Investing in Sustainability While Sustaining Your Wallet

Cole Hansen, CFA Wealth Management Advisor | Sally Eisenberg, Operations Associate | August 8, 2019

There’s a common thought in investing – put your money to work in companies that produce the products you use or in management that you believe in. Well, why not align your investments with your principles? Recently, we’ve seen massive inflows to a theme known as Socially Responsible Investing (SRI). There are two ways to utilize SRI principles – either by screening for or avoiding certain industries (ex: tobacco, firearms, oil, chemicals) or by selecting companies through specific criteria known as “ESG” factors, which broken down are:

Environmental Effect – How does a company impact the environment through direct or indirect externalities and how will the company fare as the effects of climate change take hold? Often clean-energy industries get an A grade in this factor, while polluting sectors often score poorly.

Social Stances – How does the organization treat the impact of its operations on all stakeholders? This includes gender equality, benefits to workers, and charitable activity in the community. We’ve seen numerous companies like Target, Wal-Mart, and Amazon raise wages for workers above the federal or state minimums.

Good Governance – How does the company operate through its board and management decisions? Independent directors and auditors that monitor managers are key to the longevity of the organization, just ask shareholders in Enron and Lehman Brothers.

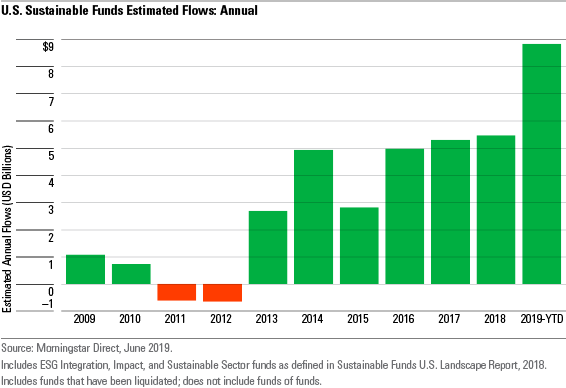

Demand for funds that satisfy ESG metrics is rising, mostly in part to a growing millennial investor base, many of whom demand social responsibility when making investments. The chart below from MorningStar highlights the estimated $8.9b in net inflows into sustainable funds held in the United States in the first six months of 2019.

Socially responsible investing in International markets is not far behind as sovereign wealth funds must look to make “financial flows consistent” with lower-carbon emissions and sustainability in accordance with the 2015 Paris Climate Agreement. Expectations for more growth in the ESG space can be attributed to new offerings for this option in employer-sponsored 401k plans, as only 5% of 401(k)s offered a dedicated ESG fund for employees in 2018.

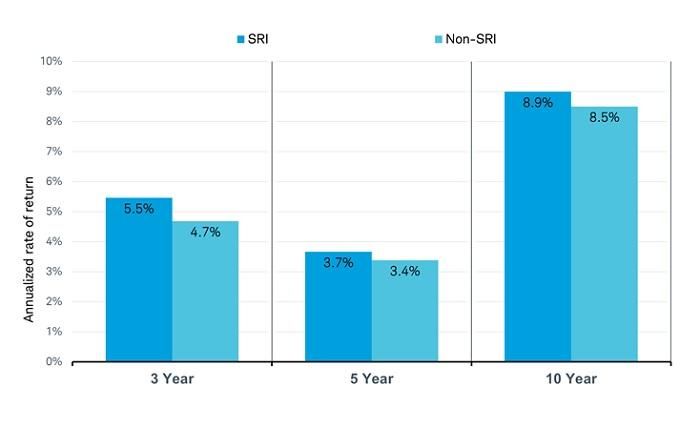

Although performance considerations may have kept some investors from utilizing socially responsible investing funds in the past, they’ve outperformed their non-SRI peers over a few different timelines as shown in the chart below.

When looking at the broader market, Vanguard’s Social Index has returned 4.3% vs. the S&P 500 return of 5.5% since the social index’s inception in 2000.

SRI funds may also have expense ratios (fees) that are higher than their counterparts given the specific criteria that a fund manager must follow. Interestingly, 53% of the available mutual funds that Morningstar highlights as socially responsible had lower expense ratios than the non-SRI funds in the same category.

Weatherly works closely with clients to attain their investing goals through the screening of unwanted holdings and creation of customized portfolios. Our team has restricted industries or companies at the requests of clients through our portfolio management system to notify our investment team of any specific sectors to avoid for each client or account. Alternatively, advisors will note when a client wishes to only invest in companies that promote ESG traits and ethics. When investments are made, a detailed background review is completed for each equity or fixed income position to ensure that the investment is made within SRI guidelines and principles as outlined per client.

We’d suggest speaking to an advisor to see if utilizing ESG metrics in your investments is appropriate. Additionally, Fidelity and Schwab both offer exchange-traded fund screeners to narrow the scope of available funds to fit ESG characteristics.

In addition to socially responsible investing, Weatherly prides itself on implementing sustainable practices throughout all areas of our business. Whether it be hosting a local beach clean-up , providing re-usable cutlery and dishes for employee lunches, or implementing electronic signature software to cut down on paper, Weatherly is passionate and dedicated towards doing what we can to create a leaner, greener future – and we want to help you do the same!

When exploring options of moving towards a sustainable lifestyle, it can sometimes be overwhelming. With so many options in just about every aspect of life, it is often hard to know where to begin. Below are some small and easy changes that can have big impact on reducing our environmental footprint.

On the go:

– Eliminate plastic bottles – Carry a re-fillable water bottle for any hydration needs. We proudly welcome all new clients with a reusable Weatherly water bottle. Please don’t hesitate to contact us if you would like one, as we would be happy to send!

– Avoid plastic bags – Keep cloth/canvas tote bags in the trunk of your car so you never forget them when going to the store to buy groceries or other goods.

– Consolidate errands – Plan/map out errand runs to save money on gas and reduce carbon emissions. Or even better, walk, bike, and/or carpool if possible.

At home:

– Know the rules of recycling in your area – Check out “What Goes Where” for San Diego county residents.

– Stop junk mail – Unsubscribe from those pesky marketers and save paper while doing it. View the New York Times article with helpful tips here.

– Compost – It is estimated that food scraps and yard waste together currently make up to 30% of what we throw away and should be composted instead. DIY compost bins can be made for as little as $10, and many communities host free workshops to help get you started.

At work:

– Eliminate take out containers – Bring your lunch from home in a re-usable lunch box. Even better, bring your own re-usable cutlery and napkin too!

– Reduce paper – Make conscious choices around the office to use less paper. Re-purpose no longer needed one-sided sheets into scratch paper before recycling or shredding.

– Unplug Electronics – Even while turned off, electronics still use energy as long as they are plugged in. Save energy by unplugging applicable electronics before leaving the office for the evening.

It is important to remember patience when transitioning towards greater sustainability. Even the smallest changes, whether in an investment portfolio or in a daily routine, can go a long way to make our world a better place.

We continue to educate ourselves on how to better our community and plan for a future in a world limited by finite resources and talent. Our team persistently researches and uncovers new trends to capture cultural and social movements in thematic investments for clients. Please free to reach out to Weatherly with any questions or suggestions to assist with your journey towards a sustainable future, we are all in this together.

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.