000 for married couples) per beneficiary per year without triggering federal gift taxes in 2024. However, special 529 rules allow you to front load five years of annual exclusions for a tax-free gift of up to $90,000 (joint taxpayers may fund $180,000). Refer to our blog post 5 Estate Planning Strategies for more information.

#5 Other

We include one last bucket as a catch-all for individual needs and goals. For those looking to diversify their net worth by investing in real estate, they can leverage funds from the taxable accounts. Investing in real estate can provide both rental income and potential appreciation in property value, which can be an effective way to build wealth and generate passive income.

Another common strategy we use with our clients who are charitably inclined is opening a Charitable Gift Fund. Donor-Advised Funds (DAFs) are a popular choice, allowing you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time. This strategy provides flexibility in your charitable giving and can be a valuable tool for estate planning. Contributions to DAFs can also help reduce your taxable estate, which can be particularly beneficial for high-net-worth individuals. We go into more information here: WAM’s Guide to Giving.

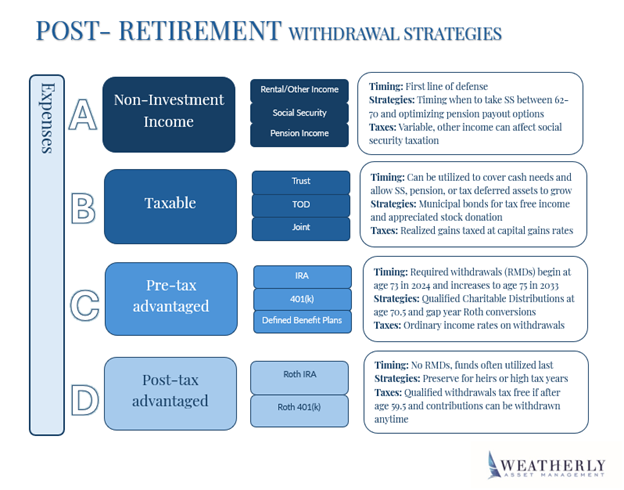

Post-Retirement Withdrawal Strategies

The shift from saving to spending in retirement can be challenging, underscoring the need for a comprehensive financial plan. We work with clients regularly on these plans and review withdrawal rates to maintain sustainable spending levels. It is important to customize your withdrawal strategy- focusing on tax efficiency while balancing factors such as age, income streams, assets, and estate goals. There is no universal approach, it is important to consider different income sources and account types over time for a more tailored strategy.

A. Non-Investment Income

If you have rental properties or other passive income streams, these should be your first line of defense for covering living expenses in retirement. Utilizing these sources can help preserve your investment portfolio, allowing it to continue to grow and support your financial needs in later years.

Two focused planning areas we often discuss with our clients revolve around Social Security and pension income. Deciding when to start collecting Social Security benefits can impact your retirement income. You can begin receiving benefits as early as age 62, but if able, delaying benefits until age 70 can significantly increase your monthly benefit. Evaluating your financial situation and life expectancy can help determine the optimal time to start Social Security. The same goes for pension payouts; to maximize its value, ensure payout options and survivor benefits are considered.

B. Taxable

Taxable accounts are generally the next step to tap into during retirement. These accounts offer favorable tax treatment on long-term capital gains or dividends and come with no age-related restrictions on withdrawals. By using funds from taxable accounts initially, you allow your tax-advantaged accounts more time to grow until RMD age.

C. Pre-Tax Advantaged Accounts

Starting in 2024, Required Minimum Distributions (RMDs) begin at age 73 and increase to 75 in 2033. Withdrawals from these accounts are taxed as ordinary income, which can significantly impact your tax bracket. Therefore, it’s crucial to strategize withdrawals to minimize tax liabilities. Understanding RMD rules and timing your withdrawals can help avoid hefty tax penalties and optimize your retirement income.

Withdrawal Restrictions: You can withdraw from these accounts without a penalty after reaching 59.5 years old. At age 70.5, you can make tax-free charitable donations directly from your IRA, which can satisfy your RMD (Required Minimum Distribution) requirements and reduce your taxable income. For more information on recent updates to Secure Act 2.0 read our recent blog Secure Act 2.0

D. Post-Tax Advantaged Accounts

Roth accounts are often saved for later in retirement or strategically leveraged by high earners due to their unique tax advantages. Unlike traditional retirement accounts, Clients over the age of 59.5 who have held their funds in a Roth account for at least five years can withdraw contributions and earnings tax-free. By delaying withdrawals from Roth accounts, individuals can allow their investments to grow tax-free for a longer period, maximizing their retirement savings. High-net-worth individuals may find Roth accounts advantageous for estate planning, as these accounts are not subject to required minimum distributions during the original owner’s lifetime. This feature allows for a more flexible and tax-efficient transfer of wealth to beneficiaries.

Conclusion

A well-structured contribution and withdrawal strategy is essential for a financially secure retirement. Prioritizing various income sources and understanding the tax implications of different account types optimizes retirement savings. We help many of our clients who are small business owners and executives prioritize income and wealth strategies through various personal and business transitions. There are many different planning opportunities available based upon various ages, life events, and individual’s personal situations that Weatherly can identify and plan for. Whether this involves running a full financial plan or isolating a particular scenario- we enjoy educating our clients and optimizing the right path forward.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.

San Diego Business Journal included Weatherly Asset Management in the 2024 listing of Wealth Management Firms, published on April 22nd, 2024. Placed among the best in San Diego County, WAM lands the 18th spot of 43 firms in total, ranked by assets under management (AUM). The list of San Diego firms can be found here: https://images.sdbj.com/wp-content/uploads/2024/04/SDBJ-Wealth-Management-Rountable-Special-Report.pdf.

Eligibility requirements to participate included being a registered investment adviser with either the Securities Exchange Commission or the California Department of Corporations. The criteria by which Firms were ranked was based on assets managed in San Diego County for fiscal year 2023.

After receiving an email invitation from the Journal to participate in the list, Weatherly completed a brief online survey.

It is not the intent of the list to endorse the participants nor to imply a firm’s size or numerical rank indicates its quality. There was no fee to participate in the list ranking, and Weatherly was not required to advertise in, or subscribe to, the San Diego Business Journal.

No organizational memberships were required of the Firm or individuals. Inclusion in the ranking is not representative of any one client’s experience and is not indicative of Weatherly’s future performance. Past performance is not necessarily indicative of future results. Weatherly is not aware of any facts that would call into question the validity of the ranking or the appropriateness of advertising inclusion in this list.

About Weatherly Asset Management, L.P.

Weatherly Asset Management, L.P. is a Registered Investment Advisor, located in Del Mar, California, dedicated to providing high quality, holistic and innovative wealth management services to high-net-worth individuals, small businesses and institutional clients since inception of the Firm in 1994.

Our comprehensive approach to all aspects of a client’s financial life, the extensive experience of our principals, and the accessibility of experts, set us apart from other firms.

Our primary business focus is money management, with each account individually managed to maximize wealth preservation and growth over time. We also provide advice related to retirement planning, tax planning, philanthropic planning, financial planning and college planning, as well as estate planning and wealth transfer guidance. Our goal is to provide clients with as much information as necessary to effectively manage portfolios and help achieve their financial goals.

Weatherly Asset Management, L.P. is the investment advisory division of Weatherly Asset Management, Inc. As an independent partnership, the Firm is wholly owned and operated by the partnership.

For information on our wealth management team, and for a full list of services we provide, please visit: http://www.weatherlyassetmgt.com/team/

For information on our ADV filings and Compliance, please visit:

https://adviserinfo.sec.gov/firm/summary/106935

http://www.weatherlyassetmgt.com/adv/

If you would like to learn more, please contact:

Carolyn P. Taylor

858-259-4507

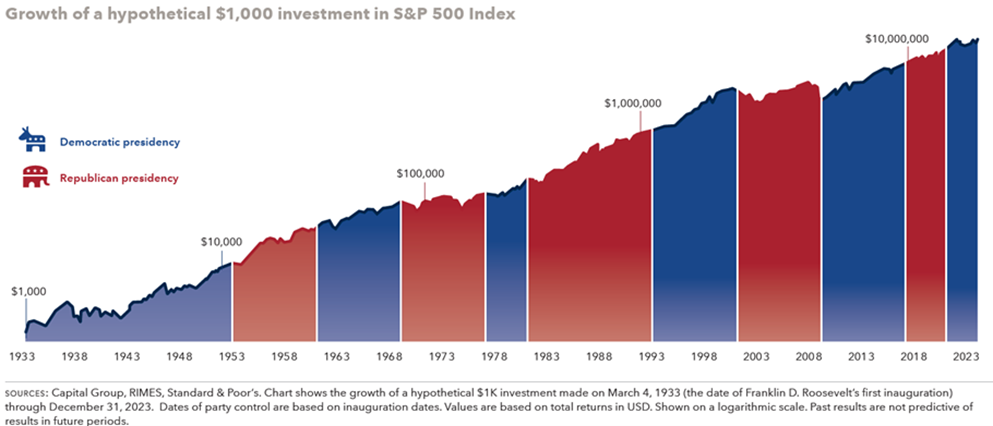

As the United States draws closer to the presidential election in November and the end of the current election cycle, many individuals may have questions and concerns about the intersection of financial markets and politics. However, when it comes to markets and your portfolio, how much impact do elections really have?

In this blog post, we review the history of US presidential elections and their impact on markets and explain why it’s important to remain disciplined and keep a long-term mentality when it comes to your portfolio and financial goals. We also touch on important financial planning considerations to think about as we head into the final stretch of the 2024 US presidential race.

Impact of Presidential Elections on Markets:

The gravity of elections is not to be understated, American policy and sentiment will change because of this year’s election. However, the impact on financial markets is not as material as people may assume. Since Franklin D. Roosevelt stepped into office in 1933, there have been eight democratic and seven republican presidents. A $1000 investment in the S&P 500, held through all 15 presidents, would have been worth over $21 million at the end of 2023. The returns generated by holding the S&P 500 regardless of election results have historically been far superior to any attempt to “time” the market based on which political party holds the White House. There appears to be little viability for an investment strategy that uses political party affiliation as a timing mechanism. The graphic below showcases the consistent upward climb of US stocks, regardless of the party in control, reiterating the importance of holding through short periods of volatility that may surface leading up to an election.

The insignificance of party affiliation on stock market returns can also be seen within the House and Senate. There is no statistical significance on stock market returns when the house and senate are both controlled by the same political party. According to Forbes, the stock market showcases the best-annualized returns when Congress is split. This is due to a natural balance of power that occurs in the legislative branch, where neither party can fully enforce their agenda resulting in a more natural development of the economy. To understand how politics have little effect on stock market outcomes, it is important to understand how financial assets derive their value.

Market returns are seldom guided by political idealizations. The impact election cycles have on markets is dwarfed by the effects of the current economic cycle and interest rates on stocks and bonds. The stock market tends to focus on the economic environment, a company’s financial health, cash flows, etc. to determine the viability of an investment. To increase success, companies primarily focus on their underlying business, market dynamics, and effective investment opportunities to keep the business healthy and viable. These decisions are made rationally and apolitically to best provide for the company and shareholders.

As we have demonstrated above, markets tend to be agnostic to the results of a US Presidential election in the long run. However, with increasing political discourse in the months leading up to an election it is not uncommon for markets to experience some form of volatility. With the constant news cycle, it may seem like the current political and economic backdrop is unprecedented, but it is important to keep in mind that uncertainty and controversy have surrounded every election. Therefore, it is vital to maintain a disciplined and long-term view of markets and your portfolio to avoid common pitfalls.

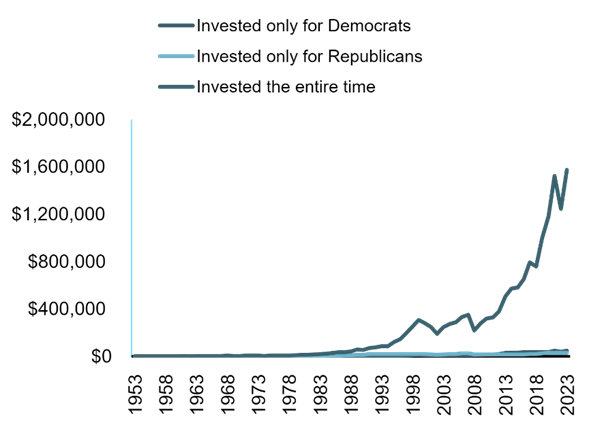

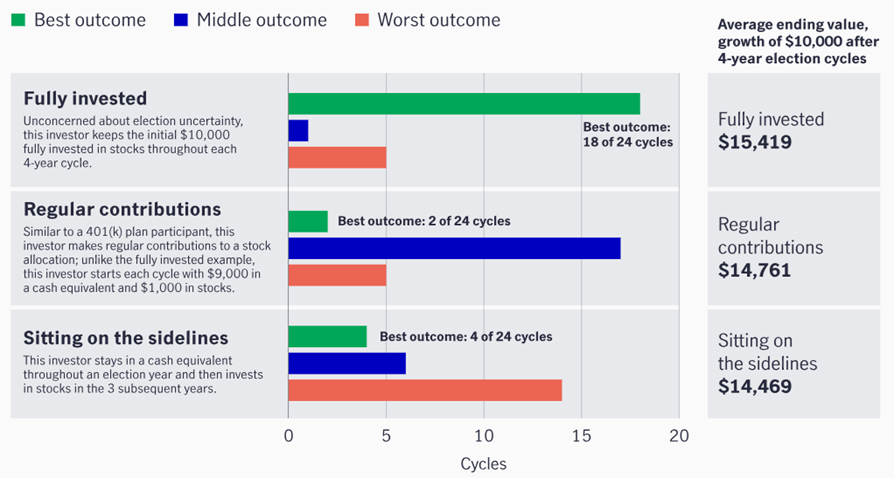

Staying Invested vs. Flight to Safety

Sitting on the sidelines of the market is a strategy that historically has not paid off. This is also true when it comes to election years. Data of the 23 election cycles since 1932 shows that a continuous investment, not based on election cycles, outperforms sitting on the sideline to avoid potential volatility. With an original investment of $10 thousand, the strategy that chose to stay uninvested on the sidelines until after the election results historically underperformed the strategy that was fully invested by over 6% for the four-year observation period. This example showcases how time and longevity in markets have historically outperformed strategies associated with political party affiliation.

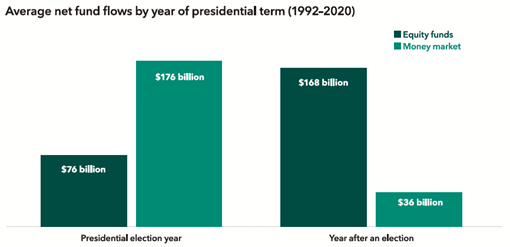

However, investor behavior seems to ignore the prudent strategy of “staying the course” during election years. Investor uncertainty around elections can be quantified by the large influxes of capital into money-market funds late in the election cycle. The last two years of an election cycle show a much larger inflow of assets into money markets than equity funds, displaying a retreat to safety by investors wanting to stay away from election-induced volatility. While cash can present as an attractive safety net, it is not a shelter needed for political volatility. Political idealizations that show up in markets tend to have short-lived ripple effects that are non-material when it comes to investment and financial planning.

As the data shows, the unwarranted retreat to safety comes at the cost of returns. When it comes to your financial success, it is more important to focus on time than timing. We see in the different graphics that a steady and continuous investment strategy performed the best throughout the emotion-based volatility seen during election cycles. Elections provide an opportunity for people to voice their opinions on hot-topic issues, causing panic among individual investors. The threat of new political ideas coming from the White House can cause people to fear for their future, thus positioning themselves on the stock market sideline when it is not needed. We believe that political discourse is important for the future development of our society. Without elections and the democratic process, people’s voices would be lost, drastically changing the core foundation the United States was founded on. However, it is important to keep political idealizations separate from your financial plan.

Financial Planning Considerations:

While we have seen that historically markets tend to focus on the broader economy rather than which party holds power, there are other topics to consider that are completely separate from financial markets. In 2017, the Tax Cuts and Jobs Act (TCJA) was passed which led to significant changes to our tax code. However, most of these revisions to the tax code are set to expire in 2025 if there are no updates to the legislation. Some of the items set to expire include the following:

- Estate Tax Exemption: The current estate tax exemption for 2024 is $13.61 million per person or $27.22 million per couple. This is set to expire in 2025 if there are no changes.

- Standard Deduction: The 2017 TCJA temporarily raised the standard deduction which is set to expire in 2025.

- Income Tax Rates: The TCJA decreased tax brackets across the board and will revert to pre-2018 levels in 2025.

For additional current tax information, you can reference our key data chart. Although these aspects of the tax code are set to expire in 2025, nothing is certain and there is a strong possibility that there will be further revisions to the tax code moving forward. However, with proper preparation and planning, there are opportunities present that you can take advantage of by consulting with an experienced group of financial professionals. Weatherly Asset Management has been having conversations with clients about the expiration of these tax laws and we continue to develop strategies to help our clients achieve their financial goals.

Staying the Course:

Historically speaking, markets have remained agnostic to the results of the US presidential election. In the period leading up to elections, it is not uncommon for markets to experience some form of volatility, but it is important to remember that in the long run what matters most is the underlying fundamentals of the economy. It is also important to keep in mind that uncertainty and controversy have been affiliated with every election cycle in US history, and that should not keep you from staying the course and maintaining a disciplined mindset when it comes to navigating markets.

We seek to offer peace of mind through professional investment management and holistic financial planning. Through our investment management services, we create customized portfolios to match your risk tolerance, time horizon, and financial goals by maintaining an appropriate, long-term asset allocation. Through our financial planning services, we take your financial picture and create a customized road map illustrating actions needed to achieve your financial goals. Within our financial planning services, we also create various “what-if” scenarios to address the changing landscape of your life, goals, and the broader economic and investment backdrop. Whether it’s creating portfolios, developing financial plans, or talking through your questions and concerns our group of experienced professionals are here to serve as your partner along your financial journey.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.