2020 Planning Opportunities: Potential Tax Changes and Roth Conversions

Cole Hansen, CFA, CFP® Wealth Management Advisor | Ryan Richardson, CFP®, Wealth Management Associate Advisor | August 27, 2020

Not much is normal these days – political conventions are virtual, major sports are played in empty arenas, and classrooms are remote. One thing that seems to remain a constant are the proposals being put forth by Presidential Candidates in the upcoming election to outline their goals, objectives, and strategies and the corresponding action by advisers to prepare their clients.

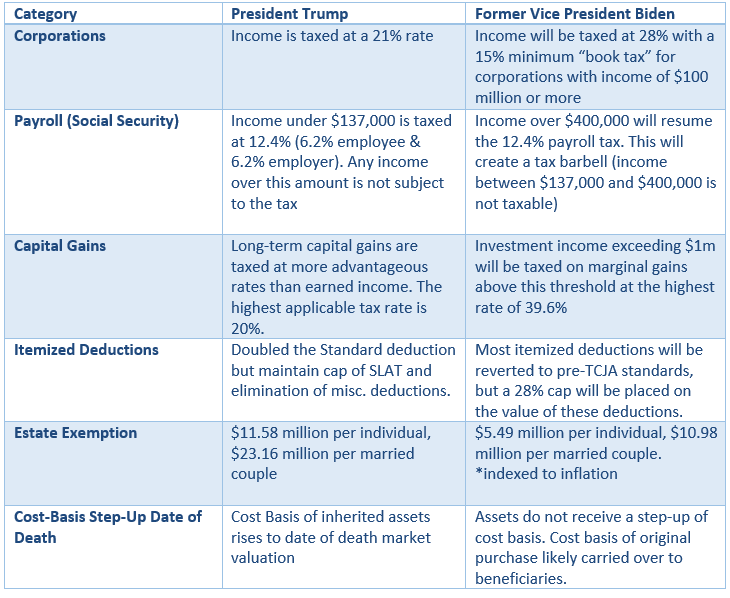

Former Vice President Joe Biden, now the Democratic Party’s official nominee for President, recently released his tax policy proposal for his administration should he win the White House in November. Key provisions in the 2017 Tax and Jobs Cuts Act (TCJA), set to expire in 2025, are now at stake of being eliminated early. President Trump’s communication has alluded to making the TCJA permanent. Below are the respective Candidates’ tax policies for their administrations:

Recently passed legislation in the SECURE and CARES Acts has created an opportunity for Weatherly clients in their “gap years” with large amounts of tax-deferred assets to potentially utilize a Roth Conversion in 2020 to lower personal taxes in future years and alleviate the tax burden for their heirs.

- CARES Act – As Required Minimum Distributions (RMD) have been waived in the 2020 calendar year, IRA owners have the flexibility to entirely skip their distributions or selectively withdrawal for Qualified Charitable Distributions or Roth Conversions. Both strategies can help reduce RMDs in future years without generating as large of a tax bill this year. Additional information on Qualified Charitable Distribution strategies to help reduce RMDs in future years. We will discuss the Roth Conversion strategy in more detail below.

- SECURE Act – Certain non-spouse beneficiaries are now required to fully withdraw the balance of an Inherited IRA within a 10-year window. Previously, these heirs could distribute the balance based on their life expectancy, a significant advantage for individuals at a young age with a long life ahead of him or her. Reducing the balance of non-Roth IRA assets will allow for greater tax flexibility for the ultimate recipient of the assets as distributions from Inherited Roth IRAs are not taxable.

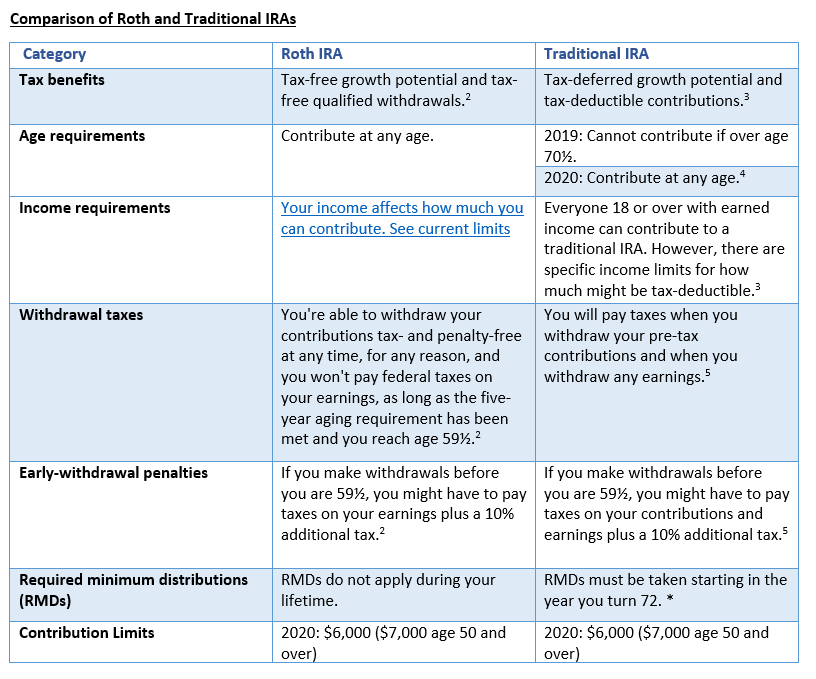

For many individuals a Roth conversion is somewhat of an unfamiliar concept. In order to understand this concept better, let’s look at a comparison between key features of a Traditional IRA and a Roth IRA, how they came to be an effective financial planning tool, how they work, and why they may make more sense than ever to do in 2020.

The Roth IRA was introduced as part of the Taxpayer Relief Act of 1997, but the Roth Conversion didn’t get its start as an effective financial planning tool until 2010, when limitations from the Tax Increase Prevention and Reconciliation Act of 2005 were removed. The removal of the limitations allowed individuals with a Modified Adjusted Gross Income (MAGI) over $100,000 to fully utilize the capabilities of a Roth Conversion.

How does a Roth Conversion work?

A Roth conversion allows individuals to take pre-tax money (cash or securities) from a Traditional IRA or 401(k) and reinvest those funds into a Roth IRA. The distribution from the traditional IRA will be included in gross income and subject to income tax at the time of conversion.

Why consider a Roth Conversion?

The decision to complete a Roth Conversion primarily comes down to deciding to pay taxes today or at retirement, with the intention to pay taxes at a lower tax rate today than you would in future years. This strategy can be especially effective for those expecting to be in a higher marginal tax bracket in the future and if you can afford the tax bill generated by the conversion.

With the amount of fiscal stimulus recently pumped into markets to combat COVID-19, along with the current low tax rate policies, there is a large likelihood that taxes will increase in the foreseeable future. If an individual believes they will be in a lower tax bracket during retirement, a Roth Conversion may not make sense.

What does this mean for your beneficiaries?

One of the major changes to retirement accounts under the SECURE act was the removal of the “Stretch” provision for IRAs inherited in 2020 and after. Certain non-spouse beneficiaries are now required to fully withdraw the balance of an Inherited IRA within a 10-year window.

Because of the removal of the “stretch” provision, it may be beneficial to use a specific Roth Conversion strategy that is referred to as the “amortization table approach.” This approach focuses on lowering the income tax liability for individuals who inherit a Traditional IRA. This can be done through the conversion of a higher annual dollar amount to a Roth IRA during the original IRA owner’s lifetime, in order to minimize the tax burden beneficiaries will face when taking their Required Minimum Distributions (RMDs) within the required 10-year window.

Read more about this approach here.

Why is now the time to consider this?

With the current backdrop of the COVID-19 pandemic, many individuals have seen a reduction of hours or a wage decrease, which may mean they are in a lower tax bracket this year than in previous or future years. Individuals who took advantage of the CARES Act ability to skip their required minimum distributions may also be in a significantly lower tax bracket in 2020. The additional unknown surrounding what taxes will look like in 2021 and going forward makes this year an ideal time to explore Roth Conversions with your advisor.

Caveats:

It is important to consult with a financial or tax professional when considering a Roth conversion to make sure that the conversion does not push the client into a significantly higher federal income tax bracket. Additional information regarding the 2020 Tax Rate Schedule can be found here.

For Example: A married couple filing jointly with taxable income of $60,000 can convert up to $20,250 to a Roth IRA while still staying within the 12% tax bracket. The 22% tax bracket starts at $80,251.

Additional Resources:

https://www.barrons.com/articles/trump-biden-and-taxes-what-to-expect-51596843040

** The information provided should not be interpreted as a recommendation, no aspects of your individual financial situation were considered. Always consult a financial professional before implementing any strategies derived from the information above.